Pur 102 2020-2026

What is the PUR 102?

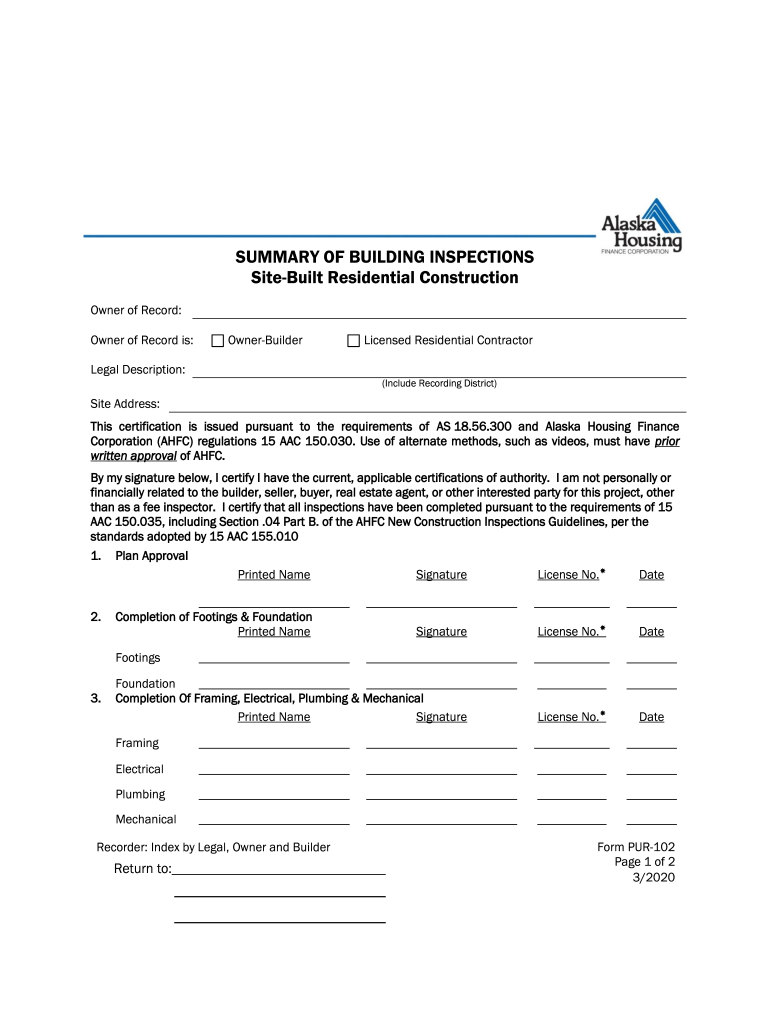

The PUR 102 is a specific form used in the state of Alaska for reporting and documenting certain transactions or activities. This form is essential for individuals and businesses to comply with state regulations. It serves as a means to collect necessary information that may be required for tax purposes, regulatory compliance, or other legal obligations. Understanding the purpose and requirements of the PUR 102 is crucial for accurate and timely submission.

How to use the PUR 102

Using the PUR 102 involves several steps to ensure that all required information is accurately reported. First, gather all necessary documentation related to the transactions or activities you need to report. Next, carefully fill out the form, ensuring that you provide complete and accurate information. It may be beneficial to consult with a tax professional or legal advisor to confirm that you are meeting all requirements. Once completed, submit the form according to the guidelines provided by the state of Alaska.

Steps to complete the PUR 102

Completing the PUR 102 involves a systematic approach:

- Gather necessary documentation, including receipts, invoices, and other relevant records.

- Review the instructions provided with the form to understand the specific requirements.

- Fill out the form accurately, ensuring all fields are completed as required.

- Double-check your entries for accuracy and completeness.

- Submit the form by the specified deadline, either online or via mail, as directed.

Legal use of the PUR 102

The PUR 102 must be used in accordance with Alaska state laws and regulations. It is important to ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or legal issues. The form may be subject to audits, and maintaining accurate records is essential for compliance. Understanding the legal implications of the PUR 102 helps individuals and businesses navigate their obligations effectively.

State-specific rules for the PUR 102

Each state may have unique rules governing the use of the PUR 102. In Alaska, it is important to familiarize yourself with the specific guidelines that apply to this form. These rules may include filing deadlines, required documentation, and submission methods. Staying informed about state-specific regulations can help ensure compliance and avoid potential penalties.

Examples of using the PUR 102

The PUR 102 can be utilized in various scenarios. For instance, a business may use it to report sales tax collected on transactions. Individuals may also use the form to report certain types of income or transactions that are subject to state regulations. Understanding these examples can provide clarity on when and how to use the PUR 102 effectively.

Quick guide on how to complete pur 102

Complete Pur 102 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the proper format and securely save it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents quickly without delays. Manage Pur 102 on any device using airSlate SignNow's Android or iOS applications, and simplify any document-related task today.

How to modify and eSign Pur 102 effortlessly

- Find Pur 102 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign Pur 102 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pur 102

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pur 102 eSigning solution offered by airSlate SignNow?

The pur 102 is an advanced eSigning solution provided by airSlate SignNow that enables users to easily send, sign, and manage documents electronically. With its intuitive interface, businesses can streamline their document workflows and enhance productivity, making the signing process quick and efficient.

-

How much does the pur 102 solution cost?

The pricing for the pur 102 eSigning solution varies based on the specific features and subscription plans you choose. AirSlate SignNow offers several flexible pricing options designed to meet the needs of businesses of all sizes, ensuring you only pay for what you use.

-

What features are included in airSlate SignNow's pur 102 plan?

The pur 102 plan includes essential features such as customizable templates, real-time tracking, and secure cloud storage for signed documents. Users also benefit from features like in-app messaging and integrations with popular tools, which help optimize the document signing experience.

-

How can the pur 102 solution improve my business processes?

Implementing the pur 102 eSigning solution can signNowly reduce turnaround times for document approvals, leading to faster business processes. Additionally, airSlate SignNow's automation features minimize manual tasks, allowing your team to focus on more strategic initiatives.

-

Is the pur 102 solution secure for sensitive documents?

Yes, the pur 102 solution prioritizes security, employing bank-level encryption and secure access controls to protect sensitive information. AirSlate SignNow also complies with various regulations, ensuring that your data remains safe and confidential during the signing process.

-

Can I integrate the pur 102 solution with my existing software?

Absolutely! The pur 102 eSigning solution by airSlate SignNow offers seamless integrations with popular software applications, including CRM systems and cloud storage solutions. This flexibility helps ensure a smooth workflow by connecting your existing tools with the eSigning process.

-

What benefits can I expect from using the pur 102 eSigning solution?

By using the pur 102 eSigning solution, you can expect enhanced efficiency, reduced costs, and improved customer satisfaction. The straightforward workflow allows for quicker deals and approvals, driving overall business success while reducing the environmental impact of paper usage.

Get more for Pur 102

- Kickball player release waiver form

- Healing touch intake form date healing touch program

- Final approval and self certification packet colorado gov colorado form

- Where are earthquakes happening right now worksheet form

- Pta reflections certificate form

- Gateway delivery order bformb chicken salad chick

- Eagle scout scholarship application middle tennessee council mtcbsa form

- Attorney verification new york state bar form

Find out other Pur 102

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy