Sales, Use, Lease Tax Form City of Helena, Alabama

What is the Sales, Use, Lease Tax Form City Of Helena, Alabama

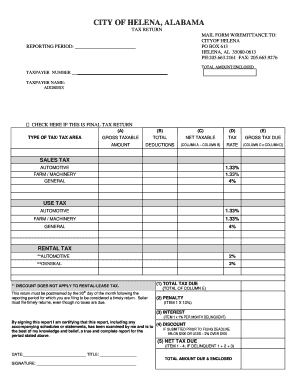

The Sales, Use, Lease Tax Form City Of Helena, Alabama is a document required for reporting and remitting sales, use, and lease taxes within the jurisdiction of Helena, Alabama. This form is essential for businesses operating in the city, as it ensures compliance with local tax regulations. The form captures details about taxable sales, the amount of tax collected, and the total sales made during a specified period. Proper completion of this form is crucial for maintaining good standing with the city’s tax authorities.

How to use the Sales, Use, Lease Tax Form City Of Helena, Alabama

Utilizing the Sales, Use, Lease Tax Form City Of Helena, Alabama involves several key steps. First, businesses must gather all relevant sales data for the reporting period. This includes total sales, any exemptions, and the amount of tax collected. Next, the form must be filled out accurately, ensuring that all figures are reported correctly. After completing the form, it can be submitted electronically or via mail, depending on the preferences of the business and the guidelines provided by the city.

Steps to complete the Sales, Use, Lease Tax Form City Of Helena, Alabama

Completing the Sales, Use, Lease Tax Form City Of Helena, Alabama involves a systematic approach:

- Gather all sales records and tax information for the reporting period.

- Access the form, ensuring you have the latest version from the city’s official resources.

- Fill in the required fields, including total sales, tax collected, and any applicable exemptions.

- Review the form for accuracy, ensuring all calculations are correct.

- Submit the form either electronically or by mail, following the submission guidelines provided by the city.

Legal use of the Sales, Use, Lease Tax Form City Of Helena, Alabama

The legal use of the Sales, Use, Lease Tax Form City Of Helena, Alabama is governed by local tax laws and regulations. This form must be completed and filed by businesses to comply with Helena’s tax requirements. Failure to use the form correctly or to submit it on time can result in penalties or fines. It is essential for businesses to understand the legal implications of this form to avoid any non-compliance issues.

Key elements of the Sales, Use, Lease Tax Form City Of Helena, Alabama

The Sales, Use, Lease Tax Form City Of Helena, Alabama includes several key elements that are vital for accurate reporting:

- Business identification information, including name and address.

- Reporting period for which the sales and taxes are being reported.

- Total sales figures and the corresponding tax collected.

- Details of any exemptions claimed during the reporting period.

- Signature of the authorized representative, certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Sales, Use, Lease Tax Form City Of Helena, Alabama are typically set by the city’s tax authority. Businesses must be aware of these deadlines to ensure timely submission. Generally, forms are due on a monthly or quarterly basis, depending on the volume of sales. Missing a deadline can lead to penalties, so it is advisable for businesses to maintain a calendar of important dates related to tax filings.

Quick guide on how to complete sales use lease tax form city of helena alabama

Complete Sales, Use, Lease Tax Form City Of Helena, Alabama effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documentation, as you can access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Sales, Use, Lease Tax Form City Of Helena, Alabama on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The easiest way to edit and eSign Sales, Use, Lease Tax Form City Of Helena, Alabama without hassle

- Obtain Sales, Use, Lease Tax Form City Of Helena, Alabama and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Edit and eSign Sales, Use, Lease Tax Form City Of Helena, Alabama and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales use lease tax form city of helena alabama

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sales, Use, Lease Tax Form City Of Helena, Alabama?

The Sales, Use, Lease Tax Form City Of Helena, Alabama is a document required by the city for reporting sales and use taxes associated with transactions. This form ensures compliance with local tax laws and helps businesses accurately report their tax obligations to the city government.

-

How can airSlate SignNow help with the Sales, Use, Lease Tax Form City Of Helena, Alabama?

airSlate SignNow offers a simple and efficient platform to prepare, send, and eSign the Sales, Use, Lease Tax Form City Of Helena, Alabama. With our user-friendly interface, users can streamline the completion process, ensuring that documents are accurate and sent on time.

-

What features does airSlate SignNow offer for managing the Sales, Use, Lease Tax Form City Of Helena, Alabama?

airSlate SignNow includes features such as customizable templates, cloud storage, and real-time tracking for the Sales, Use, Lease Tax Form City Of Helena, Alabama. These features enable businesses to enhance their document workflow, ensuring they remain organized and compliant.

-

Is there a cost associated with using airSlate SignNow for the Sales, Use, Lease Tax Form City Of Helena, Alabama?

Yes, airSlate SignNow provides various pricing plans that are cost-effective for businesses of all sizes. Users can select a plan that suits their needs and budget, allowing them to efficiently handle the Sales, Use, Lease Tax Form City Of Helena, Alabama and other documents.

-

Can I integrate airSlate SignNow with other tools for the Sales, Use, Lease Tax Form City Of Helena, Alabama?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications and tools that can assist in managing the Sales, Use, Lease Tax Form City Of Helena, Alabama. This flexibility makes it easier to incorporate into your existing workflow and enhance productivity.

-

How secure is airSlate SignNow for the Sales, Use, Lease Tax Form City Of Helena, Alabama?

Security is a top priority for airSlate SignNow. The platform employs industry-standard encryption and compliance measures to safeguard the Sales, Use, Lease Tax Form City Of Helena, Alabama and other sensitive documents, ensuring that your information remains private and secure.

-

What benefits do I gain from using airSlate SignNow for the Sales, Use, Lease Tax Form City Of Helena, Alabama?

Using airSlate SignNow for the Sales, Use, Lease Tax Form City Of Helena, Alabama provides numerous benefits, including faster processing times and improved accuracy. This ultimately reduces the stress of compliance and allows businesses to focus more on their core activities.

Get more for Sales, Use, Lease Tax Form City Of Helena, Alabama

- Fnma form 4340fannie maehazardous waste scribd

- 417 escape artist form

- Emergency marine deployment form

- Canada post complaint form

- Financial hardship waiver application emax medical billing form

- Video permission form harbor creek senior high sr hcsd iu5

- Lance trainer agreement template form

- Display advertis contract template form

Find out other Sales, Use, Lease Tax Form City Of Helena, Alabama

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe