Staple Forms Here CT 186 PM Amended Return Employer Identification Number New York State Department of Taxation and Finance Util

Understanding the CT 186 PM Amended Return

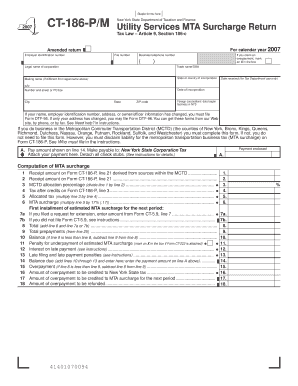

The CT 186 PM Amended Return is a specific tax form used by businesses in New York to report changes to their previously filed MTA surcharge returns. This form is essential for ensuring compliance with Tax Law Article 9, Section 186-c, which governs the Metropolitan Transportation Authority (MTA) surcharge. Businesses must provide their Employer Identification Number (EIN) on the form, which uniquely identifies them for tax purposes. The amended return allows businesses to correct any inaccuracies from prior filings, ensuring that they meet their tax obligations accurately.

Steps to Complete the CT 186 PM Amended Return

Completing the CT 186 PM Amended Return involves several key steps:

- Gather necessary documentation, including your original MTA surcharge return and any supporting financial records.

- Clearly indicate the changes being made on the amended return form, specifying the reasons for each amendment.

- Ensure that your Employer Identification Number (EIN) is accurately entered on the form.

- Review the completed form for accuracy and completeness before submission.

Following these steps will help facilitate a smooth filing process and reduce the likelihood of errors.

Required Documents for Filing

When filing the CT 186 PM Amended Return, businesses should prepare the following documents:

- The original MTA surcharge return that is being amended.

- Any additional documentation that supports the changes made, such as financial statements or corrected calculations.

- Correspondence from the New York State Department of Taxation and Finance, if applicable.

Having these documents ready will streamline the filing process and provide clarity to tax authorities.

Filing Methods for the CT 186 PM Amended Return

The CT 186 PM Amended Return can be submitted through various methods:

- Online submission through the New York State Department of Taxation and Finance website, if available.

- Mailing the completed form to the designated address provided by the tax authority.

- In-person submission at a local tax office, if preferred.

Choosing the appropriate filing method can depend on the urgency of the amendment and the resources available to the business.

Penalties for Non-Compliance

Failure to file the CT 186 PM Amended Return accurately and on time may result in penalties. These can include:

- Monetary fines based on the amount of tax owed.

- Interest on any unpaid taxes, which accumulates over time.

- Potential audits or additional scrutiny from tax authorities.

It is crucial for businesses to ensure compliance to avoid these penalties and maintain good standing with tax authorities.

Quick guide on how to complete staple forms here ct 186 pm amended return employer identification number new york state department of taxation and finance

Effortlessly complete [SKS] on any gadget

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and digitally sign your documents promptly without delays. Handle [SKS] on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and digitally sign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Employ the tools we offer to fill out your form.

- Mark relevant sections of the documents or hide sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your digital signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about missing or mislaid documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any gadget of your choice. Edit and digitally sign [SKS] and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the staple forms here ct 186 pm amended return employer identification number new york state department of taxation and finance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Staple Forms Here CT 186 PM Amended Return?

The Staple Forms Here CT 186 PM Amended Return is utilized by businesses to correct previously filed tax returns with the New York State Department of Taxation and Finance. This form helps ensure compliance with Tax Law Article 9, Section 186 c, particularly for utility services and the MTA Surcharge. It is crucial for accurate record-keeping and maintaining your Employer Identification Number.

-

How does airSlate SignNow simplify the eSigning process for tax forms?

airSlate SignNow streamlines the eSigning process for tax forms like the Staple Forms Here CT 186 PM Amended Return. With its user-friendly interface, businesses can easily sign and send documents securely, eliminating delays. This efficiency supports timely submissions to the New York State Department of Taxation and Finance.

-

What features does airSlate SignNow offer for handling tax documents?

AirSlate SignNow provides features such as templates, secure cloud storage, and audit trails specifically designed for handling tax documents like the Staple Forms Here CT 186 PM Amended Return. These tools ensure that users can manage their submission process efficiently while adhering to legal requirements. Automated reminders also help to keep track of deadlines.

-

Is there a pricing plan for businesses needing the Staple Forms Here CT 186 PM Amended Return?

Yes, airSlate SignNow offers various pricing plans designed for businesses of all sizes needing to manage forms like the Staple Forms Here CT 186 PM Amended Return. Each plan caters to different levels of usage and includes features that enhance document management. This flexibility ensures cost-effective solutions for every business need.

-

Can airSlate SignNow integrations help with tax-related documents?

Absolutely! airSlate SignNow integrates seamlessly with various software applications that can help manage tax-related documents, including the Staple Forms Here CT 186 PM Amended Return. This capability allows users to streamline their workflow and share data effortlessly, enhancing overall productivity and compliance with tax regulations.

-

What benefits do businesses gain from using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms, like the Staple Forms Here CT 186 PM Amended Return, offers businesses multiple benefits including time savings, improved accuracy, and secure document handling. This platform reduces the risk of errors, which is crucial for IRS compliance. Moreover, the cost-effective nature of the solution makes it accessible for small to large entities.

-

How does airSlate SignNow ensure the security of submitted tax documents?

AirSlate SignNow employs advanced security protocols to protect submitted tax documents, including encryption and secure user access. When handling sensitive forms like the Staple Forms Here CT 186 PM Amended Return, security is paramount to safeguard against data bsignNowes and ensure compliance with legal and regulatory standards. This reassurance allows businesses to focus on their core activities.

Get more for Staple Forms Here CT 186 PM Amended Return Employer Identification Number New York State Department Of Taxation And Finance Util

Find out other Staple Forms Here CT 186 PM Amended Return Employer Identification Number New York State Department Of Taxation And Finance Util

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online