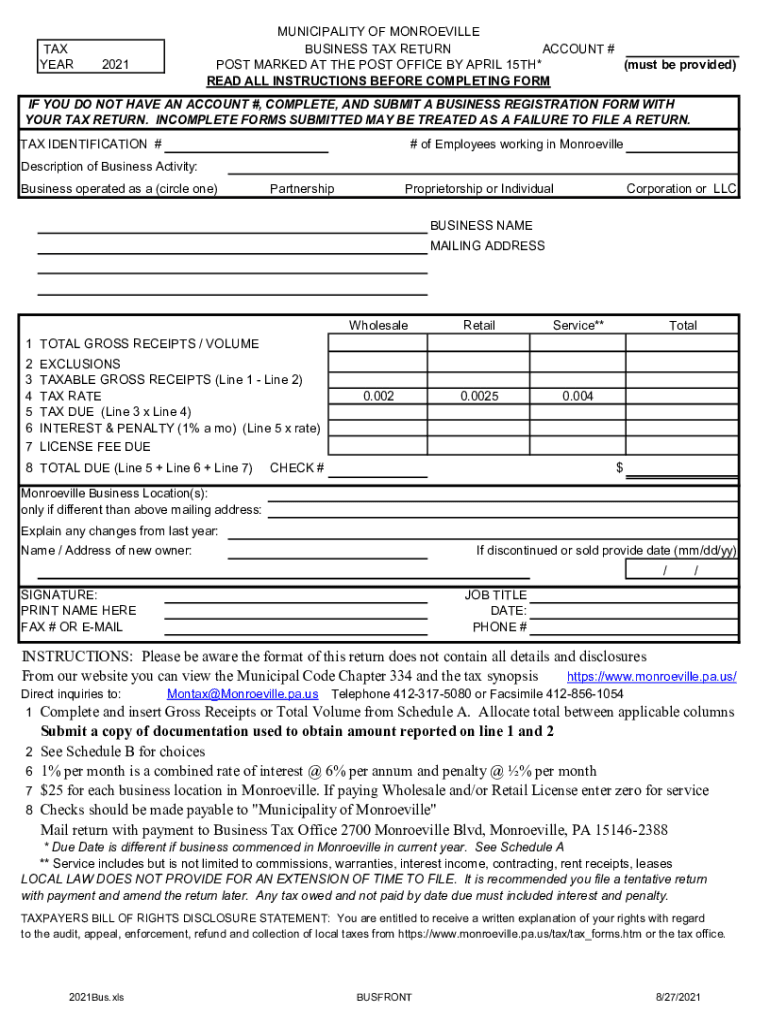

Monroeville Pa Us 450 Business Tax Form PDFPOST MARKED at the POST OFFICE by APRIL 15TH* Must Be

Understanding the PA Business Tax Return

The PA business tax return is a crucial document for businesses operating in Pennsylvania. It serves as a means for the state to assess the tax obligations of various business entities, including corporations, partnerships, and limited liability companies (LLCs). This form captures essential financial data and is used to calculate the amount of tax owed to the state. Businesses must ensure accuracy in reporting their income, deductions, and credits to avoid penalties and ensure compliance with state tax laws.

Steps to Complete the PA Business Tax Return

Completing the PA business tax return involves several important steps:

- Gather Financial Records: Collect all necessary financial documents, including income statements, balance sheets, and receipts for deductions.

- Choose the Correct Form: Identify the appropriate tax return form based on your business structure, such as the PA-20S/PA-65 for partnerships or the PA-1120 for corporations.

- Fill Out the Form: Accurately complete the form with your business's financial information, ensuring all sections are filled out correctly.

- Review for Accuracy: Double-check all entries for accuracy to prevent errors that could lead to audits or penalties.

- Submit the Form: File your completed tax return by the deadline, either electronically or via mail.

Filing Deadlines for the PA Business Tax Return

Timely filing of the PA business tax return is essential to avoid penalties. The standard deadline for submitting the return is generally April 15th for most businesses. However, specific deadlines may vary based on the business entity type or fiscal year. It is important to stay informed about any changes to deadlines and plan accordingly to ensure compliance.

Required Documents for Filing

When preparing to file the PA business tax return, certain documents are necessary to support your claims and calculations:

- Income Statements: Detailed records of all income generated by the business.

- Expense Receipts: Documentation of all business-related expenses that may be deductible.

- Previous Tax Returns: Copies of prior year returns can help in preparing the current year's return.

- Schedule of Assets: A list of business assets that may affect depreciation calculations.

Penalties for Non-Compliance

Failure to file the PA business tax return on time or inaccuracies in reporting can lead to significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action. It is crucial for businesses to understand their obligations and ensure all filings are completed accurately and on time to avoid these consequences.

Digital vs. Paper Version of the PA Business Tax Return

Businesses have the option to file the PA business tax return either digitally or using a paper form. The digital version offers advantages such as faster processing times, immediate confirmation of submission, and reduced risk of errors. Conversely, paper filing may be preferred by some for record-keeping purposes. Understanding the benefits of each method can help businesses choose the best approach for their needs.

Quick guide on how to complete monroeville pa us 450 business tax form pdfpost marked at the post office by april 15th must be

Effortlessly prepare Monroeville pa us 450 Business Tax Form PDFPOST MARKED AT THE POST OFFICE BY APRIL 15TH* must Be on any device

The online management of documents has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any holdups. Manage Monroeville pa us 450 Business Tax Form PDFPOST MARKED AT THE POST OFFICE BY APRIL 15TH* must Be on any platform with the airSlate SignNow apps for Android or iOS and enhance your document-centric processes today.

How to edit and electronically sign Monroeville pa us 450 Business Tax Form PDFPOST MARKED AT THE POST OFFICE BY APRIL 15TH* must Be with ease

- Locate Monroeville pa us 450 Business Tax Form PDFPOST MARKED AT THE POST OFFICE BY APRIL 15TH* must Be and click on Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize relevant sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of missing or lost documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Monroeville pa us 450 Business Tax Form PDFPOST MARKED AT THE POST OFFICE BY APRIL 15TH* must Be to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monroeville pa us 450 business tax form pdfpost marked at the post office by april 15th must be

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PA business tax return?

A PA business tax return is a document filed by businesses in Pennsylvania to report income, expenses, and to calculate tax liability under state law. It includes various forms and schedules tailored to the specific business type. Understanding this return is crucial for ensuring compliance and minimizing tax liabilities.

-

How can airSlate SignNow help with PA business tax returns?

airSlate SignNow simplifies the process of filing PA business tax returns by streamlining document management and offering eSignature capabilities. With our platform, you can easily send, receive, and sign necessary tax documents in a secure environment. This efficiency helps reduce the time and stress associated with tax season.

-

What features does airSlate SignNow offer for managing business tax documents?

airSlate SignNow offers features like customizable templates, automated workflows, and secure cloud storage for managing PA business tax return documents. This helps you stay organized and ensures all your forms are readily accessible. Our tools are designed to enhance the efficiency of your document processes throughout the tax filing season.

-

Is airSlate SignNow cost-effective for PA business tax returns?

Yes, airSlate SignNow provides a cost-effective solution for managing PA business tax returns, offering competitive pricing plans tailored for businesses of all sizes. By reducing the time spent on paperwork and improving document accuracy, you can save on potential penalties and late fees. Our platform's ROI often surpasses the investment in our services.

-

Can airSlate SignNow integrate with other software for tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and tax preparation software, making it easier to manage your PA business tax return process. This integration allows you to synchronize data, reduce duplication, and enhance workflow efficiency. Leveraging our integrations can signNowly streamline your overall tax management strategy.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your PA business tax return documentation brings numerous benefits including improved efficiency, enhanced security, and reduced risk of errors. Our eSignature technology allows for quick approvals, ensuring that your documents are finalized without delay. Additionally, cloud storage means your tax information is secure and accessible from anywhere.

-

How does airSlate SignNow ensure the security of my business tax information?

airSlate SignNow takes security seriously, employing advanced encryption and compliance measures to protect your PA business tax return data. We adhere to industry standards and regulations to ensure that your documents remain confidential and secure. Our platform also includes user authentication features to prevent unauthorized access.

Get more for Monroeville pa us 450 Business Tax Form PDFPOST MARKED AT THE POST OFFICE BY APRIL 15TH* must Be

Find out other Monroeville pa us 450 Business Tax Form PDFPOST MARKED AT THE POST OFFICE BY APRIL 15TH* must Be

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile

- Electronic signature Hawaii lease agreement Mobile

- How To Electronic signature Kansas lease agreement

- Electronic signature Michigan Landlord tenant lease agreement Now

- How Can I Electronic signature North Carolina Landlord tenant lease agreement

- Can I Electronic signature Vermont lease agreement

- Can I Electronic signature Michigan Lease agreement for house

- How To Electronic signature Wisconsin Landlord tenant lease agreement

- Can I Electronic signature Nebraska Lease agreement for house

- eSignature Nebraska Limited Power of Attorney Free