St Martin Parish Sales Use Tax Application Form

What is the St Martin Parish Sales Use Tax Application

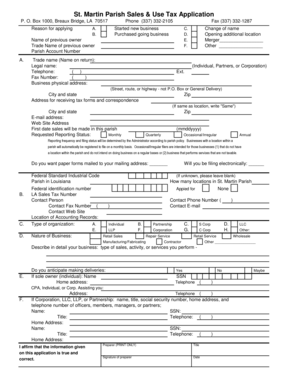

The St Martin Parish Sales Use Tax Application is a crucial document for businesses operating within St Martin Parish, Louisiana. This application allows businesses to register for collecting sales tax, ensuring compliance with local tax regulations. The application is essential for both new and existing businesses that need to report and remit sales tax to the parish authorities. Understanding this application is vital for maintaining lawful operations within the parish.

Steps to complete the St Martin Parish Sales Use Tax Application

Completing the St Martin Parish Sales Use Tax Application involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your business name, address, and federal tax identification number. Next, fill out the application form with the required details, ensuring that all entries are accurate. After completing the form, review it for any errors before submission. Finally, submit the application either online or via mail, depending on your preference and the available options.

Legal use of the St Martin Parish Sales Use Tax Application

The legal use of the St Martin Parish Sales Use Tax Application is governed by state and local tax laws. This application must be filled out accurately to ensure that businesses are compliant with tax regulations. Failure to submit the application or inaccuracies in the information provided can lead to penalties or fines. It is essential for businesses to understand the legal implications of this application to avoid complications with tax authorities.

Required Documents

To successfully complete the St Martin Parish Sales Use Tax Application, several documents are typically required. These may include your business license, federal tax identification number, and any relevant permits or registrations associated with your business operations. Having these documents on hand will facilitate a smoother application process and help ensure that all necessary information is provided.

Form Submission Methods

The St Martin Parish Sales Use Tax Application can be submitted through various methods to accommodate different preferences. Businesses may choose to submit the form online, which often provides a quicker processing time. Alternatively, the application can be mailed to the appropriate parish office or submitted in person. Each submission method has its benefits, and businesses should select the one that best meets their needs.

Eligibility Criteria

Eligibility to file the St Martin Parish Sales Use Tax Application generally requires that the business operates within the parish and is engaged in taxable sales or services. This includes retail businesses, service providers, and any other entities that sell goods or services subject to sales tax. Understanding the eligibility criteria is essential for businesses to ensure they are compliant with local tax laws.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the St Martin Parish Sales Use Tax Application can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from tax authorities. It is important for businesses to stay informed about their obligations and ensure timely submission of the application to avoid these consequences.

Quick guide on how to complete st martin parish sales use tax application

Complete St Martin Parish Sales Use Tax Application effortlessly on any gadget

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents quickly and without hold-ups. Handle St Martin Parish Sales Use Tax Application on any gadget using airSlate SignNow Android or iOS apps and enhance any document-centric process today.

How to modify and eSign St Martin Parish Sales Use Tax Application with ease

- Obtain St Martin Parish Sales Use Tax Application and click on Get Form to begin.

- Leverage the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from a device of your choosing. Modify and eSign St Martin Parish Sales Use Tax Application and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st martin parish sales use tax application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Louisiana sales tax application offered by airSlate SignNow?

The Louisiana sales tax application from airSlate SignNow is a digital solution designed to help businesses efficiently manage their sales tax documentation. By automating the process of sending and eSigning documents, it simplifies compliance with Louisiana state laws. This application is tailored for businesses of all sizes seeking to streamline their tax reporting process.

-

How does the Louisiana sales tax application help businesses save time?

With the Louisiana sales tax application, businesses can signNowly reduce the time spent on tedious paperwork. The application allows users to quickly create, send, and eSign necessary documents. This efficiency frees up valuable resources within the organization, enabling teams to focus on more critical tasks.

-

What are the pricing options for the Louisiana sales tax application?

airSlate SignNow offers competitive pricing for the Louisiana sales tax application based on the level of features required. There are various subscription plans that cater to different business needs, ensuring affordability. Additionally, users can opt for monthly or annual billing, with discounts available for longer commitments.

-

Is the Louisiana sales tax application user-friendly?

Absolutely! The Louisiana sales tax application is designed with user experience in mind, featuring an intuitive interface. This simplicity allows users—regardless of their tech-savviness—to navigate the platform effortlessly and manage their sales tax documents with ease.

-

What integrations does the Louisiana sales tax application support?

The Louisiana sales tax application integrates seamlessly with various financial and accounting software. This enhances workflow efficiency by synchronizing data between platforms, ensuring that your sales tax calculations are accurate and up-to-date. Popular integrations include QuickBooks, Xero, and other tax preparation tools.

-

What benefits does the Louisiana sales tax application provide for document security?

Security is a top priority with the Louisiana sales tax application, which uses advanced encryption to protect sensitive tax documents. This ensures that all eSigned documents are safe from unauthorized access or tampering. Businesses can confidently manage their sales tax applications knowing that their information is secure.

-

Can the Louisiana sales tax application help with compliance?

Yes, the Louisiana sales tax application is designed to assist businesses in maintaining compliance with state tax laws. By automating document creation and providing alerts for important deadlines, it helps users avoid potential penalties. This proactive approach is essential for any business operating in Louisiana.

Get more for St Martin Parish Sales Use Tax Application

- Eagle scout letter of recommendation form

- Gewa 3 po polsku form

- Socratic seminar template form

- Employee rosters dleg state mi form

- Qapi self assessment tool alliantquality org form

- Rental deposit form

- Ces payment authorization form school of continuing studies

- Iowa veterans trust fund fy honor guard form

Find out other St Martin Parish Sales Use Tax Application

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online