Register for Sales Tax Form

What is the Arkansas ET-1 Form?

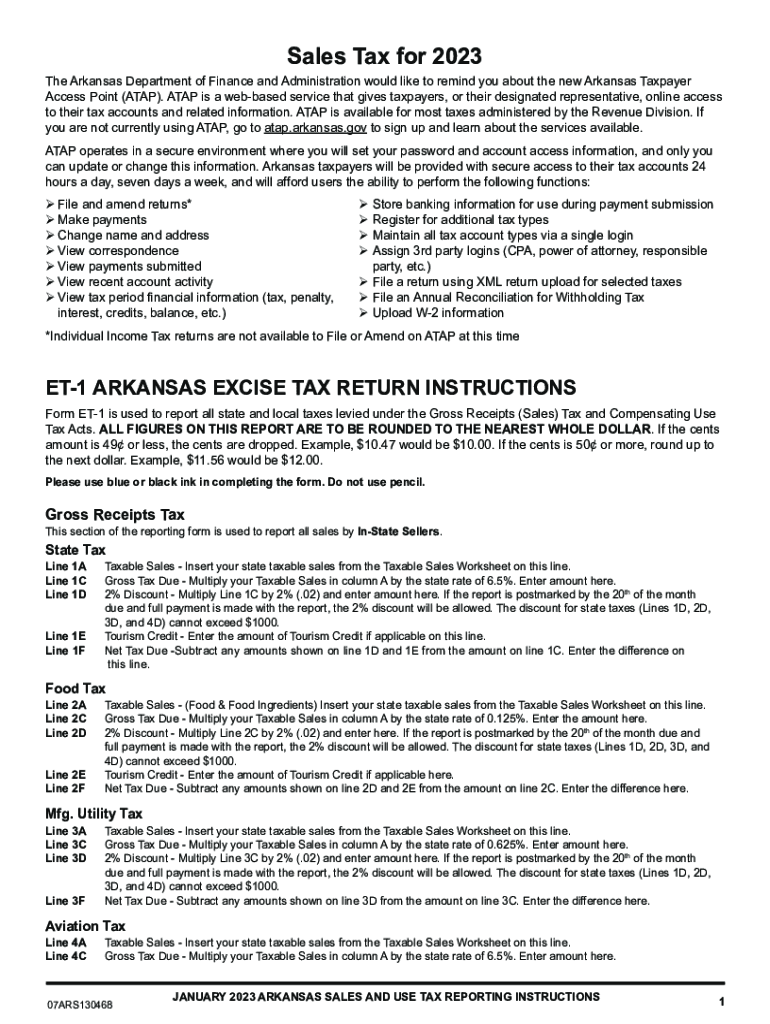

The Arkansas ET-1 form is an excise tax return used by businesses operating in Arkansas to report and pay sales tax. This form is essential for ensuring compliance with state tax regulations. It is particularly relevant for businesses that sell tangible personal property or taxable services within the state. The ET-1 form helps the Arkansas Department of Finance and Administration track sales tax revenue and ensures that businesses fulfill their tax obligations accurately.

Steps to Complete the Arkansas ET-1 Form

Completing the Arkansas ET-1 form involves several key steps:

- Gather Required Information: Collect all necessary sales data, including total sales, exempt sales, and any deductions.

- Fill Out the Form: Enter your business information, including name, address, and sales tax permit number. Report your total taxable sales and calculate the tax due.

- Review for Accuracy: Double-check all entries for accuracy to avoid penalties or delays.

- Submit the Form: Choose your submission method—online, by mail, or in person—and ensure it is sent by the due date.

Filing Deadlines / Important Dates

It is crucial to adhere to the filing deadlines for the Arkansas ET-1 form to avoid penalties. Typically, the form is due on the 20th day of the month following the end of the reporting period. For example, sales made in January must be reported by February 20. Businesses should also be aware of any changes in deadlines during tax season or due to state announcements.

Required Documents for Filing

When filing the Arkansas ET-1 form, businesses should prepare the following documents:

- Sales records for the reporting period

- Exemption certificates for any exempt sales

- Previous tax returns for reference

- Any supporting documentation for deductions claimed

Form Submission Methods

The Arkansas ET-1 form can be submitted through various methods, providing flexibility for businesses:

- Online: Many businesses prefer to file electronically through the Arkansas Department of Finance and Administration's website.

- By Mail: Completed forms can be mailed to the appropriate state office. Ensure to use the correct address and allow time for delivery.

- In-Person: Businesses may also choose to submit the form in person at designated state offices.

Penalties for Non-Compliance

Failure to file the Arkansas ET-1 form on time can result in significant penalties. The state may impose fines based on the amount of tax due, and interest may accrue on late payments. Additionally, repeated non-compliance can lead to more severe consequences, including audits or legal action. It is essential for businesses to understand these risks and prioritize timely filing.

Eligibility Criteria for Filing

To file the Arkansas ET-1 form, businesses must meet specific eligibility criteria. Primarily, the business must be registered to collect sales tax in Arkansas. This includes having a valid sales tax permit. Furthermore, the business must engage in selling taxable goods or services within the state. It is advisable for businesses to verify their eligibility before attempting to file to ensure compliance with state regulations.

Quick guide on how to complete register for sales tax

Complete Register For Sales Tax effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Register For Sales Tax on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Register For Sales Tax with ease

- Obtain Register For Sales Tax and click on Get Form to begin.

- Utilize the tools we supply to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal weight as a traditional handwritten signature.

- Verify the information and click on the Done button to save your updates.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Adjust and eSign Register For Sales Tax and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the register for sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the et 1 form arkansas and why do I need it?

The et 1 form arkansas is a specific tax document required for certain filings in the state. Having this form filled out accurately is crucial for compliance with Arkansas tax laws. Utilizing airSlate SignNow can streamline the process of completing and submitting the et 1 form arkansas, ensuring you avoid any potential penalties.

-

How can airSlate SignNow help me with the et 1 form arkansas?

airSlate SignNow provides tools to easily create, sign, and send the et 1 form arkansas digitally. With its user-friendly interface, you can complete necessary fields and gather signatures quickly. This not only saves time but also ensures that your form is submitted correctly and on time.

-

Is there a cost associated with using airSlate SignNow for the et 1 form arkansas?

Yes, there is a pricing structure for airSlate SignNow, which varies based on the plan you choose. However, the investment is typically cost-effective compared to potential costs associated with errors on the et 1 form arkansas. Consider the subscription that best fits your business needs to maximize savings while ensuring compliance.

-

Can I integrate airSlate SignNow with other applications while handling the et 1 form arkansas?

Absolutely! airSlate SignNow offers various integrations with popular applications, making it easier to manage your workflows. Whether you need to link it with your accounting software or CRM, you can seamlessly handle the et 1 form arkansas within your existing tech stack.

-

What are the benefits of using airSlate SignNow for the et 1 form arkansas?

Using airSlate SignNow provides several benefits, including speed, efficiency, and improved compliance. You can track the status of your et 1 form arkansas in real time, minimizing delays. Plus, electronic signatures are legally binding, making the entire process more reliable.

-

Is airSlate SignNow secure for handling the et 1 form arkansas?

Yes, airSlate SignNow prioritizes security and employs multiple measures to protect your documents and data. With encryption and compliance with industry standards, you can confidently handle sensitive information related to your et 1 form arkansas without worry.

-

What types of documents can I handle alongside the et 1 form arkansas?

In addition to the et 1 form arkansas, airSlate SignNow allows you to manage a wide array of documents. You can create, edit, and eSign contracts, agreements, and various other forms, all within the same easy-to-use platform. This versatility helps streamline all your document-related tasks.

Get more for Register For Sales Tax

- Bmp inspection form fillable

- Values continuum form

- San joaquin housing authority rental listings form

- Tumbling b cattle company form

- Form dacs 10900

- Taxusa form

- Nongovernmental contractor certification form

- Getting started applying for children s health care benefits chip and children s medicaid these programs offer health care form

Find out other Register For Sales Tax

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement