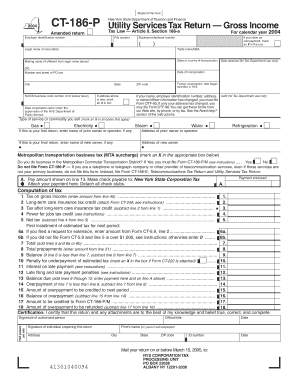

Staple Forms Here CT 186 P Amended Return Employer Identification Number Legal Name of Corporation New York State Department of

Understanding the CT-186 P Amended Return

The CT-186 P Amended Return is a crucial tax document for corporations operating in New York. This form is specifically designed for entities that need to amend their previously filed tax returns. It allows businesses to correct errors or make necessary adjustments to their reported gross income, ensuring compliance with the New York State Department of Taxation and Finance. The form requires detailed information, including the Employer Identification Number (EIN) and the legal name of the corporation, which helps in accurately identifying the entity during the review process.

Steps to Complete the CT-186 P Amended Return

Completing the CT-186 P Amended Return involves several important steps to ensure accuracy and compliance. Start by gathering all relevant financial documents, including the original tax return and any supporting documentation for the amendments. Next, fill out the form, paying close attention to the sections that require updated information. Be sure to clearly indicate the reasons for the amendments in the designated area. After completing the form, review it thoroughly to avoid any mistakes before submission.

Legal Use of the CT-186 P Amended Return

The CT-186 P Amended Return serves a legal purpose in the tax compliance framework of New York State. Corporations are required to file this form if they need to amend a previously submitted tax return. Failure to do so can lead to penalties or issues with the New York State Department of Taxation and Finance. This form is not only a mechanism for correction but also a legal obligation that helps maintain accurate tax records.

Required Documents for Filing the CT-186 P Amended Return

When preparing to file the CT-186 P Amended Return, it is essential to have all necessary documents at hand. This includes the original tax return that is being amended, any supporting financial statements, and documentation that justifies the changes being made. Having these documents ready can streamline the filing process and ensure that the amendments are substantiated with proper evidence.

Filing Methods for the CT-186 P Amended Return

The CT-186 P Amended Return can be submitted through various methods to accommodate different preferences. Corporations can choose to file the form online, which is often the quickest method, or they can opt for traditional mail. In-person submission at designated tax offices is also an option for those who prefer direct interaction. Each method has its own set of guidelines, so it is important to follow the specific instructions provided by the New York State Department of Taxation and Finance.

Penalties for Non-Compliance with the CT-186 P Amended Return

Non-compliance with the requirements surrounding the CT-186 P Amended Return can result in significant penalties. Corporations that fail to file the amended return when necessary may face fines, interest on unpaid taxes, and potential legal repercussions. It is crucial for businesses to understand their obligations and ensure timely and accurate filings to avoid these consequences.

Quick guide on how to complete staple forms here ct 186 p amended return employer identification number legal name of corporation new york state department of

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, either via email, text (SMS), an invitation link, or download it onto your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow manages all your document administration needs in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the staple forms here ct 186 p amended return employer identification number legal name of corporation new york state department of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Staple Forms Here CT 186 P Amended Return?

The Staple Forms Here CT 186 P Amended Return is specifically designed for corporations in New York to correct previously submitted tax returns. By using this form, you can ensure that your Employer Identification Number and other essential details are accurate, which is crucial for compliance with the New York State Department of Taxation and Finance. This form helps corporations adhere to Article 9, Section 186 of the Tax Law, affecting how gross income is reported.

-

How can airSlate SignNow help with submitting Staple Forms Here CT 186 P?

airSlate SignNow streamlines the process of completing and submitting Staple Forms Here CT 186 P by allowing users to eSign and send documents efficiently. With an easy-to-use digital interface, businesses can prepare their amended returns quickly and securely. This ensures accurate representation of the Employer Identification Number and legal name of the corporation when interacting with the New York State Department of Taxation and Finance.

-

What features does airSlate SignNow offer for tax-related forms?

airSlate SignNow provides a range of features ideal for managing tax-related forms, including templates for common returns like the Staple Forms Here CT 186 P. Users can utilize features such as cloud storage, secure eSignature capabilities, and real-time document tracking, ensuring that your submissions are handled efficiently and accurately. This functionality helps businesses comply with numerous regulations, including those set forth in Article 9, Section 186 a Tax Law.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow operates on a subscription-based pricing model, with plans tailored to fit various business needs. The pricing allows organizations to access premium features for completing forms such as the Staple Forms Here CT 186 P efficiently. Investing in this service can lead to signNow time savings and enhanced compliance with the New York State Department of Taxation and Finance.

-

Can airSlate SignNow integrate with accounting software for easier tax management?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software, enhancing your tax management workflow. This integration simplifies the process of preparing and submitting forms like the Staple Forms Here CT 186 P by allowing automatic data transfer from your accounting system. Since accurate financial data is critical for compliance with Article 9, Section 186, these integrations prove beneficial.

-

What are the benefits of using airSlate SignNow for my corporation's tax submissions?

Using airSlate SignNow for your corporation’s tax submissions offers several benefits, including increased efficiency and enhanced compliance with tax regulations. It simplifies the signing and submission of documents such as the Staple Forms Here CT 186 P, ensuring accuracy in reporting your Employer Identification Number and corporate details. Ultimately, this can lead to a smoother interaction with the New York State Department of Taxation and Finance.

-

How does airSlate SignNow ensure the security of sensitive tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance protocols to protect sensitive tax information. When submitting forms like the Staple Forms Here CT 186 P, you can trust that your Employer Identification Number and other personal data are safeguarded against unauthorized access. This commitment to security ensures peace of mind when handling submissions to the New York State Department of Taxation and Finance.

Get more for Staple Forms Here CT 186 P Amended Return Employer Identification Number Legal Name Of Corporation New York State Department Of

Find out other Staple Forms Here CT 186 P Amended Return Employer Identification Number Legal Name Of Corporation New York State Department Of

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice