Instructions for Form FTB 3805V Net Operating Loss NOL Computation and NOL and Disaster Loss Limitations Individuals, Estates, a

Understanding Form FTB 3805V for Net Operating Loss Computation

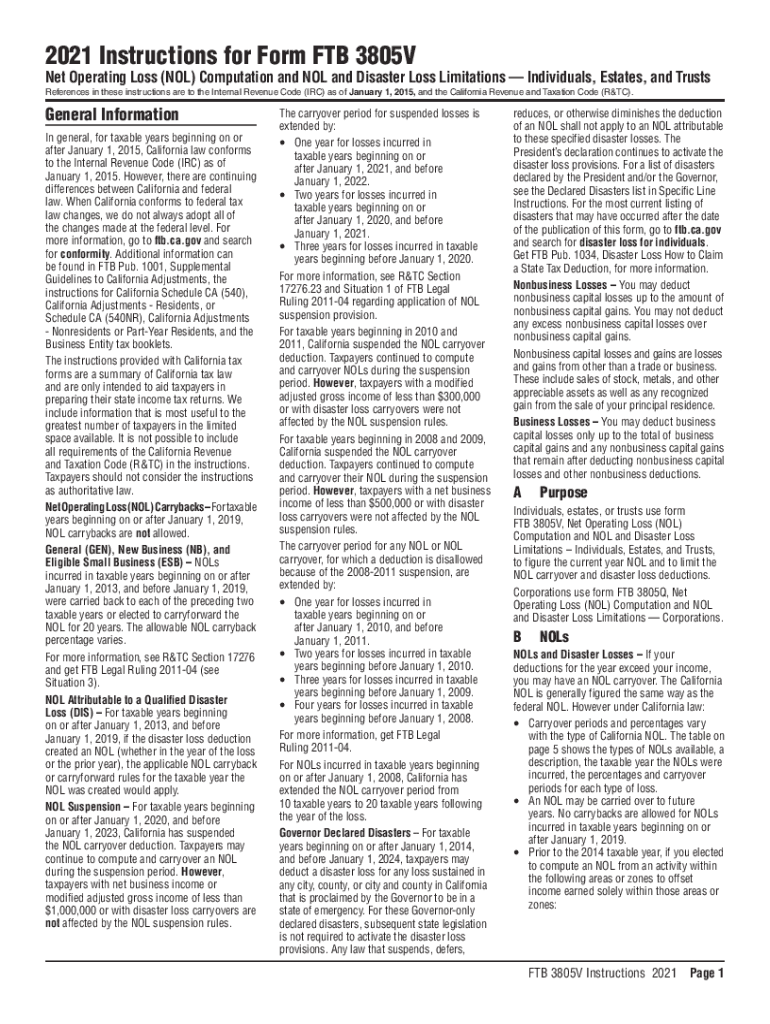

The Instructions for Form FTB 3805V focus on the calculation of Net Operating Loss (NOL) for individuals, estates, and trusts in California. This form is crucial for taxpayers who have incurred a loss in the current tax year and wish to apply it to offset taxable income from previous or future years. The form provides guidance on how to compute NOL, including specific limitations related to disaster losses. Understanding these instructions ensures that taxpayers can accurately complete the form and maximize their tax benefits.

Steps to Complete Form FTB 3805V

Completing Form FTB 3805V involves several steps that require careful attention to detail. First, gather all necessary financial documents, including income statements and records of losses. Next, follow the instructions to calculate your NOL by identifying allowable deductions and adjustments. Fill out the form accurately, ensuring that all figures are correct and supported by documentation. Finally, review the completed form for accuracy before submission. This process helps ensure compliance and reduces the risk of errors that could lead to delays or penalties.

Legal Use of Form FTB 3805V Instructions

The legal framework surrounding Form FTB 3805V is essential for ensuring that the form is used correctly. Compliance with California tax laws is mandatory, and the instructions outline the legal requirements for claiming NOL. This includes understanding the definitions of allowable losses, the timeframes for claiming these losses, and the necessary documentation. By adhering to these guidelines, taxpayers can ensure that their claims are valid and legally defensible in case of an audit.

Key Elements of Form FTB 3805V Instructions

The key elements of the Instructions for Form FTB 3805V include detailed explanations of what constitutes a Net Operating Loss, how to compute it, and the limitations that apply. Important aspects include the distinction between regular losses and those resulting from disasters, as well as specific calculations required to determine the NOL carryover. These elements are vital for taxpayers to understand in order to navigate the complexities of the form effectively.

Eligibility Criteria for Form FTB 3805V

Eligibility for using Form FTB 3805V is primarily determined by the taxpayer's financial situation. Individuals, estates, and trusts that have experienced a net operating loss in the tax year can apply. Specific criteria include the nature of the losses, the type of income being offset, and adherence to California tax regulations. Understanding these criteria is important for taxpayers to ensure they qualify for the benefits associated with filing this form.

Filing Deadlines for Form FTB 3805V

Filing deadlines for Form FTB 3805V are critical for compliance with California tax laws. Generally, the form must be submitted by the due date of the tax return for the year in which the NOL occurred. Extensions may be available, but it is essential to check the specific deadlines each tax year. Missing these deadlines can result in the loss of the opportunity to claim the NOL, making timely filing a priority for affected taxpayers.

Quick guide on how to complete instructions for form ftb 3805v net operating loss nol computation and nol and disaster loss limitations individuals estates

Complete Instructions For Form FTB 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, A effortlessly on any gadget

Web-based document administration has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Instructions For Form FTB 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, A on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Instructions For Form FTB 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, A while staying relaxed

- Locate Instructions For Form FTB 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, A and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools designed by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, lengthy form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Instructions For Form FTB 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, A and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ftb 3805v net operating loss nol computation and nol and disaster loss limitations individuals estates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 3805v, and how can it benefit my business?

The form 3805v is a critical tax document that businesses in California use to report income from various entities. Utilizing airSlate SignNow to digitally sign and send this form increases efficiency and ensures compliance. With our solution, you can manage your tax documents securely and streamline submission processes.

-

How much does airSlate SignNow cost for signing the form 3805v?

airSlate SignNow offers competitive pricing plans starting with a free trial to assess the service. Plans vary based on features and user needs, but all include the capability to eSign crucial documents like the form 3805v. Our affordable solutions make it easy for businesses to choose a plan that fits their budget.

-

Are there any features tailored for managing the form 3805v?

Yes, airSlate SignNow provides specific features for managing documents such as the form 3805v. These features include templates, reminders, and secure storage, helping you keep track of your tax forms. With our platform, you can easily customize the workflow to fit your needs.

-

Can I integrate airSlate SignNow with other software for handling the form 3805v?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications commonly used in businesses, allowing for better management of the form 3805v. Whether you use CRM, project management, or accounting software, our integrations ensure a smooth workflow.

-

Is it safe to use airSlate SignNow for signing the form 3805v?

Yes, airSlate SignNow prioritizes security. Our platform utilizes advanced encryption and digital signing technology, ensuring that your form 3805v and other documents are protected from unauthorized access. Incorporating security measures helps businesses maintain compliance and protects sensitive information.

-

How do I start using airSlate SignNow to manage the form 3805v?

Getting started with airSlate SignNow is simple. Sign up for a free trial on our website, then follow the introductory guide to upload and customize your form 3805v. You'll be able to send, sign, and store your documents within minutes, enjoying a user-friendly experience.

-

What are the advantages of using airSlate SignNow for the form 3805v compared to traditional methods?

Using airSlate SignNow for the form 3805v offers numerous advantages over traditional methods. Enhanced speed, reduced paperwork, and improved tracking capabilities ensure a more efficient process. Additionally, eSigning eliminates the hassle of printing, signing, and scanning, saving time and resources.

Get more for Instructions For Form FTB 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, A

Find out other Instructions For Form FTB 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, A

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors