Oregon Tax Form

What is the Oregon Tax

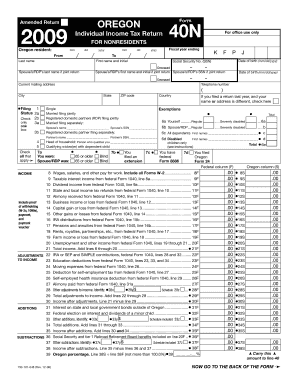

The Oregon tax system primarily refers to the state income tax imposed on individuals and businesses operating within Oregon. This tax is based on the taxpayer's income and is designed to fund state services such as education, healthcare, and infrastructure. Oregon has a progressive income tax structure, meaning that individuals with higher incomes pay a higher percentage of their income in taxes. The tax applies to both residents and nonresidents who earn income in the state.

Steps to complete the Oregon Tax

Completing your Oregon tax return involves several key steps:

- Gather necessary documents, including W-2 forms, 1099 forms, and any other income statements.

- Determine your filing status, which can affect your tax rate and deductions.

- Calculate your total income by adding all sources of income, including wages, interest, and dividends.

- Subtract any allowable deductions to determine your taxable income. Common deductions include mortgage interest and state taxes paid.

- Apply the appropriate tax rates to your taxable income to calculate your tax liability.

- Complete the Oregon income tax return form, which may include Form 40 or Form 40N for nonresidents.

- Review your return for accuracy before submitting it.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Oregon tax returns is crucial to avoid penalties. The standard deadline for filing individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers can request an extension, which allows for additional time to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To successfully complete your Oregon tax return, you will need several important documents:

- W-2 forms from employers, detailing your annual earnings.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or investments.

- Documentation for any deductions you plan to claim, such as mortgage interest statements or receipts for charitable contributions.

Eligibility Criteria

Eligibility for filing an Oregon tax return generally depends on your residency status and income level. Residents of Oregon are required to file a return if their gross income exceeds a certain threshold, which varies based on filing status. Nonresidents must file if they earn income sourced from Oregon. It is important to review the specific income thresholds and residency definitions to determine your filing obligations accurately.

Penalties for Non-Compliance

Failing to comply with Oregon tax laws can result in various penalties. Common penalties include late filing fees, which can be a percentage of the unpaid tax amount, and interest on any taxes owed. Additionally, taxpayers who fail to file or pay their taxes may face legal action from the state, including liens on property or garnishment of wages. It is advisable to address any tax issues promptly to minimize potential penalties.

Quick guide on how to complete oregon tax

Effortlessly Create Oregon Tax on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without delays. Handle Oregon Tax on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Steps to Modify and eSign Oregon Tax with Ease

- Locate Oregon Tax and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Oregon Tax and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's solution for handling Oregon tax documents?

airSlate SignNow provides a streamlined solution for managing Oregon tax documents. With our eSigning features, you can easily prepare, send, and sign tax-related documents without the hassle of printing or scanning. This not only saves time but also ensures that your documents are secure and compliant with Oregon tax regulations.

-

How does airSlate SignNow ensure compliance with Oregon tax laws?

AirSlate SignNow is designed with compliance in mind, including adherence to Oregon tax laws. Our platform provides legally binding eSignatures, ensuring that all signed documents meet the requirements set forth by the state. Additionally, we offer detailed audit trails that can be invaluable during an Oregon tax audit.

-

What are the pricing options for businesses in Oregon using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses in Oregon. Our pricing model is competitive and designed to be cost-effective for any size of business. You can choose from various plans depending on your volume of documents and features needed, allowing you to optimize your Oregon tax processes without overspending.

-

Can airSlate SignNow integrate with accounting software for Oregon tax management?

Yes, airSlate SignNow seamlessly integrates with popular accounting software like QuickBooks and Xero, which is essential for managing Oregon tax filings. This integration helps automate the process of sending and signing tax documents, reducing errors and improving efficiency. You'll be able to track your Oregon tax obligations with ease.

-

What features does airSlate SignNow offer for tracking Oregon tax documents?

airSlate SignNow provides robust features for tracking Oregon tax documents, including real-time notifications and a dashboard to monitor the status of your eSigned documents. This allows users to stay informed about their submissions, ensuring that all necessary tax documents are completed on time. Our platform makes it easy to manage and retrieve past documents related to Oregon tax.

-

Is the airSlate SignNow platform user-friendly for new users in Oregon?

Absolutely! The airSlate SignNow platform is designed with user experience in mind, making it accessible even for those new to eSigning in Oregon. Our intuitive interface guides users through every step, ensuring that sending and signing Oregon tax documents is straightforward and stress-free.

-

Are there any security measures in place for Oregon tax documents signed with airSlate SignNow?

Yes, airSlate SignNow takes security seriously, especially when it comes to sensitive Oregon tax documents. We implement industry-standard encryption and compliance protocols to protect your data. With features like secure access and customizable permissions, you can be confident that your Oregon tax documents are safe.

Get more for Oregon Tax

Find out other Oregon Tax

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online