Drc 01a Word Format

What is the Drc 01a Word Format

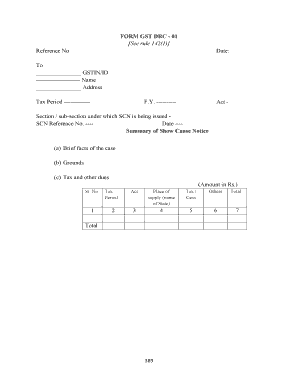

The Drc 01a format is a specific document used primarily for tax purposes within the United States. It serves as a formal request for certain tax-related adjustments or clarifications. This form is essential for individuals and businesses looking to ensure compliance with tax regulations and to facilitate accurate reporting. Understanding its structure and purpose is crucial for effective use.

How to Use the Drc 01a Word Format

Using the Drc 01a format involves several key steps to ensure that the form is filled out correctly. Begin by downloading the form in Word format, which allows for easy editing. Carefully read the instructions associated with the form to understand the required information. Fill in all necessary fields, ensuring accuracy in the information provided. Once completed, the form should be saved and submitted as per the guidelines provided by the relevant tax authority.

Steps to Complete the Drc 01a Word Format

Completing the Drc 01a format requires attention to detail. Follow these steps:

- Download the Drc 01a Word format from a reliable source.

- Open the document in a compatible word processor.

- Read through the form to familiarize yourself with the required sections.

- Fill in your personal and tax-related information accurately.

- Review the completed form for any errors or omissions.

- Save the document securely, ensuring that it is easily accessible for submission.

Legal Use of the Drc 01a Word Format

The Drc 01a format is legally recognized when filled out and submitted according to established guidelines. It is important to ensure compliance with relevant tax laws to avoid penalties. The form must be signed and dated appropriately, and any supporting documents should be attached as required. Using a reliable eSignature solution can enhance the legal validity of the submission.

Key Elements of the Drc 01a Word Format

Several key elements are crucial for the Drc 01a format to be considered complete:

- Identifying information, including name and taxpayer identification number.

- Specific details regarding the tax issue being addressed.

- Clear instructions on the actions being requested.

- Signature and date fields to validate the submission.

Examples of Using the Drc 01a Word Format

Examples of scenarios in which the Drc 01a format may be used include:

- Requesting a refund for overpaid taxes.

- Clarifying discrepancies in reported income.

- Adjusting tax liabilities based on new information.

Quick guide on how to complete drc 01a word format

Complete Drc 01a Word Format seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Drc 01a Word Format on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to edit and eSign Drc 01a Word Format effortlessly

- Locate Drc 01a Word Format and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow manages all your needs in document administration in just a few clicks from a device of your choice. Edit and eSign Drc 01a Word Format and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the drc 01a word format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the drc 01a format and how is it used in airSlate SignNow?

The drc 01a format is a specific document format supported by airSlate SignNow for electronic signatures. It allows businesses to create, edit, and manage documents efficiently while ensuring compliance with various regulations. Utilizing this format can streamline your document workflow and improve overall productivity.

-

Is there a cost associated with using the drc 01a format in airSlate SignNow?

Using the drc 01a format within airSlate SignNow is part of our subscription plans, which are designed to be cost-effective for businesses of all sizes. The pricing offers flexible options that cater to different needs and volume of usage. You can assess the pricing details on our website to find a plan that fits your requirements.

-

What features does airSlate SignNow offer for the drc 01a format?

airSlate SignNow provides several features for the drc 01a format, including easy import and export options, customizable templates, and security measures for e-signature compliance. Additionally, users can track document status and receive notifications, which simplifies the signature process. These features enhance efficiency for any business leveraging the drc 01a format.

-

Can I integrate airSlate SignNow with other software to manage drc 01a format documents?

Yes, airSlate SignNow offers integration capabilities with a variety of software solutions, enhancing your workflow for managing drc 01a format documents. You can connect with platforms like CRMs, cloud storage solutions, and other productivity tools. This integration supports a seamless user experience and centralizes your document management.

-

What are the benefits of using airSlate SignNow with the drc 01a format?

One of the key benefits of airSlate SignNow with the drc 01a format is the ability to manage documents electronically, reducing paper waste and speeding up the signing process. Additionally, it ensures that documents are stored securely and are easily accessible. This results in improved efficiency and can lead to faster business transactions.

-

How can I get started with the drc 01a format in airSlate SignNow?

Getting started with the drc 01a format in airSlate SignNow is simple. First, sign up for a free trial or choose a subscription plan that suits your needs. Once registered, explore the intuitive interface to create and manage your first document using the drc 01a format.

-

Are there any limitations with the drc 01a format in airSlate SignNow?

While the drc 01a format is robust, users should be aware of any specific compliance regulations related to electronic signatures in their industry. airSlate SignNow is designed to support many business requirements, but it is crucial to ensure alignment with legal standards applicable to your documents. Review the guidelines and best practices provided by airSlate SignNow for optimal usage.

Get more for Drc 01a Word Format

Find out other Drc 01a Word Format

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word