CT 32 S Employer Identification Number New York State Department of Taxation and Finance New York Bank S Corporation Franchise T Form

Understanding the CT-32-S Form

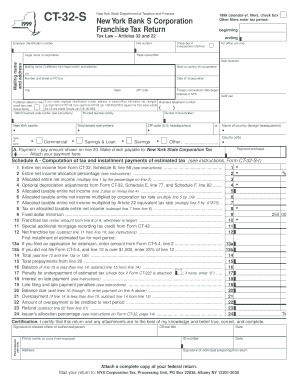

The CT-32-S form is a crucial document for New York Bank S Corporations, specifically used for filing the Franchise Tax Return. This form is governed by Articles 32 and 22 of the New York State Tax Law. It requires the Employer Identification Number (EIN) of the corporation, which is essential for tax identification purposes. The form also includes a section to check if an overpayment is being claimed, which can be beneficial for businesses seeking refunds. Understanding the specific requirements and implications of this form is vital for compliance with state tax regulations.

Steps to Complete the CT-32-S Form

Completing the CT-32-S form involves several key steps:

- Gather necessary information, including the Employer Identification Number and financial details of the corporation.

- Fill out the form accurately, ensuring all sections are completed, including the check box for overpayment claims if applicable.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Eligibility Criteria for Filing CT-32-S

To file the CT-32-S form, a corporation must meet specific eligibility criteria. It must be classified as a New York Bank S Corporation under the state tax laws. Additionally, the corporation should have been active during the calendar year for which the tax return is being filed. Ensuring eligibility is critical for compliance and to avoid potential issues with the New York State Department of Taxation and Finance.

Required Documents for CT-32-S Submission

When preparing to submit the CT-32-S form, several documents are typically required:

- Financial statements for the relevant tax year.

- Proof of the Employer Identification Number.

- Any previous tax returns that may be relevant for reference.

- Documentation supporting any claims for overpayment.

Filing Deadlines for CT-32-S

Timely submission of the CT-32-S form is essential to avoid penalties. The filing deadline is generally the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. It is advisable to mark this date on your calendar to ensure compliance.

Penalties for Non-Compliance with CT-32-S

Failure to file the CT-32-S form on time can result in significant penalties. The New York State Department of Taxation and Finance may impose fines, and interest may accrue on any unpaid taxes. Additionally, non-compliance can lead to further scrutiny from tax authorities, which may complicate future filings. Understanding these penalties underscores the importance of timely and accurate submissions.

Quick guide on how to complete ct 32 s employer identification number new york state department of taxation and finance new york bank s corporation franchise 130065

Complete [SKS] effortlessly on any gadget

Online document management has surged in popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, alter, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest method to modify and eSign [SKS] without hassle

- Find [SKS] and then click Get Form to commence.

- Utilize the features we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the information and then click the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] and ensure excellent communication throughout any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 32 s employer identification number new york state department of taxation and finance new york bank s corporation franchise 130065

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT 32 S Employer Identification Number?

The CT 32 S Employer Identification Number is a unique identifier issued by the New York State Department of Taxation and Finance for corporations filing the New York Bank S Corporation Franchise Tax Return. This number is crucial for tax identification, ensuring compliance with Tax Law Articles 32 and 22.

-

How do I apply for a CT 32 S Employer Identification Number?

To apply for a CT 32 S Employer Identification Number, businesses must submit the required forms to the New York State Department of Taxation and Finance. Typically, the application involves filling out the correct tax forms associated with the New York Bank S Corporation Franchise Tax Return.

-

What are the benefits of eSigning documents for tax filings?

eSigning documents simplifies the tax filing process, especially for forms related to the CT 32 S Employer Identification Number and New York Bank S Corporation Franchise Tax Return. It enhances efficiency, reduces paperwork, and provides secure, verifiable records of your filings.

-

Is there a cost associated with obtaining a CT 32 S Employer Identification Number?

There is typically no fee to obtain a CT 32 S Employer Identification Number itself, but businesses should be aware of potential costs associated with tax preparation services, especially when filing the New York Bank S Corporation Franchise Tax Return.

-

Can airSlate SignNow integrate with tax preparation software?

Yes, airSlate SignNow can integrate with various tax preparation software, making it easier to manage documents required for the CT 32 S Employer Identification Number and the New York Bank S Corporation Franchise Tax Return. This integration saves time and streamlines the filing process.

-

What types of documents can I eSign for tax returns?

You can eSign various documents related to your tax returns, including those required for the CT 32 S Employer Identification Number and the New York Bank S Corporation Franchise Tax Return. This includes forms and declarations needed to claim a refund if overpayment is claimed.

-

How can I check the status of my CT 32 S Employer Identification Number?

To check the status of your CT 32 S Employer Identification Number, you can visit the New York State Department of Taxation and Finance website. They provide resources and guidance on how to verify your file number and any related tax information.

Get more for CT 32 S Employer Identification Number New York State Department Of Taxation And Finance New York Bank S Corporation Franchise T

- Internship certificate for mechanical engineering students pdf form

- Mortgage loan officer business plan examples form

- Rcsc employment form

- The purple violet of oshaantu pdf form

- Anatomy of the constitution fill in the blank answers form

- From to city link express form

- Nrc application form

- American beauty screenplay pdf form

Find out other CT 32 S Employer Identification Number New York State Department Of Taxation And Finance New York Bank S Corporation Franchise T

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document