Form CT 186 Utilty Corporation Franchise Tax Return for Tax Ny

What is the Form CT 186 Utility Corporation Franchise Tax Return for Tax NY

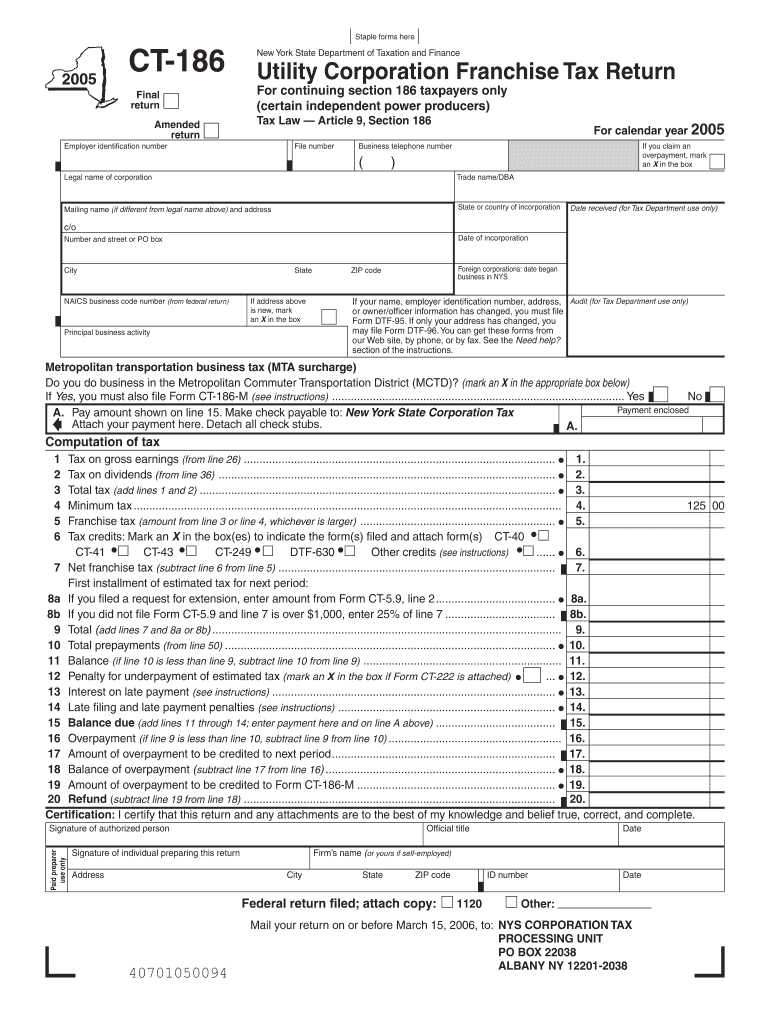

The Form CT 186 is a tax return specifically designed for utility corporations operating in New York. This form is essential for reporting franchise taxes owed by these corporations to the state. Utility corporations are typically involved in providing essential services such as electricity, gas, water, and telecommunications. By filing this form, these entities comply with state tax regulations and ensure that they are fulfilling their financial obligations to New York State.

How to use the Form CT 186 Utility Corporation Franchise Tax Return for Tax NY

To effectively use the Form CT 186, utility corporations must gather all necessary financial information related to their operations. This includes revenue figures, deductions, and any applicable credits. The form requires precise calculations to determine the total franchise tax due. It is important for corporations to review the instructions carefully to ensure that all sections are completed accurately. In addition, maintaining thorough records will support the information provided on the form and facilitate any potential audits.

Steps to complete the Form CT 186 Utility Corporation Franchise Tax Return for Tax NY

Completing the Form CT 186 involves several key steps:

- Gather all relevant financial documents, including income statements and balance sheets.

- Calculate total gross income and applicable deductions.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the appropriate state tax authority by the specified deadline.

Filing Deadlines / Important Dates

Utility corporations must adhere to specific filing deadlines for the Form CT 186. Generally, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. It is crucial for corporations to be aware of these dates to avoid penalties and interest on late submissions. Keeping a calendar of important tax deadlines can help ensure timely compliance.

Required Documents

When preparing to file the Form CT 186, utility corporations should have the following documents ready:

- Financial statements, including income and balance sheets.

- Records of all income generated during the tax year.

- Documentation for any deductions or credits claimed.

- Previous tax returns for reference and comparison.

Penalties for Non-Compliance

Failure to file the Form CT 186 on time or inaccuracies in the submission can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for utility corporations to understand the implications of non-compliance and take proactive steps to ensure timely and accurate filings.

Quick guide on how to complete form ct 186 utilty corporation franchise tax return for tax ny

Execute [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can locate the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Oversee [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest method to alter and electronically sign [SKS] without hassle

- Locate [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Select pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from any device of your choosing. Edit and electronically sign [SKS] and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 186 utilty corporation franchise tax return for tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 186 Utilty Corporation Franchise Tax Return For Tax Ny?

Form CT 186 Utilty Corporation Franchise Tax Return For Tax Ny is a tax form required for utility corporations in New York that outlines the corporation's tax obligations. This form ensures compliance with state tax laws and helps businesses avoid potential penalties for non-filing.

-

How does airSlate SignNow help with Form CT 186 Utilty Corporation Franchise Tax Return For Tax Ny?

airSlate SignNow simplifies the process of managing Form CT 186 Utilty Corporation Franchise Tax Return For Tax Ny by allowing businesses to easily create, send, and eSign documents online. Our platform streamlines your filing process, ensuring accuracy and saving time.

-

What are the pricing options for using airSlate SignNow for Form CT 186?

Our pricing plans are designed to cater to various business needs, starting with a free trial that includes access to features relevant for managing Form CT 186 Utilty Corporation Franchise Tax Return For Tax Ny. Paid plans provide additional tools and integrations to further enhance your experience.

-

Can I integrate airSlate SignNow with other software for Form CT 186?

Yes, airSlate SignNow offers multiple integrations with popular software like CRM systems, accounting tools, and productivity suites. This allows for a seamless workflow when handling Form CT 186 Utilty Corporation Franchise Tax Return For Tax Ny and other business documents.

-

Is airSlate SignNow secure for handling sensitive tax documents like Form CT 186?

Absolutely. Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to ensure that all documents, including Form CT 186 Utilty Corporation Franchise Tax Return For Tax Ny, are safely managed and protected.

-

Can I track the status of my Form CT 186 submissions with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your submissions for Form CT 186 Utilty Corporation Franchise Tax Return For Tax Ny in real-time. You’ll receive notifications as your document progresses through various stages of the signing process.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents like Form CT 186 Utilty Corporation Franchise Tax Return For Tax Ny helps businesses save time and reduce errors. The eSigning feature accelerates the approval process while ensuring documents are legally binding and secure.

Get more for Form CT 186 Utilty Corporation Franchise Tax Return For Tax Ny

Find out other Form CT 186 Utilty Corporation Franchise Tax Return For Tax Ny

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors