Pa Business Privilege Tax Return Form

What is the PA Business Privilege Tax Return

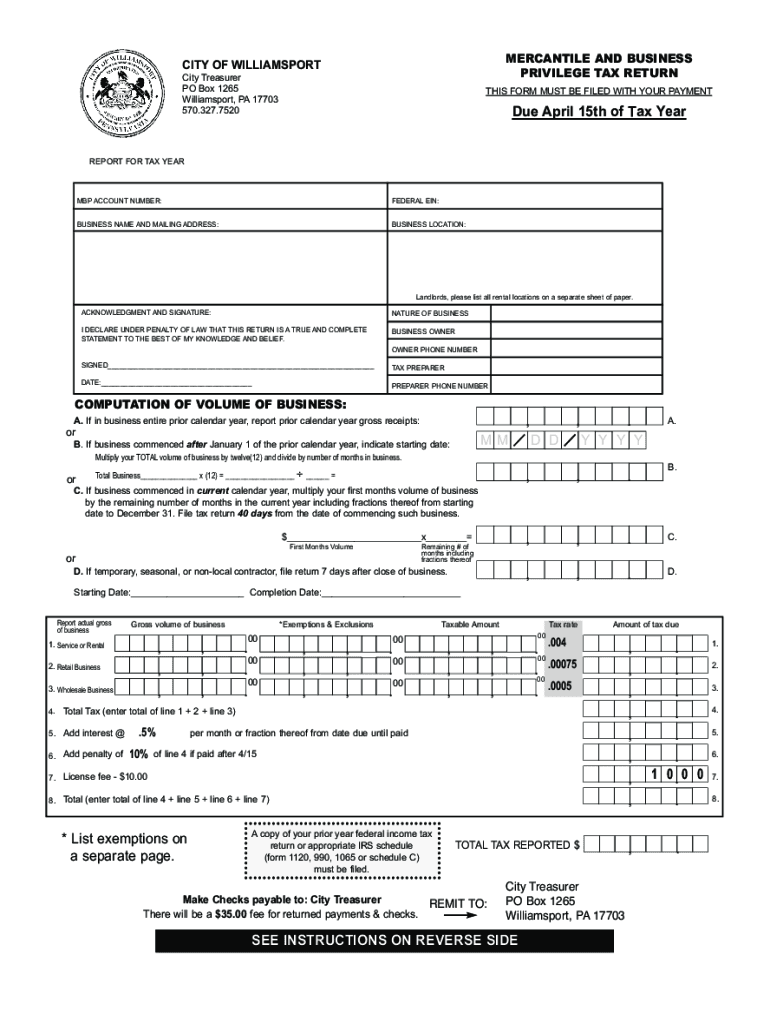

The PA Business Privilege Tax Return is a tax form that businesses operating within Pennsylvania must file to report their income and pay the corresponding business privilege tax. This tax is levied on the privilege of doing business in the state and is applicable to various business entities, including corporations, partnerships, and sole proprietorships. The return helps the state assess the tax based on the business's gross receipts and other relevant financial information.

Steps to Complete the PA Business Privilege Tax Return

Completing the PA Business Privilege Tax Return involves several key steps. First, gather all necessary financial documents, including income statements and expense records. Next, accurately calculate your gross receipts for the reporting period. Once you have this information, fill out the business privilege tax return form, ensuring that all figures are correct and complete. After completing the form, review it for accuracy, then submit it either electronically or via mail to the appropriate tax authority.

Legal Use of the PA Business Privilege Tax Return

The PA Business Privilege Tax Return must be used in accordance with Pennsylvania tax laws. This means that businesses are required to file the return annually, reporting their gross receipts honestly. Failure to comply with these legal requirements can result in penalties, including fines and interest on unpaid taxes. It is essential for businesses to understand their obligations and ensure that they are filing the return correctly to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the PA Business Privilege Tax Return are crucial for compliance. Typically, the return must be filed annually by the 15th day of the fourth month following the end of the business's fiscal year. For businesses operating on a calendar year, this means the return is due by April 15. It is important to stay informed about any changes to these deadlines, as late filings can incur penalties.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the PA Business Privilege Tax Return. The form can be filed online through the Pennsylvania Department of Revenue's e-filing system, which offers a convenient and efficient way to submit tax documents. Alternatively, businesses may choose to mail the completed form to the appropriate tax office or deliver it in person. Each method has its own advantages, and businesses should select the one that best fits their needs.

Required Documents

To complete the PA Business Privilege Tax Return, businesses must gather specific documents. These typically include financial statements, such as profit and loss statements, and records of gross receipts. Additionally, any supporting documentation that verifies income and expenses may be required. Having these documents ready can streamline the filing process and help ensure accuracy in reporting.

Penalties for Non-Compliance

Non-compliance with the requirements for the PA Business Privilege Tax Return can lead to significant penalties. Businesses that fail to file on time may incur late fees and interest on unpaid taxes. In more severe cases, persistent non-compliance can result in legal action or the revocation of business licenses. It is essential for business owners to understand these implications and prioritize timely and accurate filings.

Quick guide on how to complete pa business privilege tax return

Effortlessly Prepare Pa Business Privilege Tax Return on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle Pa Business Privilege Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to Modify and eSign Pa Business Privilege Tax Return with Ease

- Locate Pa Business Privilege Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow efficiently addresses your document management needs with just a few clicks from any device of your choice. Modify and eSign Pa Business Privilege Tax Return and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa business privilege tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a business privilege tax return PDF?

A business privilege tax return PDF is a document that businesses file to report and pay taxes to their local government. This form typically includes details about business income and operations. Using airSlate SignNow, you can easily create, send, and eSign your business privilege tax return PDF, making the filing process seamless.

-

How can airSlate SignNow help with my business privilege tax return PDF?

airSlate SignNow streamlines the process of generating and signing your business privilege tax return PDF. Our platform allows you to prepare the document, collect signatures from necessary parties, and securely store everything in one place. This helps in simplifying compliance and ensuring timely submissions.

-

What features does airSlate SignNow offer for business privilege tax return PDFs?

airSlate SignNow offers a range of features for handling your business privilege tax return PDF, including customizable templates, eSignature capabilities, and secure cloud storage. These features ensure that your documents are not only compliant but also easily accessible whenever you need them.

-

Is there a cost associated with using airSlate SignNow for my business privilege tax return PDF?

Yes, airSlate SignNow has flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from various subscription options that provide access to all features necessary for managing your business privilege tax return PDF effectively. This pricing model allows for cost-effective solutions without sacrificing quality.

-

Can I integrate airSlate SignNow with other software for my business privilege tax return PDF?

Absolutely! airSlate SignNow offers integrations with many third-party applications, making it easier to streamline your workflow. This means you can connect your accounting software or document management systems, ensuring that your business privilege tax return PDF is efficiently processed within your existing systems.

-

What are the benefits of using airSlate SignNow for business privilege tax return PDFs?

Using airSlate SignNow for your business privilege tax return PDF offers several benefits, including time savings, enhanced accuracy, and improved compliance. The eSigning feature allows for quicker approvals, while cloud storage ensures you have easy access and security for your important documents.

-

How secure is my information when submitting a business privilege tax return PDF through airSlate SignNow?

airSlate SignNow prioritizes security, employing industry-leading encryption and compliance measures. When you submit a business privilege tax return PDF through our platform, your data is protected to prevent unauthorized access and maintain confidentiality at all times.

Get more for Pa Business Privilege Tax Return

- Nederlands voor buitenlanders 5th edition pdf form

- Demand letter for return of stolen property form

- Fra guide for preparing us dot crossing inventory forms

- Think time behavior debriefing form learningtargets

- Fitness application form

- Instructions for form 990 t instructions for form 990 t exempt organization business income tax return and proxy tax under

- Swiss employment contract template form

- Taxi driver employment contract template form

Find out other Pa Business Privilege Tax Return

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template