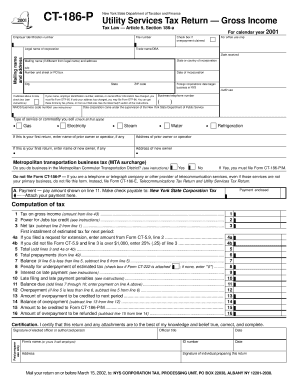

Utility Services Tax Return Gross Income Tax Ny Form

What is the Utility Services Tax Return Gross Income Tax Ny

The Utility Services Tax Return Gross Income Tax in New York is a tax imposed on utility companies that provide services such as electricity, gas, and telecommunications. This tax is calculated based on the gross income derived from the sale of these utility services. It is essential for utility providers to accurately report their income to ensure compliance with state tax regulations. Understanding this tax is crucial for both utility companies and their customers, as it can impact pricing and service availability.

Steps to complete the Utility Services Tax Return Gross Income Tax Ny

Completing the Utility Services Tax Return involves several key steps:

- Gather all necessary financial records, including gross income statements from utility services.

- Determine the applicable tax rate based on the type of utility service provided.

- Fill out the appropriate tax return form, ensuring all income is reported accurately.

- Review the completed form for any errors or omissions before submission.

- Submit the tax return by the designated deadline, either online or via mail.

Required Documents

To file the Utility Services Tax Return Gross Income Tax, utility companies must prepare several documents:

- Gross income reports for the relevant tax period.

- Records of any deductions or credits claimed.

- Previous tax returns for reference, if applicable.

- Supporting documentation for any adjustments made to reported income.

Filing Deadlines / Important Dates

Filing deadlines for the Utility Services Tax Return Gross Income Tax in New York are typically set annually. Companies should be aware of the following important dates:

- The annual tax return is usually due on the last day of the month following the end of the tax year.

- Extensions may be available but must be requested before the original deadline.

- Penalties may apply for late submissions, so timely filing is crucial.

Legal use of the Utility Services Tax Return Gross Income Tax Ny

The Utility Services Tax Return Gross Income Tax is legally mandated under New York State tax law. Utility companies are required to comply with this tax regulation to operate legally within the state. Non-compliance can result in penalties, including fines and interest on unpaid taxes. It is vital for utility providers to stay informed about changes in tax laws to ensure ongoing compliance.

Who Issues the Form

The form for the Utility Services Tax Return Gross Income Tax is issued by the New York State Department of Taxation and Finance. This department oversees the administration of tax laws and ensures that utility companies adhere to the regulations governing the reporting and payment of taxes related to utility services.

Quick guide on how to complete utility services tax return gross income tax ny

Complete [SKS] effortlessly on any device

Digital document management has become popular among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign [SKS] effortlessly

- Access [SKS] and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Utility Services Tax Return Gross Income Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the utility services tax return gross income tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Utility Services Tax Return Gross Income Tax NY?

The Utility Services Tax Return Gross Income Tax NY is a tax imposed on the gross income of utility services provided within New York. Understanding this tax is crucial for businesses in the utility sector as it affects financial reporting and compliance. Properly filing this tax can help avoid penalties and ensure that your business remains in good standing with state regulations.

-

How does airSlate SignNow simplify the Utility Services Tax Return Gross Income Tax NY filing process?

airSlate SignNow streamlines the filing of the Utility Services Tax Return Gross Income Tax NY by allowing users to eSign and send documents efficiently. With its intuitive interface, businesses can quickly prepare tax documents, reducing the time spent on administrative tasks. This integration of eSignature technology ensures accuracy and compliance.

-

What are the pricing options for using airSlate SignNow for tax document management?

airSlate SignNow offers various pricing plans that cater to different business needs for managing tax documents, including Utility Services Tax Return Gross Income Tax NY. Pricing is competitive, and you can choose from monthly or annual subscriptions based on your use case. Each plan includes essential features to ensure a hassle-free experience.

-

Can I integrate airSlate SignNow with other accounting software for filing my Utility Services Tax Return Gross Income Tax NY?

Yes, airSlate SignNow supports integration with popular accounting software, facilitating the filing of your Utility Services Tax Return Gross Income Tax NY. This integration helps maintain consistency and accuracy across your financial records. Companies can easily import data and streamline their tax filing processes.

-

What features might benefit my business when dealing with Utility Services Tax Return Gross Income Tax NY?

Key features of airSlate SignNow include eSigning, document management, and secure storage, which are all beneficial when dealing with the Utility Services Tax Return Gross Income Tax NY. These features help ensure your documents are signed, stored, and accessible at any time, enhancing workflow efficiency for tax preparations. Additionally, reminders and notifications can assist in meeting filing deadlines.

-

How does airSlate SignNow ensure data security while managing Utility Services Tax Return Gross Income Tax NY documents?

airSlate SignNow prioritizes data security with advanced encryption technologies to protect all documents related to the Utility Services Tax Return Gross Income Tax NY. This ensures that sensitive information remains confidential while being easy to access for authorized users. Regular security updates and compliance with industry standards further protect your data.

-

What benefits does airSlate SignNow offer for small businesses handling Utility Services Tax Return Gross Income Tax NY?

For small businesses, airSlate SignNow provides an affordable and user-friendly solution for managing Utility Services Tax Return Gross Income Tax NY responsibilities. The platform's ease of use allows small business owners to focus on core operations without being bogged down by tedious document processes. Cost savings from streamlined operations can directly support business growth.

Get more for Utility Services Tax Return Gross Income Tax Ny

Find out other Utility Services Tax Return Gross Income Tax Ny

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement