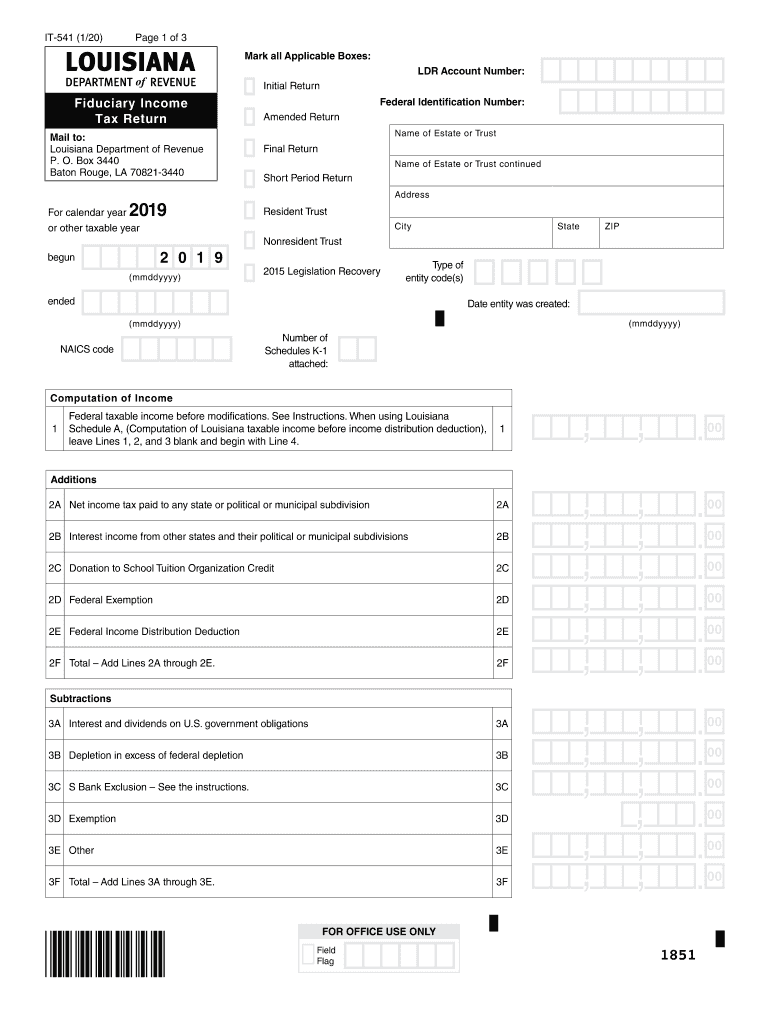

Louisiana Income Tax Form

Understanding the Louisiana Income Tax

The Louisiana income tax is a state tax imposed on the income of individuals and businesses residing in Louisiana. It is calculated based on the taxpayer's net income, which includes wages, salaries, and other forms of compensation. The tax rates are progressive, meaning that higher income levels are taxed at higher rates. For individuals, the rates range from two percent to six percent, depending on the income bracket. Understanding this tax is crucial for accurate filing and compliance with state laws.

Steps to Complete the Louisiana Income Tax Return

Completing the Louisiana income tax return involves several key steps:

- Gather necessary documents, including W-2 forms, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and deductions.

- Calculate your total income and allowable deductions to arrive at your taxable income.

- Apply the appropriate tax rates to your taxable income to compute your tax liability.

- Complete the Louisiana income tax return form, ensuring all information is accurate.

- Review the return for any errors before submission.

Required Documents for Filing

To file the Louisiana income tax return, taxpayers must gather specific documents, which typically include:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for other income sources, such as freelance work or interest earned.

- Receipts for deductible expenses, including medical costs and educational expenses.

- Any relevant documentation for tax credits, such as child care expenses or education credits.

Filing Deadlines and Important Dates

Timely filing of the Louisiana income tax return is essential to avoid penalties. The standard deadline for filing is usually May fifteenth of each year. If May fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available, which can provide additional time for filing if necessary.

Form Submission Methods

Taxpayers in Louisiana have several options for submitting their income tax returns:

- Online submission through the Louisiana Department of Revenue's website, which allows for secure and efficient filing.

- Mailing a paper return to the appropriate state address, ensuring that it is postmarked by the filing deadline.

- In-person submission at local Department of Revenue offices, where assistance may be available for completing the form.

Penalties for Non-Compliance

Failure to file the Louisiana income tax return by the deadline can result in significant penalties. These may include:

- Late filing penalties, which accrue for each month the return is not filed.

- Interest on unpaid taxes, which accumulates until the balance is paid in full.

- Potential legal action for severe non-compliance, including liens or levies on property.

Eligibility Criteria for Filing

To be eligible to file a Louisiana income tax return, individuals must meet certain criteria, including:

- Residency in Louisiana for at least part of the tax year.

- Having a minimum level of income that exceeds the state’s filing threshold.

- Compliance with federal tax laws, as state returns often require information from federal filings.

Quick guide on how to complete louisiana income tax

Effortlessly Prepare Louisiana Income Tax on Any Device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the features you require to create, modify, and electronically sign your documents quickly and without delays. Manage Louisiana Income Tax on any platform using the airSlate SignNow Android or iOS applications and streamline any document-oriented task today.

The easiest method to modify and electronically sign Louisiana Income Tax effortlessly

- Locate Louisiana Income Tax and click Get Form to begin.

- Use the provided tools to complete your form.

- Highlight important parts of your documents or redact sensitive information with specialized tools that airSlate SignNow offers for this purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and electronically sign Louisiana Income Tax and ensure excellent communication throughout every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the louisiana income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the louisiana income tax form and why is it important?

The louisiana income tax form is a document that residents of Louisiana must file to report their income and calculate their tax liability. It is essential for complying with state tax regulations and avoiding penalties. Ensuring accuracy on this form can help maximize your tax refunds and ensure you are meeting your legal obligations.

-

How can airSlate SignNow help me with the louisiana income tax form?

airSlate SignNow provides an efficient platform for eSigning and sending your louisiana income tax form securely and promptly. With our easy-to-use interface, you can streamline the process of filing your tax documents without unnecessary delays. This means you can focus more on completing your tax form accurately and less on administrative tasks.

-

Is there a cost associated with using airSlate SignNow for the louisiana income tax form?

Yes, airSlate SignNow operates on a subscription model, providing various pricing plans to suit different needs. The cost can vary depending on features and your organization size, making it a cost-effective solution for managing the louisiana income tax form. You can explore our plans to find one that best meets your requirements without breaking the bank.

-

What features does airSlate SignNow offer for managing the louisiana income tax form?

airSlate SignNow offers features such as customizable templates, secure document storage, and advanced eSignature capabilities that are essential for the louisiana income tax form. You can track the status of your documents and ensure they are signed on time, helping you avoid filing delays. These features make managing your taxes simpler and more efficient.

-

Can I integrate airSlate SignNow with other software for filing the louisiana income tax form?

Yes, airSlate SignNow offers seamless integration with a variety of third-party applications, allowing you to connect your existing software for enhanced functionality. This means you can easily import or export data related to your louisiana income tax form from systems you already use. Integration helps streamline your workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the louisiana income tax form?

Using airSlate SignNow for your louisiana income tax form provides increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning, which helps you meet deadlines without hassle. Additionally, you can store completed forms securely, ensuring that your sensitive information is protected.

-

Is it easy to learn how to use airSlate SignNow for the louisiana income tax form?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to understand how to complete the louisiana income tax form. Our intuitive interface and step-by-step guides help you get started quickly, even if you have little experience with eSigning tools. You'll be managing your taxes more efficiently in no time.

Get more for Louisiana Income Tax

- Pennsylvania general durable power of attorney for property and finances or financial effective immediately form

- Procurement form 37536774

- Ohio epa open burning request form v10 032008

- Sf424 mandatory fillable form

- Taxi voucher service application anne arundel county aacounty form

- Ubo declaration letter 396396278 form

- University of washington seattle tuition forfeiture fee form

- Deer spotlight survey form

Find out other Louisiana Income Tax

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now