CT 186 Stapleformshere NewYorkStateDepartmentofTaxationandFinance Final Return Amended Return Employeridentificationnumber Utili

Understanding the CT 186 Form

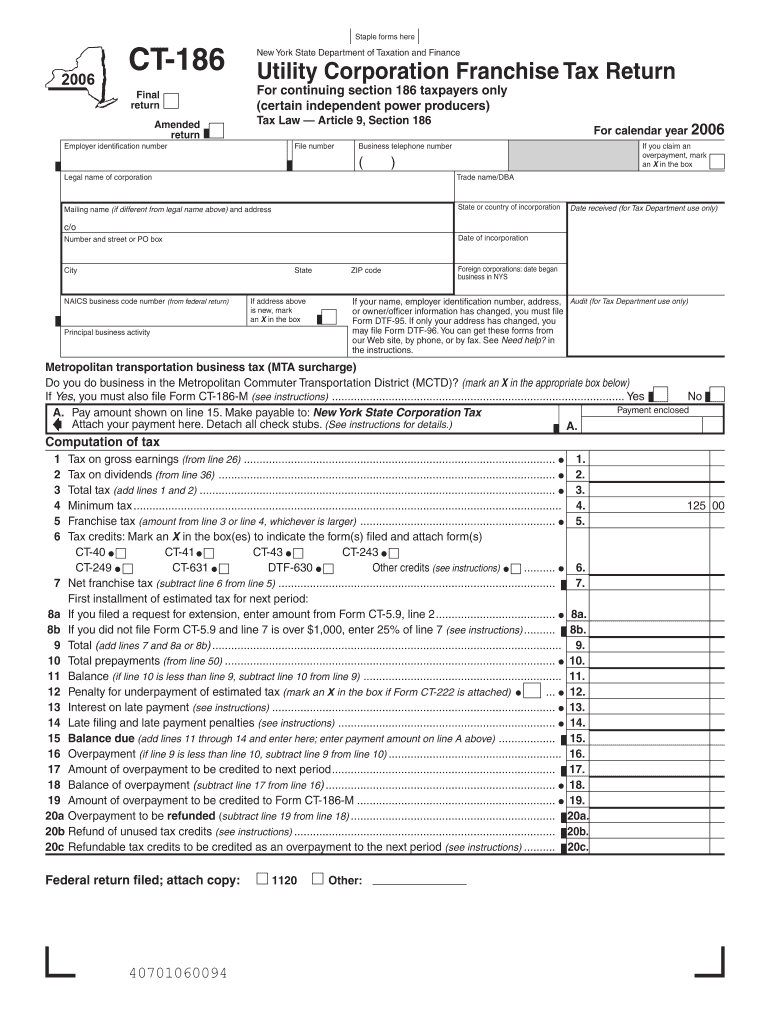

The CT 186 is a tax form utilized by the New York State Department of Taxation and Finance for reporting the Utility Corporation Franchise Tax. This form is specifically designed for continuing section 186 taxpayers, including certain independent power producers. The CT 186 serves as both a final return and an amended return, allowing businesses to accurately report their tax obligations and correct any previous submissions as necessary.

Steps to Complete the CT 186 Form

Completing the CT 186 form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your Employer Identification Number (EIN) and financial records for the reporting period. Follow these steps:

- Review the specific instructions provided by the New York State Department of Taxation and Finance.

- Fill out the form with accurate financial data, ensuring all calculations are correct.

- Double-check your entries for any errors or omissions.

- Sign and date the form before submission.

Required Documents for Filing the CT 186

To successfully file the CT 186 form, certain documents are required. These include:

- Financial statements for the reporting period.

- Supporting documentation for any deductions or credits claimed.

- A copy of the previous year's tax return, if applicable.

Having these documents ready will facilitate a smoother filing process and help avoid delays or complications.

Filing Methods for the CT 186 Form

The CT 186 form can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file:

- Online through the New York State Department of Taxation and Finance website.

- By mail, sending the completed form to the designated address.

- In-person at specific tax offices, if preferred.

Penalties for Non-Compliance with the CT 186

Failure to comply with the requirements of the CT 186 form can result in significant penalties. These may include:

- Late filing fees, which accumulate over time.

- Interest on any unpaid taxes.

- Potential audits or further scrutiny from tax authorities.

It is crucial for taxpayers to adhere to filing deadlines and ensure that all information is accurate to avoid these consequences.

Eligibility Criteria for Using the CT 186

The CT 186 form is intended for specific types of taxpayers. Eligibility criteria include:

- Entities classified as utility corporations under New York State law.

- Continuing section 186 taxpayers, particularly those engaged in independent power production.

Understanding these criteria is essential for businesses to determine if they should use this form for their tax reporting needs.

Quick guide on how to complete ct 186 stapleformshere newyorkstatedepartmentoftaxationandfinance final return amended return employeridentificationnumber

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly and without issues. Manage [SKS] on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-focused process today.

Easily Modify and eSign [SKS]

- Find [SKS] and click on Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Select pertinent sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Decide how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] while ensuring clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CT 186 Stapleformshere NewYorkStateDepartmentofTaxationandFinance Final Return Amended Return Employeridentificationnumber Utili

Create this form in 5 minutes!

How to create an eSignature for the ct 186 stapleformshere newyorkstatedepartmentoftaxationandfinance final return amended return employeridentificationnumber

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT 186 Stapleformshere NewYorkStateDepartmentofTaxationandFinance Final Return Amended Return?

The CT 186 Stapleformshere NewYorkStateDepartmentofTaxationandFinance Final Return Amended Return is a necessary document for filing your tax returns in New York related to utility corporations. It enables eligible entities to amend previous returns and ensure compliance with tax regulations. Understanding this form is crucial for maintaining good standing as a taxpayer.

-

How can airSlate SignNow help with the filing of the CT 186 Stapleformshere NewYorkStateDepartmentofTaxationandFinance Final Return Amended Return?

airSlate SignNow simplifies the process of sending and eSigning documents, including the CT 186 Stapleformshere NewYorkStateDepartmentofTaxationandFinance Final Return Amended Return. With our intuitive interface, you can easily prepare and manage your tax documents, ensuring that all necessary signatures are collected swiftly and securely.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features essential for effective tax document management, including in-app signing, custom templates, and advanced tracking options. These tools are specifically designed to streamline the completion of forms like the CT 186 Stapleformshere NewYorkStateDepartmentofTaxationandFinance Final Return Amended Return, enhancing your overall filing efficiency.

-

What is the pricing structure for using airSlate SignNow?

Our pricing structure is designed to be cost-effective, catering to businesses of all sizes. You can choose from various plans based on your usage, which allows you to leverage airSlate SignNow’s capabilities, including handling the CT 186 Stapleformshere NewYorkStateDepartmentofTaxationandFinance Final Return Amended Return at an affordable rate.

-

Is there integration available for airSlate SignNow with accounting software?

Yes, airSlate SignNow integrates seamlessly with popular accounting software to streamline your financial workflows. This makes it easier to manage documents like the CT 186 Stapleformshere NewYorkStateDepartmentofTaxationandFinance Final Return Amended Return alongside your accounting processes, enhancing accuracy and efficiency.

-

How does airSlate SignNow ensure the security of my sensitive tax documents?

At airSlate SignNow, we prioritize the security of your sensitive tax documents with robust encryption and compliance with data protection regulations. When dealing with the CT 186 Stapleformshere NewYorkStateDepartmentofTaxationandFinance Final Return Amended Return, you can rest assured that your information is safe and securely handled throughout the signing process.

-

Can I track the status of my documents in airSlate SignNow?

Absolutely, airSlate SignNow offers tracking features that allow you to monitor the status of your documents in real time. This is particularly beneficial when handling important forms like the CT 186 Stapleformshere NewYorkStateDepartmentofTaxationandFinance Final Return Amended Return, as you can ensure timely completion and compliance.

Get more for CT 186 Stapleformshere NewYorkStateDepartmentofTaxationandFinance Final Return Amended Return Employeridentificationnumber Utili

Find out other CT 186 Stapleformshere NewYorkStateDepartmentofTaxationandFinance Final Return Amended Return Employeridentificationnumber Utili

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement