Form 507 Statement of Person Claiming an Income Tax Refund Due a Deceased Taxpayer

What is the Form 507 Statement of Person Claiming an Income Tax Refund Due a Deceased Taxpayer

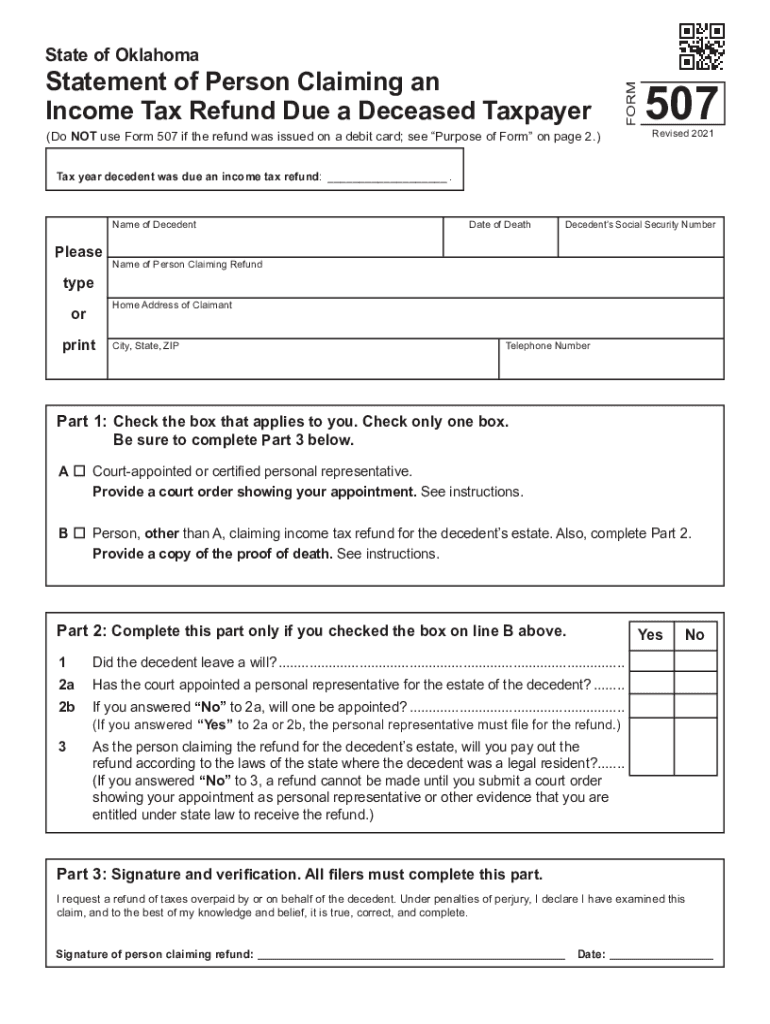

The Form 507 is a specific document used in Oklahoma for individuals claiming an income tax refund on behalf of a deceased taxpayer. This form is essential for ensuring that any tax refunds owed to the deceased are properly directed to the rightful claimant, typically a family member or legal representative. The form requires detailed information about the deceased taxpayer, including their Social Security number, date of death, and the reason for the refund claim. It is crucial for the claimant to provide accurate information to facilitate the processing of the refund.

How to Use the Form 507 Statement of Person Claiming an Income Tax Refund Due a Deceased Taxpayer

Using the Form 507 involves several steps to ensure compliance with state regulations. The claimant must first complete the form with accurate details regarding the deceased taxpayer. This includes their personal information and the specific tax year for which the refund is being claimed. Once the form is filled out, it should be submitted along with any required supporting documents, such as a copy of the death certificate and proof of the claimant's relationship to the deceased. It is advisable to keep copies of all submitted documents for personal records.

Steps to Complete the Form 507 Statement of Person Claiming an Income Tax Refund Due a Deceased Taxpayer

Completing the Form 507 requires careful attention to detail. The following steps outline the process:

- Obtain the Form 507 from the Oklahoma Tax Commission website or other official sources.

- Fill in the deceased taxpayer's personal information, including their name, Social Security number, and date of death.

- Provide the claimant's details, ensuring to include their relationship to the deceased.

- Indicate the tax year for which the refund is being claimed.

- Attach any necessary documentation, such as the death certificate and proof of identity.

- Review the completed form for accuracy before submission.

Required Documents for the Form 507 Statement of Person Claiming an Income Tax Refund Due a Deceased Taxpayer

To successfully file the Form 507, certain documents are required to validate the claim. These documents typically include:

- A copy of the deceased taxpayer's death certificate.

- Proof of the claimant's identity, such as a driver's license or Social Security card.

- Any relevant tax documents that support the refund claim, including prior tax returns for the deceased.

Eligibility Criteria for the Form 507 Statement of Person Claiming an Income Tax Refund Due a Deceased Taxpayer

Eligibility to file the Form 507 is generally limited to individuals who are legally recognized as representatives of the deceased taxpayer's estate. This may include:

- Immediate family members, such as spouses or children.

- Legal representatives or executors appointed through a will or estate proceedings.

It is important for claimants to ensure they meet these criteria to avoid delays in processing the refund.

Form Submission Methods for the Form 507 Statement of Person Claiming an Income Tax Refund Due a Deceased Taxpayer

The Form 507 can be submitted through various methods, depending on the preferences of the claimant. The available submission methods include:

- Mailing the completed form and supporting documents to the appropriate address provided by the Oklahoma Tax Commission.

- Submitting the form in person at designated tax offices.

- In some cases, electronic submission may be available, allowing for a more streamlined process.

Quick guide on how to complete form 507 statement of person claiming an income tax refund due a deceased taxpayer

Complete Form 507 Statement Of Person Claiming An Income Tax Refund Due A Deceased Taxpayer seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to easily access the appropriate template and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents promptly without delays. Handle Form 507 Statement Of Person Claiming An Income Tax Refund Due A Deceased Taxpayer on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

The easiest way to alter and eSign Form 507 Statement Of Person Claiming An Income Tax Refund Due A Deceased Taxpayer effortlessly

- Acquire Form 507 Statement Of Person Claiming An Income Tax Refund Due A Deceased Taxpayer and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method of sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign Form 507 Statement Of Person Claiming An Income Tax Refund Due A Deceased Taxpayer while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 507 statement of person claiming an income tax refund due a deceased taxpayer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma 507 refund?

The Oklahoma 507 refund is a tax refund related to certain tax credits and deductions in the state of Oklahoma. It is designed to help taxpayers recover eligible expenses and ensure they receive their rightful refund. Understanding the Oklahoma 507 refund can assist you in maximizing your tax benefits.

-

How can airSlate SignNow help with the Oklahoma 507 refund process?

AirSlate SignNow streamlines the document signing process, making it easier to manage the paperwork needed for the Oklahoma 507 refund claim. By using our eSign solution, you can quickly sign and send your tax documents, ensuring a faster and more efficient refund process. With our user-friendly interface, you'll save time and avoid unnecessary delays.

-

Are there any costs associated with using airSlate SignNow for Oklahoma 507 refund documentation?

AirSlate SignNow offers various pricing plans to accommodate different needs, including costs that align with filing for Oklahoma 507 refunds. Our cost-effective solutions can help you save money while ensuring all necessary documents are filed appropriately. Explore our plans to find the best fit for your needs!

-

What features does airSlate SignNow offer for Oklahoma 507 refund documentation?

AirSlate SignNow provides essential features like e-signature capabilities, easy document sharing, and template creation specifically designed for tax-related paperwork. These features ensure that your Oklahoma 507 refund forms are completed accurately and efficiently. By utilizing these tools, you can simplify your tax documentation process signNowly.

-

Can I integrate airSlate SignNow with other tools for my Oklahoma 507 refund needs?

Yes, airSlate SignNow offers integrations with various applications to support your Oklahoma 507 refund documentation. Tools such as CRM systems and cloud storage services can seamlessly work alongside our platform, enhancing your overall workflow. This integration capability ensures you keep all related documents organized and accessible.

-

What are the benefits of using airSlate SignNow for my Oklahoma 507 refund documents?

Using airSlate SignNow for your Oklahoma 507 refund documents offers signNow benefits such as improved efficiency and reduced paper usage. Our eSigning feature allows you to manage your refund documentation from anywhere, which is convenient and time-saving. Furthermore, it's a secure method to handle sensitive tax information.

-

Is airSlate SignNow suitable for small businesses applying for the Oklahoma 507 refund?

Absolutely! AirSlate SignNow is ideal for small businesses seeking to navigate the Oklahoma 507 refund process effortlessly. Our user-friendly platform allows you to manage your documentation without complex systems, making it easier for small organizations to claim their refunds promptly. Experience cost-effective solutions designed for businesses of all sizes.

Get more for Form 507 Statement Of Person Claiming An Income Tax Refund Due A Deceased Taxpayer

- Backflow device test report prince william county service authority form

- Dna history webquest answer key form

- Change of address form nhsbsa nhs uk

- Arkansas electrician application form

- Went out of network form

- Crops service postmortem submission formlab use

- Joint sale agreement template form

- Joint venture real estate agreement template form

Find out other Form 507 Statement Of Person Claiming An Income Tax Refund Due A Deceased Taxpayer

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney