Form 656 Sp Rev 4 Offer in Compromise Spanish Version 2023-2026

What is the Form 656 sp Rev 4 Offer In Compromise Spanish Version

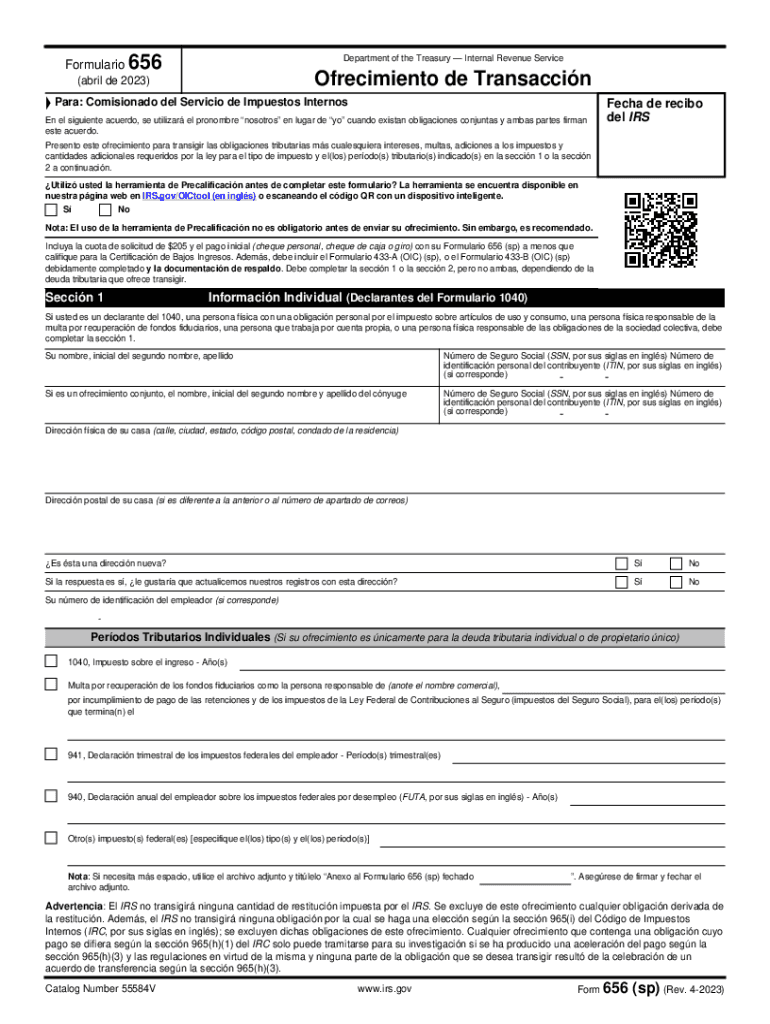

The Form 656 sp Rev 4 Offer In Compromise Spanish Version is a legal document used by taxpayers in the United States to propose a settlement with the Internal Revenue Service (IRS) for a reduced tax liability. This form allows individuals who are unable to pay their full tax debt to negotiate a lower amount that they can afford to pay. The Spanish version ensures accessibility for Spanish-speaking taxpayers, facilitating their understanding of the process and requirements involved in submitting an offer in compromise.

How to use the Form 656 sp Rev 4 Offer In Compromise Spanish Version

Using the Form 656 sp Rev 4 Offer In Compromise Spanish Version involves several steps. First, taxpayers must gather all necessary financial information, including income, expenses, and assets. Next, they should fill out the form accurately, providing detailed information about their financial situation and the proposed offer amount. After completing the form, taxpayers can submit it to the IRS, either electronically or by mail, depending on their preference and the specific guidelines provided by the IRS.

Steps to complete the Form 656 sp Rev 4 Offer In Compromise Spanish Version

Completing the Form 656 sp Rev 4 Offer In Compromise Spanish Version requires careful attention to detail. Here are the essential steps:

- Gather financial documents, including pay stubs, bank statements, and tax returns.

- Fill out the form, providing accurate and complete information about your income, expenses, and assets.

- Calculate your offer amount based on your ability to pay and the IRS guidelines.

- Sign and date the form, ensuring all required signatures are included.

- Submit the form to the IRS, along with any necessary supporting documentation and the required fee.

Eligibility Criteria

To qualify for submitting the Form 656 sp Rev 4 Offer In Compromise Spanish Version, taxpayers must meet specific eligibility criteria set by the IRS. These criteria include demonstrating an inability to pay the full tax liability, showing that the offer amount is reasonable based on financial circumstances, and not being in an open bankruptcy proceeding. Taxpayers should review these requirements carefully to ensure they are eligible before submitting the form.

Required Documents

When submitting the Form 656 sp Rev 4 Offer In Compromise Spanish Version, taxpayers must include several supporting documents. These typically include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of expenses, including bills and statements.

- Asset information, such as bank statements and property deeds.

- A completed Form 433-A (OIC) or Form 433-B (OIC), detailing financial information.

Filing Deadlines / Important Dates

Filing deadlines for the Form 656 sp Rev 4 Offer In Compromise Spanish Version are critical to ensure timely processing. Taxpayers should be aware of the IRS guidelines regarding submission timelines, especially if they are responding to a tax notice or seeking to resolve tax debt before certain deadlines. It is advisable to check the IRS website or consult a tax professional for the most current dates and deadlines related to offers in compromise.

Quick guide on how to complete form 656 sp rev 4 offer in compromise spanish version

Effortlessly prepare Form 656 sp Rev 4 Offer In Compromise Spanish Version on any device

The management of online documents has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditionally printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Form 656 sp Rev 4 Offer In Compromise Spanish Version on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Form 656 sp Rev 4 Offer In Compromise Spanish Version with ease

- Obtain Form 656 sp Rev 4 Offer In Compromise Spanish Version and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to conserve your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Adjust and electronically sign Form 656 sp Rev 4 Offer In Compromise Spanish Version while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 656 sp rev 4 offer in compromise spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

The Form 656 sp Rev 4 Offer In Compromise Spanish Version is an IRS form used to submit an Offer In Compromise in Spanish, allowing taxpayers to settle their tax debts for less than the amount owed. This form is specifically designed for Spanish-speaking individuals who want to negotiate with the IRS. It simplifies the process for those who are more comfortable in their native language.

-

How do I access the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

You can easily access the Form 656 sp Rev 4 Offer In Compromise Spanish Version by visiting the IRS website or by using platforms like airSlate SignNow. These platforms provide an easy and efficient way to fill out, sign, and submit your forms securely. Make sure to select the Spanish version for your needs.

-

What features does airSlate SignNow offer for the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

airSlate SignNow offers user-friendly features such as eSigning, document sharing, and cloud storage for the Form 656 sp Rev 4 Offer In Compromise Spanish Version. The platform ensures your documents are securely stored and easily accessed from any device. Additionally, it allows for real-time collaboration, making it easier to manage your tax forms.

-

Is there a cost associated with using airSlate SignNow for the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

Yes, there is a cost associated with using airSlate SignNow, but it is known for being a cost-effective solution for managing documents like the Form 656 sp Rev 4 Offer In Compromise Spanish Version. Various pricing plans are available depending on your needs, which provide access to all the essential features required for document signing and eSigning. It's a worthwhile investment for efficient document handling.

-

What are the benefits of using the Form 656 sp Rev 4 Offer In Compromise Spanish Version with airSlate SignNow?

Using the Form 656 sp Rev 4 Offer In Compromise Spanish Version with airSlate SignNow offers several benefits, including time-saving eSigning, secure document handling, and improved organization. The platform streamlines the process of submitting your offer to the IRS, reduces paperwork, and minimizes errors. It also allows you to track the status of your documents easily.

-

Can I integrate airSlate SignNow with other software while using the Form 656 sp Rev 4 Offer In Compromise Spanish Version?

Yes, airSlate SignNow supports integrations with various software applications, enhancing your experience while using the Form 656 sp Rev 4 Offer In Compromise Spanish Version. You can connect it with CRM systems, cloud storage solutions, and project management tools to simplify your workflow. This flexibility ensures that you can manage your documents more effectively.

-

Is technical support available while using the Form 656 sp Rev 4 Offer In Compromise Spanish Version with airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive customer support for users of the Form 656 sp Rev 4 Offer In Compromise Spanish Version. Whether you have queries regarding form submissions, features, or integration issues, their support team is available to assist you promptly. You can signNow them through multiple channels, including chat, email, and phone.

Get more for Form 656 sp Rev 4 Offer In Compromise Spanish Version

Find out other Form 656 sp Rev 4 Offer In Compromise Spanish Version

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple