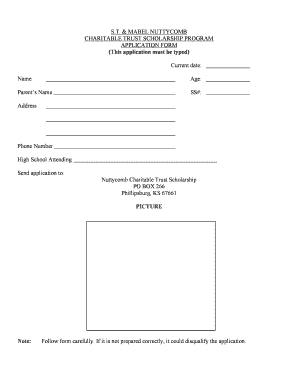

CHARITABLE TRUST SCHOLARSHIP PROGRAM Form

What is the nuttycomb?

The nuttycomb is a specialized form designed to facilitate the application and management of charitable trust scholarship programs. This form serves as a crucial tool for individuals and organizations looking to establish or participate in scholarship initiatives that provide financial assistance to students. By outlining the necessary criteria and processes, the nuttycomb ensures that applicants understand their obligations and the benefits associated with the program.

How to use the nuttycomb

Using the nuttycomb involves several straightforward steps. First, gather all required information, including personal details and financial data. Next, complete the form by accurately filling in each section, ensuring that all information aligns with supporting documents. Once completed, review the form for any errors or omissions. Finally, submit the nuttycomb through the designated channels, which may include online submission, mailing, or in-person delivery, depending on specific program guidelines.

Eligibility criteria for the nuttycomb

Eligibility for the nuttycomb typically includes specific requirements related to residency, income levels, and academic performance. Applicants must be residents of the state where the scholarship is offered and demonstrate financial need. Additionally, academic qualifications may be necessary, such as maintaining a minimum GPA or being enrolled in an accredited institution. It is essential to review the specific eligibility criteria outlined in the program details to ensure compliance.

Required documents for the nuttycomb

When applying for the nuttycomb, certain documents are essential for a complete submission. Commonly required documents include:

- Proof of residency, such as a utility bill or lease agreement

- Financial statements, including tax returns or income verification

- Academic transcripts or records

- Letters of recommendation, if applicable

Gathering these documents in advance can streamline the application process and help avoid delays.

Steps to complete the nuttycomb

Completing the nuttycomb involves a systematic approach. Follow these steps:

- Review the eligibility criteria to ensure you qualify.

- Collect all required documents to support your application.

- Fill out the nuttycomb form accurately, providing all requested information.

- Double-check your entries for accuracy and completeness.

- Submit the form through the appropriate method as outlined by the program.

By adhering to these steps, applicants can enhance their chances of a successful application.

Legal use of the nuttycomb

The nuttycomb must be used in accordance with local and federal regulations governing charitable trust scholarship programs. This includes adhering to guidelines regarding the distribution of funds, maintaining transparency in financial reporting, and ensuring compliance with any applicable tax laws. Understanding these legal requirements is crucial for both applicants and organizations managing scholarships to avoid potential penalties or legal issues.

Examples of using the nuttycomb

Examples of how the nuttycomb can be utilized include:

- Individuals applying for scholarships to cover tuition costs for higher education.

- Non-profit organizations establishing scholarship funds to support underprivileged students.

- Educational institutions using the form to manage and allocate scholarship resources effectively.

These examples illustrate the versatility of the nuttycomb in various educational and charitable contexts.

Quick guide on how to complete charitable trust scholarship program

Effortlessly Prepare CHARITABLE TRUST SCHOLARSHIP PROGRAM on Any Device

Digital document management has gained traction among businesses and individuals. It offers a remarkable eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the suitable form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Manage CHARITABLE TRUST SCHOLARSHIP PROGRAM on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign CHARITABLE TRUST SCHOLARSHIP PROGRAM with Ease

- Find CHARITABLE TRUST SCHOLARSHIP PROGRAM and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as an ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from your preferred device. Modify and eSign CHARITABLE TRUST SCHOLARSHIP PROGRAM and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the charitable trust scholarship program

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is nuttycomb and how does it work with airSlate SignNow?

Nuttycomb is a feature that enhances the eSigning process by streamlining document flow within airSlate SignNow. It allows users to easily create, send, and manage documents for electronic signatures, ensuring a seamless signing experience.

-

What are the pricing options for nuttycomb with airSlate SignNow?

Nuttycomb offers various pricing plans tailored to fit the needs of different businesses using airSlate SignNow. These plans range from basic options for small teams to advanced packages for large enterprises, providing flexibility and cost-effectiveness.

-

What key features does nuttycomb offer with airSlate SignNow?

Nuttycomb comes with several powerful features, such as customizable templates, real-time tracking, and secure storage. It integrates seamlessly with airSlate SignNow, making it easy for users to manage their document signing workflows efficiently.

-

How does nuttycomb benefit businesses using airSlate SignNow?

Nuttycomb signNowly benefits businesses by reducing turnaround time for document signing and improving overall efficiency. With airSlate SignNow, users can quickly send, sign, and store documents all in one place, enhancing productivity.

-

Can nuttycomb integrate with other software or tools?

Yes, nuttycomb is designed to integrate smoothly with various third-party applications and tools. This allows businesses using airSlate SignNow to enhance their workflows and connect with existing software for improved document management.

-

Is nuttycomb secure for sending sensitive documents?

Absolutely! Nuttycomb adheres to strict security protocols to ensure that all documents sent through airSlate SignNow are encrypted and securely stored. This ensures the confidentiality and integrity of sensitive information during the signing process.

-

What types of businesses can benefit from using nuttycomb with airSlate SignNow?

Nuttycomb is suitable for a wide range of businesses, from startups to large corporations. Any organization that requires a reliable and efficient way to handle eSignature processes will benefit from the capabilities of airSlate SignNow and nuttycomb.

Get more for CHARITABLE TRUST SCHOLARSHIP PROGRAM

- A guide to new york citys noise code nyc gov form

- Gentlebrook west lafayette ohio form

- Myuhealthchart form

- Termination declaration form 56925549

- Get a pencil youre tackling the deficit form

- Plumbing hvacpermit application requirements form

- 7 things in car mechanic simulator that will make a real form

- Horse surrender form fill online printable fillable blank

Find out other CHARITABLE TRUST SCHOLARSHIP PROGRAM

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF