Form CT 3 S a C Report by an S Corporation Included in a Tax Ny

What is the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny

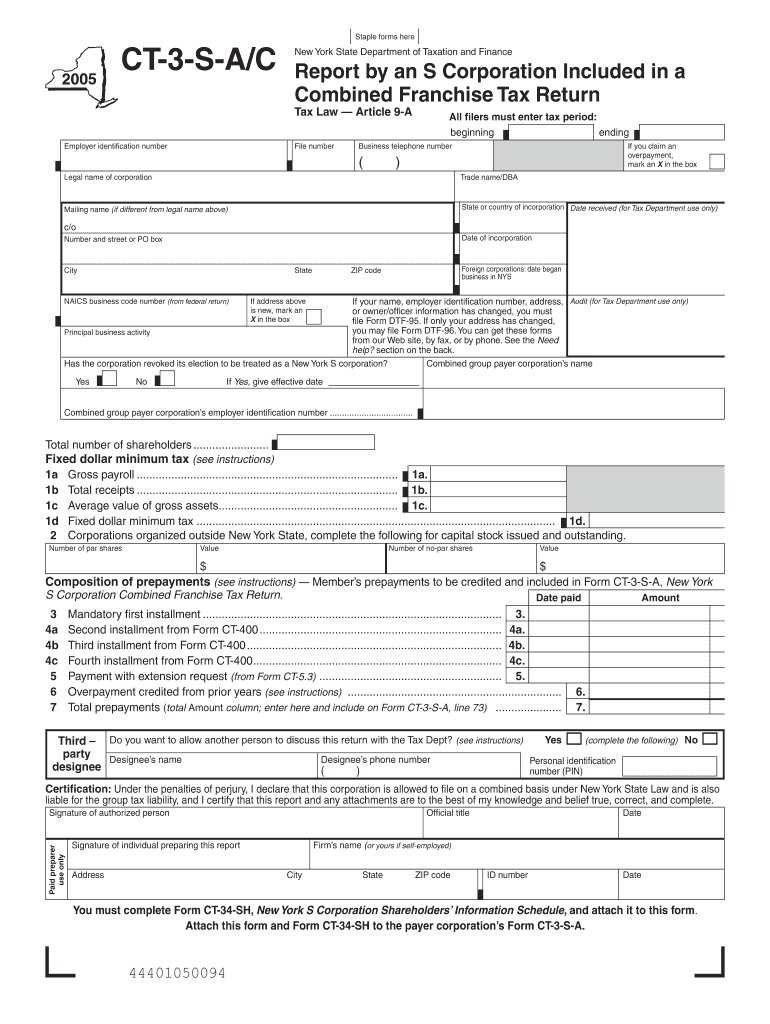

The Form CT 3 S A C Report is a tax document specifically designed for S corporations operating in New York. This form is crucial for reporting the corporation's income, deductions, and credits to the state tax authorities. It ensures compliance with New York tax regulations and helps determine the corporation's tax liability. By accurately completing this form, S corporations can fulfill their legal obligations while potentially minimizing their tax burden.

Steps to complete the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny

Completing the Form CT 3 S A C Report involves several key steps:

- Gather Financial Records: Collect all relevant financial documents, including income statements, balance sheets, and expense reports.

- Fill Out the Form: Begin entering information in the designated sections, such as income, deductions, and credits.

- Review for Accuracy: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Sign and Date: Ensure that the form is signed and dated by an authorized individual within the corporation.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

Legal use of the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny

The legal use of the Form CT 3 S A C Report is essential for S corporations in New York to comply with state tax laws. This form serves as an official record of the corporation's financial activities and tax obligations. Failing to file this report can result in penalties and interest charges. It is important for S corporations to understand their legal responsibilities regarding this form to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 3 S A C Report are critical for S corporations to meet. Typically, the form must be submitted by the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. It is advisable to keep track of these dates to ensure timely filing and to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

S corporations have several options for submitting the Form CT 3 S A C Report. These methods include:

- Online Submission: Many corporations choose to file electronically through the New York State Department of Taxation and Finance website.

- Mail: The form can be printed and mailed to the appropriate tax office. Ensure that the correct address is used to avoid delays.

- In-Person: Corporations may also submit the form in person at designated tax offices, which can be beneficial for those needing immediate assistance.

Key elements of the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny

Understanding the key elements of the Form CT 3 S A C Report is essential for accurate completion. Important sections include:

- Income Section: Report total income earned by the corporation during the tax year.

- Deductions: List allowable deductions that reduce taxable income, such as business expenses.

- Credits: Identify any tax credits the corporation is eligible for, which can further reduce tax liability.

- Signature Section: Ensure that the form is signed by an authorized officer of the corporation to validate the submission.

Quick guide on how to complete form ct 3 s a c report by an s corporation included in a tax ny

Prepare [SKS] effortlessly on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your paperwork quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to change and eSign [SKS] without a hassle

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or a sharing link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require new document prints. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form CT 3 S A C Report By An S Corporation Included In A Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 s a c report by an s corporation included in a tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny?

The Form CT 3 S A C Report By An S Corporation Included In A Tax Ny is a tax document that S corporations in New York must file to report their income, deductions, and credits. This form is crucial for ensuring compliance with state tax requirements and can impact the corporation's tax liabilities.

-

How can airSlate SignNow help with filing the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny?

airSlate SignNow provides an easy-to-use platform where you can create, send, and eSign your documents, including the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny. This streamlines the filing process, ensuring that all documents are completed accurately and filed on time.

-

What are the pricing options for airSlate SignNow when handling the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny?

airSlate SignNow offers various pricing plans to accommodate different business needs, including monthly and annual subscriptions. Pricing is competitive and designed to provide cost-effective solutions for companies needing to manage documents like the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny.

-

Are there any integrations available with airSlate SignNow for tax-related forms including the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny?

Yes, airSlate SignNow integrates seamlessly with numerous accounting and tax software systems, helping you manage your Form CT 3 S A C Report By An S Corporation Included In A Tax Ny alongside your other financial documents. These integrations enhance workflows and make tracking easier.

-

What features does airSlate SignNow offer for managing the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny?

airSlate SignNow includes features such as document templates, eSigning, and secure cloud storage that facilitate the efficient handling of the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny. These tools simplify collaboration and ensure regulatory compliance.

-

Can airSlate SignNow help me to ensure compliance when filing the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny?

Absolutely! airSlate SignNow prioritizes security and compliance, providing tools that help you track, manage, and sign documents like the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny with confidence, ensuring you meet all legal requirements.

-

What benefits can I expect from using airSlate SignNow for the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny?

Using airSlate SignNow for the Form CT 3 S A C Report By An S Corporation Included In A Tax Ny increases efficiency by automating document workflows and reducing the time needed to process forms. This allows businesses to focus on growth while keeping their tax documentation in order.

Get more for Form CT 3 S A C Report By An S Corporation Included In A Tax Ny

Find out other Form CT 3 S A C Report By An S Corporation Included In A Tax Ny

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple