Trust Transfer Deed 2015-2026

What is the Trust Transfer Deed?

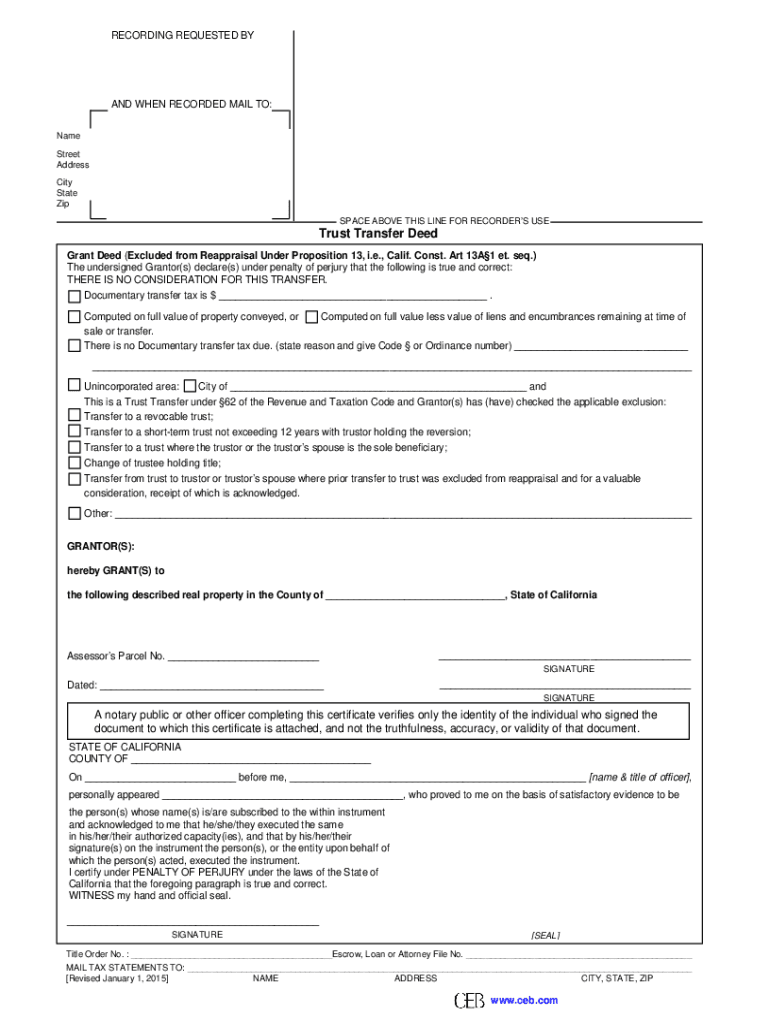

A Trust Transfer Deed is a legal document used in California that allows an individual to transfer real property to a trust upon their death. This deed enables the property to bypass probate, simplifying the transfer process to beneficiaries. By utilizing this deed, property owners can ensure that their assets are managed according to their wishes without the delays and costs associated with probate court. It is essential to understand that the Trust Transfer Deed must be properly executed and recorded to be effective.

How to use the Trust Transfer Deed

To use a Trust Transfer Deed, the property owner must first create a trust and designate the property to be transferred into that trust. The deed must clearly identify the property and the trust, including the trustee's name. Once completed, the deed should be signed by the property owner in the presence of a notary public. After notarization, the deed must be recorded with the county recorder's office where the property is located to ensure its validity. This process helps protect the property from potential claims and ensures a smooth transfer to the beneficiaries.

Steps to complete the Trust Transfer Deed

Completing a Trust Transfer Deed involves several key steps:

- Draft the deed, including the property description and trust details.

- Sign the deed in front of a notary public to validate the signature.

- Record the deed at the county recorder's office where the property is situated.

- Notify the trustee and any beneficiaries about the transfer.

Following these steps ensures that the transfer is legally binding and recognized by the state.

Legal use of the Trust Transfer Deed

The Trust Transfer Deed is legally recognized in California, provided it meets specific requirements outlined by state law. This includes proper execution, notarization, and recording. It is crucial to ensure that the deed complies with California’s legal standards to avoid disputes or challenges after the property owner's death. Additionally, the deed must clearly state the intent to transfer the property into the trust, which is essential for its enforceability.

Key elements of the Trust Transfer Deed

Several key elements must be included in a Trust Transfer Deed for it to be valid:

- Grantor Information: The name and address of the property owner transferring the property.

- Trustee Information: The name of the trustee who will manage the trust.

- Property Description: A detailed description of the property being transferred.

- Signature and Notarization: The grantor's signature must be notarized.

- Recording Information: The deed must be recorded with the appropriate county office.

State-specific rules for the Trust Transfer Deed

In California, specific rules govern the use of Trust Transfer Deeds. These rules include the requirement for the deed to be recorded within a certain timeframe after execution, typically within 60 days. Additionally, the deed must comply with California Probate Code sections that outline the requirements for transferring property into a trust. Understanding these state-specific rules is essential for ensuring the deed's effectiveness and legality.

Quick guide on how to complete trust transfer deed 522997450

Prepare Trust Transfer Deed effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can obtain the correct form and securely maintain it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without delays. Handle Trust Transfer Deed on any device using airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and electronically sign Trust Transfer Deed with ease

- Locate Trust Transfer Deed and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal value as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Trust Transfer Deed to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the trust transfer deed 522997450

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a transfer on death deed in California?

A transfer on death deed in California allows an individual to transfer real estate to a designated beneficiary upon their death, bypassing probate. This document must be recorded with the county clerk before the owner's death to be valid. It's a simple and effective way to ensure that your property goes directly to your chosen beneficiary.

-

How do I create a transfer on death deed in California?

To create a transfer on death deed in California, you need to fill out the appropriate form, which includes details about the property and the beneficiary. After completing the form, you must sign it in front of a notary public and record it with the county recorder's office. Utilizing airSlate SignNow can simplify this process with easy eSigning and document management.

-

What are the benefits of using a transfer on death deed in California?

The main benefits of using a transfer on death deed in California include avoiding probate, maintaining control of your property during your lifetime, and ensuring a smooth transition of property to your beneficiary. It provides peace of mind knowing that your asset will pass directly and efficiently to your loved ones without court intervention.

-

Is there a cost associated with filing a transfer on death deed in California?

Yes, there is typically a small fee associated with recording a transfer on death deed in California, which varies by county. Additionally, if you choose to use services like airSlate SignNow, there may be a fee for eSigning and managing your documents online. These costs can be relatively low compared to the expenses of probate.

-

Can I revoke a transfer on death deed in California?

Yes, a transfer on death deed in California can be revoked at any time before the owner's death. This can be done by executing a new deed that explicitly states the revocation or by filing a statement of revocation with the county recorder's office. Using airSlate SignNow can facilitate the revocation process through easy electronic document editing.

-

Who can be a beneficiary on a transfer on death deed in California?

In California, the beneficiary of a transfer on death deed can be an individual, multiple individuals, or an entity such as a trust. However, it is important to ensure that the beneficiaries are clearly identified in the deed to avoid any confusion. airSlate SignNow makes it easy to specify and manage beneficiary information securely.

-

How does a transfer on death deed affect tax implications in California?

Generally, a transfer on death deed in California does not have immediate tax implications for the beneficiary since ownership is transferred only upon the owner's death. However, it is advisable to consult with a tax professional to understand any potential property tax reassessment or estate tax implications. airSlate SignNow can help you organize your documentation effectively for any consultations.

Get more for Trust Transfer Deed

- Chapter 6 10 resources physics answers form

- Proof of claim form 1212

- Bolton council discretionary housing payment form

- Ses beneftis canada corporation smart employee benefits form

- Dd form 2345 militarily critical technical data agreement march

- Manufacturer agreement template form

- Managing director agreement template form

- Dog sitt contract template form

Find out other Trust Transfer Deed

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter