Massachusetts Department of Revenue Form M 4422 Ap

Understanding the Massachusetts Department Of Revenue Form M 4422

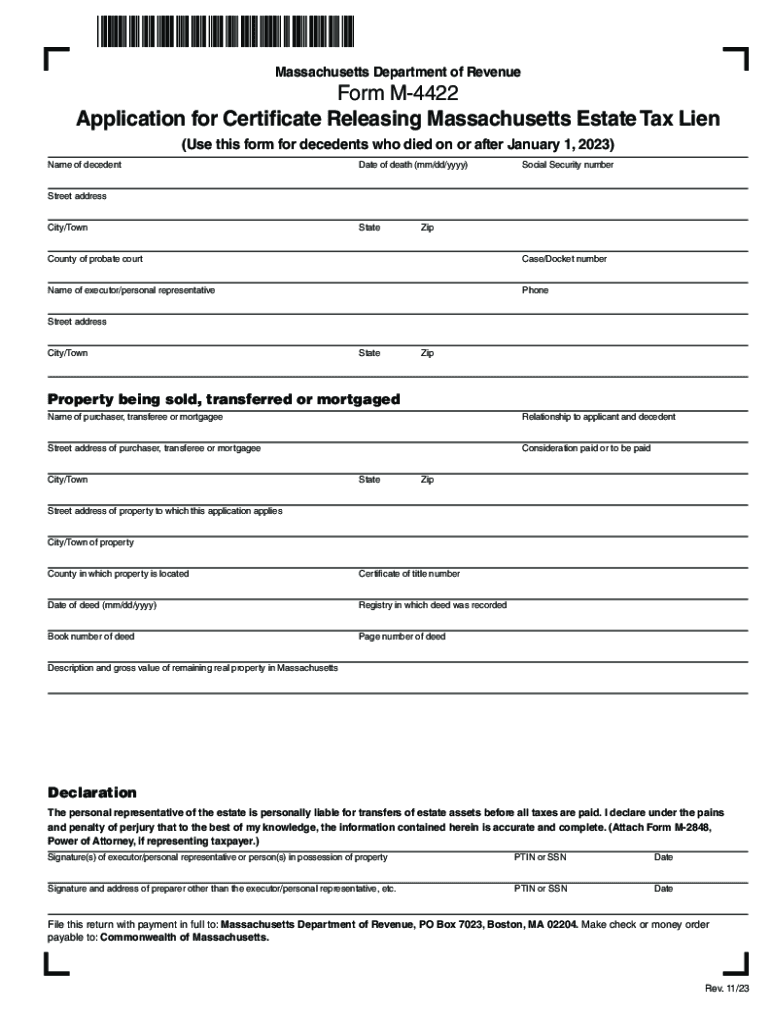

The Massachusetts Department of Revenue Form M 4422 is a crucial document for individuals dealing with estate matters in Massachusetts. This form is primarily used to report the estate's value and determine any tax obligations that may arise after a person's death. It is essential for ensuring compliance with state tax laws and facilitating the proper distribution of the deceased's assets.

How to Complete the Massachusetts Department Of Revenue Form M 4422

Completing Form M 4422 involves several steps. First, gather all necessary documentation related to the deceased's assets, liabilities, and any prior tax filings. Next, accurately fill out the form, providing detailed information about the estate's value and any deductions that may apply. It is crucial to double-check all entries for accuracy before submission, as errors can lead to delays or penalties.

Required Documents for Form M 4422

To successfully file Form M 4422, specific documents are required. These typically include:

- Death certificate of the deceased

- List of all assets and liabilities of the estate

- Previous tax returns, if applicable

- Any relevant legal documents, such as wills or trusts

Having these documents prepared in advance can streamline the filing process and help avoid complications.

Filing Deadlines for Form M 4422

Timely submission of Form M 4422 is critical to avoid penalties. The form must generally be filed within nine months of the date of death. However, if an extension is needed, it is important to file for an extension before the original deadline. Understanding these timelines can help ensure compliance with Massachusetts tax regulations.

Submission Methods for Form M 4422

Form M 4422 can be submitted through various methods to accommodate different preferences. Individuals can choose to file online via the Massachusetts Department of Revenue's website, mail a paper copy of the form, or submit it in person at designated offices. Each method has its own processing times, so selecting the most suitable option based on urgency is advisable.

Legal Use of Form M 4422

Form M 4422 serves a legal purpose in the estate settlement process. It ensures that the estate complies with state tax laws and provides a clear record of the estate's financial standing. Proper use of this form can help prevent legal disputes among heirs and beneficiaries, making it an essential component of estate administration.

Quick guide on how to complete massachusetts department of revenue form m 4422 ap

Complete Massachusetts Department Of Revenue Form M 4422 Ap effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers a superb environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to draft, modify, and eSign your documents quickly without delays. Handle Massachusetts Department Of Revenue Form M 4422 Ap on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest method to modify and eSign Massachusetts Department Of Revenue Form M 4422 Ap with ease

- Obtain Massachusetts Department Of Revenue Form M 4422 Ap and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of your documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to preserve your adjustments.

- Select how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Leave behind the hassle of lost or misplaced files, tedious form searching, or errors that require reprinting. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Massachusetts Department Of Revenue Form M 4422 Ap to ensure effective communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form m 4422 ap

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Massachusetts estates?

airSlate SignNow is a user-friendly eSignature solution designed to streamline document signing processes. For Massachusetts estates, it offers an efficient way to handle estate planning documents, making it easier for executors and beneficiaries to manage legal paperwork.

-

How does airSlate SignNow help with Massachusetts estate planning?

With airSlate SignNow, you can easily create, send, and sign estate planning documents quickly and securely. This ensures that your Massachusetts estate documents are legally binding while saving time and reducing the potential for errors.

-

What pricing options does airSlate SignNow offer for Massachusetts estate professionals?

airSlate SignNow provides various pricing tiers to accommodate different needs, including options suited for Massachusetts estate professionals. You can choose from individual plans to business solutions, allowing you to find the most cost-effective approach to managing your estate documents.

-

Are there any features specifically tailored for Massachusetts estate management?

Yes, airSlate SignNow includes features designed to assist with Massachusetts estate management, such as templates for wills and powers of attorney. These tools simplify the creation of essential documents, ensuring they meet state-specific requirements.

-

Can I integrate airSlate SignNow with other tools for my Massachusetts estate practice?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your Massachusetts estate practice's efficiency. Whether you use CRM systems or cloud storage solutions, SignNow can complement your existing tools.

-

How secure is airSlate SignNow for managing Massachusetts estate documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive Massachusetts estate documents. The platform uses industry-standard encryption and complies with legal regulations to ensure your documents are safe and confidential.

-

What are the benefits of using airSlate SignNow for my Massachusetts estate?

Using airSlate SignNow for your Massachusetts estate offers numerous benefits, including faster document turnaround times and increased accuracy. This intuitive platform reduces the hassle of traditional paperwork while providing you with a reliable method to gather eSignatures.

Get more for Massachusetts Department Of Revenue Form M 4422 Ap

- Note taking worksheet the nonliving environment form

- Delta county building and zoning form

- Resignation letter tagalog form

- Physical therapy competency checklist 210629400 form

- Sample addendum to employee handbook form

- R22 weight and balance las vegas helicopter form

- Physician special diet diet rchs 3599 co ramsey mn form

- Aegis treatment form

Find out other Massachusetts Department Of Revenue Form M 4422 Ap

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself