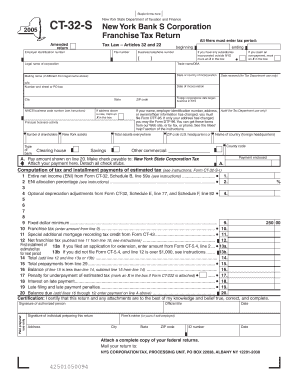

Staple Forms Here CT 32 S Amended Return Employer Identification Number New York State Department of Taxation and Finance New Yo

Understanding the CT-32-S Amended Return

The CT-32-S Amended Return is a crucial document for businesses operating as S Corporations in New York. This form is specifically designed for amending previously filed New York Bank S Corporation Franchise Tax Returns. It is essential for ensuring compliance with New York State tax regulations, particularly under Tax Law Articles 32 and 22. The form requires the Employer Identification Number (EIN) and mandates that all filers enter the correct tax period for which the amendment is being made. This ensures that the tax records are accurate and up to date.

Steps to Complete the CT-32-S Amended Return

Filling out the CT-32-S Amended Return involves several key steps:

- Gather necessary information, including your EIN and the tax period you are amending.

- Obtain the CT-32-S form from the New York State Department of Taxation and Finance website or through authorized channels.

- Complete the form by providing accurate financial data and any adjustments needed from the original return.

- Review the form for completeness and accuracy to avoid delays in processing.

- Submit the completed form either electronically or via mail, following the guidelines provided by the Department of Taxation and Finance.

Required Documents for Filing

When filing the CT-32-S Amended Return, it is important to have the following documents ready:

- Copy of the original CT-32-S return that is being amended.

- Supporting documentation for any changes made, such as revised financial statements or additional schedules.

- Any correspondence from the New York State Department of Taxation and Finance regarding the original return.

Filing Methods for the CT-32-S Amended Return

The CT-32-S Amended Return can be submitted through various methods:

- Online: Many businesses prefer to file electronically through the New York State Department of Taxation and Finance's online services.

- Mail: You can also print the completed form and send it via postal service to the designated address provided by the department.

- In-Person: Some businesses may choose to deliver the form in person at local tax offices, ensuring immediate receipt.

Penalties for Non-Compliance

Failure to file the CT-32-S Amended Return or inaccuracies in the submission can lead to significant penalties. These may include:

- Monetary fines for late submissions or underpayment of taxes.

- Interest on any unpaid tax amounts, which can accumulate over time.

- Potential audits or further scrutiny from the New York State Department of Taxation and Finance.

Eligibility Criteria for Filing

To file the CT-32-S Amended Return, businesses must meet specific eligibility criteria:

- Must be classified as an S Corporation under New York State law.

- Must have previously filed a CT-32-S return that requires amendment.

- Must have a valid Employer Identification Number (EIN) issued by the IRS.

Quick guide on how to complete staple forms here ct 32 s amended return employer identification number new york state department of taxation and finance new

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Simplest Method to Modify and eSign [SKS] Without Any Hassle

- Obtain [SKS] and then click Get Form to commence.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools that airSlate SignNow specifically offers for this purpose.

- Formulate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Staple Forms Here CT 32 S Amended Return Employer Identification Number New York State Department Of Taxation And Finance New Yo

Create this form in 5 minutes!

How to create an eSignature for the staple forms here ct 32 s amended return employer identification number new york state department of taxation and finance new

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Staple Forms Here CT 32 S Amended Return?

The Staple Forms Here CT 32 S Amended Return is essential for making necessary corrections to your tax filings with the New York State Department of Taxation and Finance. When completing this form, it's crucial to include your Employer Identification Number to ensure accurate processing. This amended return addresses tax law articles 32 and 22, focusing on the requirements for New York Bank S Corporation Franchise Tax Return.

-

How does airSlate SignNow streamline the filing process for the CT 32 S Amended Return?

airSlate SignNow simplifies the CT 32 S Amended Return filing by allowing users to send, sign, and manage documents electronically. The platform ensures that your Employer Identification Number and tax period information are collected accurately and securely. With its user-friendly interface, it helps you complete your New York State filings promptly and efficiently.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features such as electronic signatures, document tracking, and secure storage specifically tailored for tax documentation like the CT 32 S Amended Return. By integrating these features, businesses can ensure compliance with New York tax laws and regulations while keeping all relevant information readily accessible. This makes it the ideal tool for managing New York Bank S Corporation Franchise Tax Returns.

-

Is there a cost associated with using airSlate SignNow for filing CT 32 S Amended Returns?

Yes, airSlate SignNow offers a range of pricing plans designed to meet the needs of businesses of all sizes. The cost of using the platform for filing your Staple Forms Here CT 32 S Amended Return may vary based on the chosen plan. Each plan provides features that cater to efficient document management and eSigning, ensuring value for your investment.

-

Can airSlate SignNow integrate with other software for tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with popular tax preparation software, enhancing your workflow for managing the CT 32 S Amended Return. This integration allows for automatic data transfer, reducing the risk of errors while ensuring that all necessary information, like your Employer Identification Number, is accurately reflected in your tax filings.

-

What benefits can I expect from using airSlate SignNow for tax filings?

Utilizing airSlate SignNow for your tax filings, including the CT 32 S Amended Return, provides a range of benefits such as improved efficiency, reduced paperwork, and enhanced security. By streamlining document processes, you will save time and resources, allowing you to focus on other important aspects of your business while ensuring compliance with New York State Department of Taxation and Finance requirements.

-

How can I ensure my documents are secure when using airSlate SignNow?

airSlate SignNow prioritizes security with features like end-to-end encryption, ensuring that your Staple Forms Here CT 32 S Amended Return and other sensitive documents are protected throughout the signing and filing process. The platform also provides an audit trail, allowing you to track who accessed the documents and when, giving you added peace of mind in the handling of your Employer Identification Number and tax information.

Get more for Staple Forms Here CT 32 S Amended Return Employer Identification Number New York State Department Of Taxation And Finance New Yo

- Membership form for samuel l derby american legion

- Publications order form publications of the casact

- Legal bind between two parties contract template form

- Legal between two parties contract template form

- Legal business contract template form

- Legal contract template form

- Legal for borrow money contract template form

- Legal for payment contract template form

Find out other Staple Forms Here CT 32 S Amended Return Employer Identification Number New York State Department Of Taxation And Finance New Yo

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple