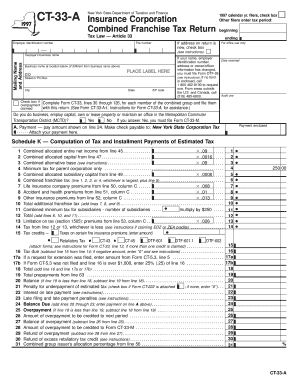

Form CT 33 a , Insurance Corporation Combined Franchise Tax Ny

What is the Form CT 33 A, Insurance Corporation Combined Franchise Tax NY

The Form CT 33 A is a tax form used by insurance corporations in New York to report and pay the combined franchise tax. This form is essential for insurance companies operating within the state, as it ensures compliance with state tax regulations. The combined franchise tax applies to various business entities, including insurance corporations, and is calculated based on the corporation's entire net income or a fixed dollar minimum, whichever is greater.

How to use the Form CT 33 A, Insurance Corporation Combined Franchise Tax NY

Using the Form CT 33 A involves several steps to ensure accurate reporting and compliance with New York tax laws. First, gather all necessary financial information, including income statements and balance sheets. Next, complete the form by entering the required data, such as total income and deductions. It is crucial to review the form for accuracy before submission. The completed form can then be filed either online or via mail, depending on the preferences of the corporation.

Steps to complete the Form CT 33 A, Insurance Corporation Combined Franchise Tax NY

Completing the Form CT 33 A requires careful attention to detail. Follow these steps:

- Collect financial documents, including income and expense statements.

- Fill out the form with the corporation's financial information, ensuring all fields are completed accurately.

- Calculate the combined franchise tax based on the guidelines provided.

- Review the form for any errors or omissions.

- Submit the form by the designated deadline, either online or by mailing a hard copy.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 33 A are critical for compliance. Typically, the form is due on the fifteenth day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by March 15. It is advisable to keep track of these deadlines to avoid penalties and ensure timely submission.

Required Documents

To complete the Form CT 33 A, several documents are necessary. These include:

- Financial statements, including income statements and balance sheets.

- Records of any deductions or credits the corporation intends to claim.

- Previous tax returns, if applicable, to ensure consistency in reporting.

Penalties for Non-Compliance

Failure to file the Form CT 33 A on time or inaccuracies in reporting can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal repercussions. It is essential for corporations to understand these risks and ensure compliance with all filing requirements to avoid financial penalties.

Quick guide on how to complete form ct 33 a insurance corporation combined franchise tax ny

Complete [SKS] effortlessly on any device

Online document management has become increasingly prevalent among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without interruptions. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and eSign [SKS] without hassle

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 33 a insurance corporation combined franchise tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 33 A, Insurance Corporation Combined Franchise Tax NY?

Form CT 33 A, Insurance Corporation Combined Franchise Tax NY, is a tax form used by insurance corporations operating in New York to report their franchise tax obligations. This form includes details about the corporation's income, deductions, and overall tax liability. Completing this form accurately is crucial for compliance with New York tax regulations.

-

How can airSlate SignNow help with filing Form CT 33 A, Insurance Corporation Combined Franchise Tax NY?

airSlate SignNow simplifies the process of preparing and eSigning Form CT 33 A, Insurance Corporation Combined Franchise Tax NY. Our platform allows users to fill out and securely sign their documents online, streamlining the filing process. This helps ensure timely submission and reduces the risk of errors.

-

What are the pricing plans for using airSlate SignNow for Form CT 33 A, Insurance Corporation Combined Franchise Tax NY?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. Each plan includes features designed to assist in preparing documents like Form CT 33 A, Insurance Corporation Combined Franchise Tax NY efficiently. You can choose a plan that best fits your needs, ensuring cost-effective solutions for your tax filing requirements.

-

What features does airSlate SignNow provide for handling tax documents?

airSlate SignNow includes features such as template creation, document sharing, and secure eSigning, all of which are beneficial for handling tax documents like Form CT 33 A, Insurance Corporation Combined Franchise Tax NY. Additionally, users can track document status and streamline collaboration for a more efficient workflow. These features enhance productivity and accuracy during the filing process.

-

Is airSlate SignNow compliant with NY tax regulations when eSigning Form CT 33 A?

Yes, airSlate SignNow is compliant with New York tax regulations, ensuring that eSignatures on documents like Form CT 33 A, Insurance Corporation Combined Franchise Tax NY are legally binding. Our platform utilizes advanced security measures to protect your data and maintain compliance. This gives users peace of mind when signing crucial tax documents.

-

Can I integrate airSlate SignNow with other tools for filing Form CT 33 A, Insurance Corporation Combined Franchise Tax NY?

Absolutely! airSlate SignNow offers integrations with various business tools and software, making it easier to manage your workflow when preparing Form CT 33 A, Insurance Corporation Combined Franchise Tax NY. This integration capability allows users to import data and automate processes, enhancing efficiency and reducing manual errors.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management, especially for Form CT 33 A, Insurance Corporation Combined Franchise Tax NY, provides several benefits such as increased efficiency and reduced paperwork. The platform's capabilities facilitate faster eSigning and document retrieval, enabling businesses to focus on more critical tasks. Additionally, it enhances security and compliance with tax regulations.

Get more for Form CT 33 A , Insurance Corporation Combined Franchise Tax Ny

Find out other Form CT 33 A , Insurance Corporation Combined Franchise Tax Ny

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word