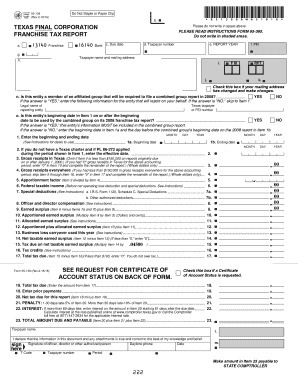

05 139, Texas Final Corporation Franchise Tax Texas Form

What is the 05 139, Texas Final Corporation Franchise Tax

The 05 139, Texas Final Corporation Franchise Tax form is a crucial document for corporations in Texas that are winding down their business operations. This form is utilized to report the final franchise tax due to the state, ensuring compliance with Texas tax laws. It serves as a formal declaration that the corporation is ceasing its operations and provides a mechanism for settling any outstanding tax obligations. Completing this form accurately is essential for avoiding future liabilities and penalties.

Steps to complete the 05 139, Texas Final Corporation Franchise Tax

Completing the 05 139 form involves several key steps:

- Gather necessary information about your corporation, including its legal name, address, and tax identification number.

- Calculate the final franchise tax amount owed, considering any applicable deductions or credits.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for completeness and accuracy before submission.

- Submit the form to the Texas Comptroller of Public Accounts by the designated deadline.

Legal use of the 05 139, Texas Final Corporation Franchise Tax

The legal use of the 05 139 form is to formally notify the state of Texas that a corporation is terminating its business operations. By filing this form, the corporation fulfills its legal obligations under Texas law, thus preventing potential legal repercussions. It is important to ensure that all information is truthful and complete, as inaccuracies may lead to penalties or complications in the dissolution process.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the 05 139 form. Typically, the final franchise tax return is due on or before the 15th day of the fourth month after the end of the corporation's tax year. For entities terminating their operations, it is advisable to file as soon as the decision to dissolve is made to avoid late fees and ensure compliance with state regulations.

Required Documents

To complete the 05 139 form, certain documents are necessary:

- Previous franchise tax returns for reference.

- Financial statements to assist in calculating the final tax amount.

- Any documentation related to deductions or credits that may apply.

- Records of any outstanding liabilities or obligations that need to be settled.

Form Submission Methods (Online / Mail / In-Person)

The 05 139 form can be submitted through various methods for convenience. Corporations have the option to file online through the Texas Comptroller's website, which is often the quickest method. Alternatively, the form can be mailed to the appropriate address provided by the Comptroller's office. In some cases, in-person submissions may also be accepted, although this is less common. It is essential to choose the method that best suits your needs and to keep a copy of the submitted form for your records.

Quick guide on how to complete 05 139 texas final corporation franchise tax texas

Complete 05 139, Texas Final Corporation Franchise Tax Texas effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage 05 139, Texas Final Corporation Franchise Tax Texas on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to modify and eSign 05 139, Texas Final Corporation Franchise Tax Texas with ease

- Find 05 139, Texas Final Corporation Franchise Tax Texas and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or downloading it to your PC.

Forget about lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Modify and eSign 05 139, Texas Final Corporation Franchise Tax Texas and ensure seamless communication at every stage of the form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 05 139 texas final corporation franchise tax texas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 05 139, Texas Final Corporation Franchise Tax Texas form?

The 05 139, Texas Final Corporation Franchise Tax Texas form is a requirement for corporations that have ceased operations or are terminating their existence in Texas. Completing this form accurately ensures that all tax obligations are met before dissolution. Filing it correctly can help businesses avoid penalties and future liabilities.

-

How can airSlate SignNow help with the 05 139, Texas Final Corporation Franchise Tax Texas filings?

airSlate SignNow streamlines the document signing process, making it easier to manage the 05 139, Texas Final Corporation Franchise Tax Texas filings. Our platform allows you to request signatures and ensure that all necessary documents are collected efficiently. This can save both time and resources while ensuring compliance.

-

What features does airSlate SignNow offer for managing tax documents like the 05 139, Texas Final Corporation Franchise Tax Texas?

With airSlate SignNow, you can benefit from features such as templates, advanced signing workflows, document tracking, and real-time notifications. These tools are designed to simplify the management of essential tax forms, including the 05 139, Texas Final Corporation Franchise Tax Texas. This ensures you can stay organized and compliant.

-

Is airSlate SignNow a cost-effective solution for filing the 05 139, Texas Final Corporation Franchise Tax Texas?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to file the 05 139, Texas Final Corporation Franchise Tax Texas. Our flexible pricing plans cater to different business sizes, making it an affordable choice for both small businesses and large corporations. This helps you manage your tax-related documents without breaking the bank.

-

Can I use airSlate SignNow for other tax-related documents besides the 05 139, Texas Final Corporation Franchise Tax Texas?

Absolutely! airSlate SignNow supports a variety of tax-related documents in addition to the 05 139, Texas Final Corporation Franchise Tax Texas. Whether it's for corporate filings, compliance documents, or other important forms, our platform provides the tools you need to manage all aspects of your documentation efficiently.

-

What integrations does airSlate SignNow provide for managing the 05 139, Texas Final Corporation Franchise Tax Texas?

airSlate SignNow integrates seamlessly with various tools and platforms to facilitate the management of the 05 139, Texas Final Corporation Franchise Tax Texas. From CRM systems to cloud storage solutions, our integrations enhance workflow efficiency and ensure that your documents are always accessible. This connectivity simplifies the entire process.

-

How secure is airSlate SignNow when handling the 05 139, Texas Final Corporation Franchise Tax Texas documents?

Security is a top priority at airSlate SignNow. We implement industry-leading security measures, including encryption and secure access controls, to protect your 05 139, Texas Final Corporation Franchise Tax Texas documents. You can be confident that your sensitive information is safe and secure while using our platform.

Get more for 05 139, Texas Final Corporation Franchise Tax Texas

- Test form 3a answer key

- Drill team permission slip and expectation sheet form

- Cancellation of security interest marion county iowa form

- Form 1192

- Online nm rpd 41109 rev 062010 form

- Lease to own car agreement template form

- Lease to own equipment agreement template form

- Lease to own vehicle agreement template form

Find out other 05 139, Texas Final Corporation Franchise Tax Texas

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure