For Office Use Only New York State Department of Taxation and Finance Partnership Return for Calendar Year or Fiscal Year Beginn Form

What is the For Office Use Only New York State Department Of Taxation And Finance Partnership Return

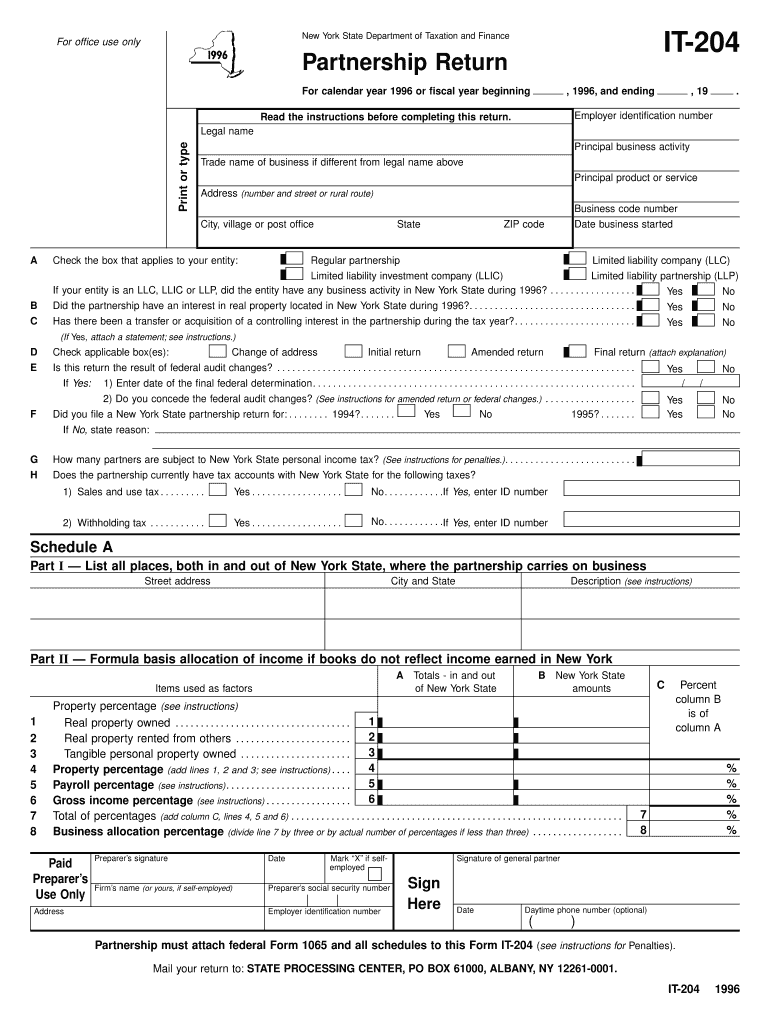

The For Office Use Only New York State Department Of Taxation And Finance Partnership Return is a tax form specifically designed for partnerships operating within New York State. This form is essential for reporting the income, deductions, and credits of a partnership for either the calendar year or a fiscal year. It ensures that partnerships comply with state tax regulations and accurately report their financial activities. It is crucial for partnerships to read the accompanying instructions carefully before completing this return to avoid errors and ensure compliance with state tax laws.

Steps to Complete the Partnership Return

Completing the Partnership Return requires careful attention to detail. Here are the key steps involved:

- Gather all necessary financial documents, including income statements and expense records.

- Review the instructions provided with the form to understand the requirements and specific sections.

- Fill out the form accurately, ensuring that all income, deductions, and credits are reported correctly.

- Double-check all entries for accuracy and completeness before submission.

- Sign and date the return as required.

Required Documents for Submission

Before submitting the Partnership Return, it is important to have the following documents ready:

- Partnership financial statements, including income and expense reports.

- Supporting documentation for deductions and credits claimed.

- Previous year’s tax return for reference, if applicable.

- Any additional forms or schedules that may be required based on the partnership’s activities.

Filing Deadlines for the Partnership Return

Partnerships must be aware of the filing deadlines to avoid penalties. The return is typically due on the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the return is due by March 15. It is advisable to mark these dates on your calendar to ensure timely submission.

Legal Use of the Partnership Return

The Partnership Return is a legal document that must be completed accurately and submitted to the New York State Department of Taxation and Finance. Failing to file this return can lead to penalties, including fines and interest on unpaid taxes. It is essential for partnerships to understand their legal obligations and ensure compliance with state tax laws to maintain good standing.

State-Specific Rules for the Partnership Return

New York State has specific rules and regulations governing the filing of the Partnership Return. These include guidelines on what constitutes taxable income, allowable deductions, and the treatment of various credits. Partnerships should familiarize themselves with these state-specific rules to ensure they are meeting all legal requirements and maximizing their tax benefits.

Quick guide on how to complete for office use only new york state department of taxation and finance partnership return for calendar year or fiscal year

Complete [SKS] seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and electronically sign [SKS] and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to For Office Use Only New York State Department Of Taxation And Finance Partnership Return For Calendar Year Or Fiscal Year Beginn

Create this form in 5 minutes!

How to create an eSignature for the for office use only new york state department of taxation and finance partnership return for calendar year or fiscal year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 'For Office Use Only New York State Department Of Taxation And Finance Partnership Return For Calendar Year Or Fiscal Year Beginning Read The Instructions Before Completing This Return Tax Ny'?

The 'For Office Use Only New York State Department Of Taxation And Finance Partnership Return For Calendar Year Or Fiscal Year Beginning Read The Instructions Before Completing This Return Tax Ny' is a critical document for partnerships in New York State. It allows businesses to report their income, deductions, and credits accurately, ensuring compliance with state tax regulations. Proper completion of this return helps to avoid penalties and facilitates smoother operations.

-

How does airSlate SignNow help in the completion of the partnership return?

With airSlate SignNow, businesses can streamline the process of completing the 'For Office Use Only New York State Department Of Taxation And Finance Partnership Return For Calendar Year Or Fiscal Year Beginning Read The Instructions Before Completing This Return Tax Ny.' Our platform allows for easy document preparation, electronic signatures, and secure storage. This enhances efficiency and minimizes errors when preparing this important tax document.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans suitable for various business needs. Whether you are a small partnership or a larger organization, we have a cost-effective solution that fits your budget. Our plans are designed to provide maximum value while ensuring easy access to functionalities needed for the 'For Office Use Only New York State Department Of Taxation And Finance Partnership Return For Calendar Year Or Fiscal Year Beginning Read The Instructions Before Completing This Return Tax Ny.'

-

Can multiple users collaborate on the partnership return using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate seamlessly on the 'For Office Use Only New York State Department Of Taxation And Finance Partnership Return For Calendar Year Or Fiscal Year Beginning Read The Instructions Before Completing This Return Tax Ny.' Team members can access the document simultaneously, making real-time edits and comments. This feature enhances communication and ensures that all necessary inputs are considered before the final submission.

-

Is airSlate SignNow compliant with New York State tax regulations?

Absolutely, airSlate SignNow is designed to comply with New York State tax regulations. We ensure that our software adheres to the latest requirements for documents, including the 'For Office Use Only New York State Department Of Taxation And Finance Partnership Return For Calendar Year Or Fiscal Year Beginning Read The Instructions Before Completing This Return Tax Ny.' You can trust our platform to provide a secure and reliable way to manage your tax documentation.

-

What features does airSlate SignNow offer to assist with document management?

airSlate SignNow includes robust features to assist with document management, such as customizable templates, electronic signatures, and secure cloud storage. These features simplify the process of handling important documents, including the 'For Office Use Only New York State Department Of Taxation And Finance Partnership Return For Calendar Year Or Fiscal Year Beginning Read The Instructions Before Completing This Return Tax Ny.' Our platform is user-friendly and designed for efficiency.

-

How do I get started with airSlate SignNow for my partnership return?

Getting started with airSlate SignNow is quick and easy. Sign up for an account, choose the appropriate plan, and start creating your documents for the 'For Office Use Only New York State Department Of Taxation And Finance Partnership Return For Calendar Year Or Fiscal Year Beginning Read The Instructions Before Completing This Return Tax Ny.' Our intuitive interface guides you through the entire process, ensuring a smoother experience.

Get more for For Office Use Only New York State Department Of Taxation And Finance Partnership Return For Calendar Year Or Fiscal Year Beginn

Find out other For Office Use Only New York State Department Of Taxation And Finance Partnership Return For Calendar Year Or Fiscal Year Beginn

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online