C 159d 2004-2026

What is the C 159d?

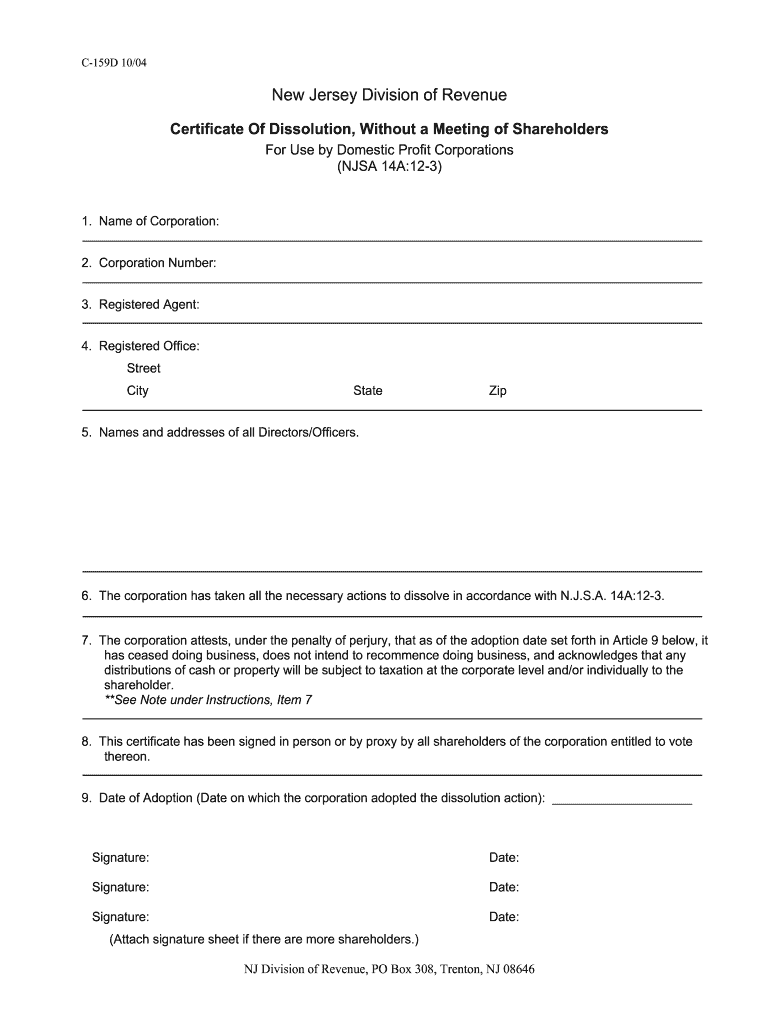

The C 159d is a certificate form specifically used for the dissolution of certain business entities in the state of New Jersey. This form is essential for formally terminating the existence of a corporation or limited liability company (LLC). Completing the C 159d ensures that all legal obligations are met and that the business is officially recognized as dissolved by the state. It includes necessary fields for information such as the business name, date of dissolution, and relevant signatures.

Steps to complete the C 159d

Completing the C 159d involves several key steps to ensure accuracy and compliance. First, gather all required information about the business, including its name, address, and the date of dissolution. Next, accurately fill in the form’s fields, ensuring that all information is correct and up-to-date. After completing the form, it is crucial to obtain the necessary signatures from the appropriate parties, which may include directors or members of the LLC. Finally, review the completed form for any errors before submission.

How to obtain the C 159d

The C 159d form can be obtained through the New Jersey Division of Revenue and Enterprise Services. It is available as a downloadable PDF on their official website, allowing users to fill it out electronically or print it for manual completion. Additionally, physical copies may be available at designated state offices. Ensuring that you have the most current version of the form is important for compliance with state regulations.

Legal use of the C 159d

The legal use of the C 159d is critical for businesses seeking to dissolve their entity status in New Jersey. By submitting this form, businesses fulfill their legal obligations to notify the state of their dissolution. It is important to ensure that all outstanding debts and obligations are settled prior to filing the form, as this can affect the dissolution process. The C 159d serves as a formal declaration of the entity's intent to cease operations and is a necessary step in the legal dissolution process.

Filing Deadlines / Important Dates

When dealing with the C 159d, it is essential to be aware of any relevant deadlines. Typically, businesses must file the dissolution form within a specific timeframe after deciding to dissolve. This timeframe can vary based on the type of entity and any outstanding obligations. It is advisable to consult with a legal professional or the New Jersey Division of Revenue for specific deadlines that apply to your situation to avoid penalties or complications.

Form Submission Methods

The C 159d can be submitted through multiple methods, including online, by mail, or in person. For online submissions, businesses can utilize the New Jersey Division of Revenue's electronic filing system, which streamlines the process and provides immediate confirmation of receipt. If submitting by mail, ensure that the form is sent to the correct address and is postmarked by the required deadline. In-person submissions can be made at designated state offices, allowing for direct interaction with state officials if any questions arise.

Quick guide on how to complete c 159d 1004

Your assistance manual on how to prepare your C 159d

If you’re curious about how to finalize and submit your C 159d, here are a few straightforward instructions to simplify tax processing.

To begin, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, create, and complete your tax paperwork effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and revisit to modify information where necessary. Streamline your tax administration with advanced PDF editing, eSigning, and intuitive sharing.

Follow the steps below to complete your C 159d in a matter of minutes:

- Establish your account and start working on PDFs in just a few minutes.

- Utilize our catalog to locate any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your C 159d in our editor.

- Fill in the essential fillable fields with your details (text content, numbers, checkmarks).

- Utilize the Sign Tool to add your legally binding eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this guide to file your taxes electronically with airSlate SignNow. Please remember that submitting in paper format can lead to return errors and delay reimbursements. Of course, before e-filing your taxes, check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

What is the time period to fill out form 10?

Well its a huge mission if you’re going to use a printer forget about it :)I’ve tried all the products and a lot of them you struggle with the mouse cursor to find the space to complete. So I think people can sometimes just get annoyed and use a printer.But the best is Paperjet. Go Paperless which uses field detection and makes the form fillable online immediately.No doubt the easiest and quickest way imho.

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the c 159d 1004

How to make an eSignature for the C 159d 1004 in the online mode

How to make an electronic signature for your C 159d 1004 in Google Chrome

How to generate an eSignature for putting it on the C 159d 1004 in Gmail

How to make an eSignature for the C 159d 1004 straight from your smartphone

How to make an electronic signature for the C 159d 1004 on iOS

How to create an electronic signature for the C 159d 1004 on Android OS

People also ask

-

What is c 159d in the context of airSlate SignNow?

C 159d refers to a specific feature set within airSlate SignNow that enhances document signing and management. This feature allows businesses to streamline their eSignature processes, ensuring compliance and security while improving efficiency.

-

How much does airSlate SignNow cost?

AirSlate SignNow offers flexible pricing plans tailored to various business needs. Whether you're looking for basic functionalities or advanced features like c 159d, you can find a plan that suits your budget and requirements.

-

What are the key features of airSlate SignNow's c 159d?

The c 159d feature in airSlate SignNow includes advanced eSignature capabilities, document templates, and workflow automation. These features help businesses efficiently manage documents and enhance collaboration among team members.

-

Can c 159d integrate with other business applications?

Yes, c 159d is designed to integrate seamlessly with popular business applications such as CRM and project management tools. This integration capability allows users to streamline their workflows and improve productivity by connecting various platforms.

-

What benefits does c 159d offer to businesses?

C 159d provides several benefits, including improved turnaround times for document signing, enhanced security protocols, and reduced administrative workload. By utilizing these features, businesses can focus more on core activities while ensuring compliance.

-

Is there a free trial available for c 159d?

Yes, airSlate SignNow offers a free trial for users interested in exploring the c 159d features. This trial provides access to all functionalities, allowing prospective customers to evaluate how it can meet their document management needs.

-

How does c 159d enhance the document signing experience?

C 159d enhances the document signing experience through its user-friendly interface and quick signing options. This feature reduces the friction often associated with traditional signatures, leading to faster approval processes and increased customer satisfaction.

Get more for C 159d

- Abington radiology blair mill road form

- Cans massachusetts form

- Sri venkateswara university application for the award of the degree of b svudde form

- Vehicle motor form

- Employee election form 441227537

- Njhmfa low income tax credit tenant income self certification njhousing form

- Home health patient tracking sheet home health patient tracking sheet form

- Purchase with gift of equity agreement template form

Find out other C 159d

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT