Tax Return Drop off Sheet Mark Cross Tax Services Form

What is the Tax Return Drop Off Sheet Mark Cross Tax Services

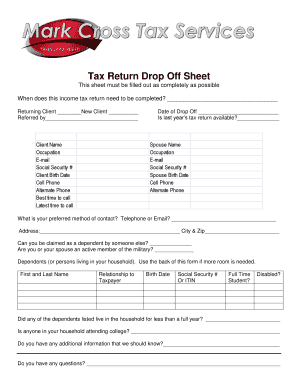

The Tax Return Drop Off Sheet from Mark Cross Tax Services is a document designed to facilitate the submission of tax-related information securely and efficiently. This form allows clients to provide necessary financial data to their tax preparer without the need for in-person meetings. It is particularly useful for individuals and businesses looking to streamline their tax filing process while ensuring compliance with IRS regulations.

How to use the Tax Return Drop Off Sheet Mark Cross Tax Services

Using the Tax Return Drop Off Sheet is straightforward. Clients should first download the form from the Mark Cross Tax Services website. After obtaining the sheet, fill in all required fields with accurate information regarding income, deductions, and any other relevant financial details. Once completed, the form can be securely submitted via email or through a designated online portal, ensuring that sensitive information is protected during transmission.

Steps to complete the Tax Return Drop Off Sheet Mark Cross Tax Services

Completing the Tax Return Drop Off Sheet involves several key steps:

- Download the Tax Return Drop Off Sheet from the Mark Cross Tax Services website.

- Fill in your personal information, including name, address, and Social Security number.

- Provide detailed information about your income sources, such as W-2s or 1099s.

- List any deductions you plan to claim, including mortgage interest, charitable contributions, and medical expenses.

- Review the completed form for accuracy and completeness.

- Submit the form through the preferred method, ensuring that it is sent securely.

Legal use of the Tax Return Drop Off Sheet Mark Cross Tax Services

The Tax Return Drop Off Sheet is legally valid as long as it is completed accurately and submitted according to IRS guidelines. It is essential to ensure that the information provided is true and correct to avoid penalties. Additionally, using a secure platform for submission enhances the legal standing of the document, as it protects sensitive information and maintains compliance with eSignature regulations.

Key elements of the Tax Return Drop Off Sheet Mark Cross Tax Services

Key elements of the Tax Return Drop Off Sheet include:

- Personal Information: Name, address, and Social Security number.

- Income Details: Sources of income, including W-2 and 1099 forms.

- Deductions: Information on eligible deductions that can reduce taxable income.

- Signature Section: A place for the client to sign, confirming the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

The Tax Return Drop Off Sheet can be submitted through various methods to accommodate client preferences. Options include:

- Online Submission: Securely upload the completed form through the Mark Cross Tax Services online portal.

- Email: Send the completed form as an attachment via email, ensuring that sensitive information is encrypted.

- Mail: Physically mail the form to the Mark Cross Tax Services office, using a secure mailing method.

- In-Person: Drop off the form directly at the office if preferred.

Quick guide on how to complete tax return drop off sheet mark cross tax services

Complete Tax Return Drop Off Sheet Mark Cross Tax Services effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Tax Return Drop Off Sheet Mark Cross Tax Services on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Tax Return Drop Off Sheet Mark Cross Tax Services with ease

- Find Tax Return Drop Off Sheet Mark Cross Tax Services and click Get Form to begin.

- Use the tools we offer to complete your form.

- Mark important parts of your documents or black out confidential information using the tools that airSlate SignNow specifically provides for this task.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Tax Return Drop Off Sheet Mark Cross Tax Services and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax return drop off sheet mark cross tax services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Return Drop Off Sheet Mark Cross Tax Services?

The Tax Return Drop Off Sheet Mark Cross Tax Services is a user-friendly document designed to simplify the process of submitting your tax documents. It allows clients to organize their tax information efficiently, ensuring nothing is overlooked when filing. This tool is essential for a smooth tax preparation experience.

-

How can I access the Tax Return Drop Off Sheet Mark Cross Tax Services?

You can easily access the Tax Return Drop Off Sheet Mark Cross Tax Services by visiting our website and navigating to the resources section. This document is available for download in a convenient format, making it simple to print and fill out your tax information before submission.

-

Are there any fees associated with using the Tax Return Drop Off Sheet Mark Cross Tax Services?

The Tax Return Drop Off Sheet Mark Cross Tax Services is provided for free as part of our commitment to helping clients prepare their taxes efficiently. While there may be fees for our comprehensive tax services, utilizing this drop-off sheet incurs no additional cost.

-

What features does the Tax Return Drop Off Sheet Mark Cross Tax Services include?

The Tax Return Drop Off Sheet Mark Cross Tax Services includes sections for all necessary tax information, ensuring that you capture income, deductions, and credits accurately. It's designed to guide you through the tax preparation process, preventing common errors and omissions.

-

How does the Tax Return Drop Off Sheet Mark Cross Tax Services benefit clients?

The primary benefit of the Tax Return Drop Off Sheet Mark Cross Tax Services is its ability to streamline the tax preparation process. By organizing your documents effectively, this sheet minimizes the risk of errors and facilitates a quicker turnaround time for your tax filing.

-

Can I integrate the Tax Return Drop Off Sheet Mark Cross Tax Services with other tools?

While the Tax Return Drop Off Sheet Mark Cross Tax Services is primarily a standalone resource, it can be complemented with various tax software tools for enhanced efficiency. Many clients choose to upload completed sheets into their preferred tax filing software, making integration seamless.

-

Is the Tax Return Drop Off Sheet Mark Cross Tax Services suitable for all types of taxpayers?

Yes, the Tax Return Drop Off Sheet Mark Cross Tax Services is designed to accommodate a wide range of taxpayers, including individuals, freelancers, and small business owners. It's versatile and easy to use, making it an ideal solution regardless of your tax situation.

Get more for Tax Return Drop Off Sheet Mark Cross Tax Services

- Application for persons with disabilities parking iowa dot forms familytofamilyiowa

- Nims forms 04

- Pnb los angeles form

- Physical form stafford municipal school district

- Citrus county fl variance application form

- More than anything chords form

- Boulder county housing authority housing rehabilitation programs 720 864 6401 fax 720 864 6419 complete all items form

- Pdf notification of assignment release or grant of secured interest x x form

Find out other Tax Return Drop Off Sheet Mark Cross Tax Services

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document