Form it 204 , Partnership Return, IT204 Tax Ny

Understanding Form IT 204: Partnership Return

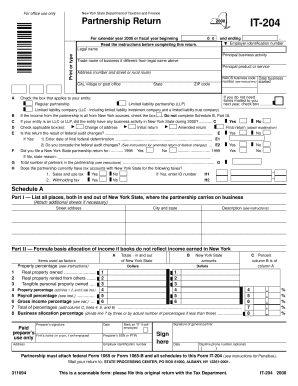

The Form IT 204 is a tax document used for reporting the income, deductions, and credits of partnerships operating in New York State. This form is essential for partnerships to comply with state tax regulations and accurately report their financial activities. The IT 204 allows partnerships to convey their financial information to the New York State Department of Taxation and Finance, ensuring that all partners are appropriately taxed on their share of the partnership's income.

Steps to Complete Form IT 204

Completing Form IT 204 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, identify all partners and their respective shares in the partnership. Fill out the form by entering the partnership's total income, deductions, and credits. Make sure to allocate the income and deductions to each partner according to their ownership percentage. Finally, review the completed form for accuracy before submitting it to the appropriate state agency.

Obtaining Form IT 204

Form IT 204 can be obtained through the New York State Department of Taxation and Finance website. The form is available for download in PDF format, allowing users to print and complete it manually. Additionally, partnerships may also request a physical copy by contacting the department directly. It is important to ensure that you are using the most current version of the form to comply with any updates in tax law.

Legal Use of Form IT 204

Form IT 204 is legally required for partnerships operating in New York State to report their income and expenses. Failure to file this form can result in penalties and interest on unpaid taxes. The form must be completed accurately to reflect the partnership's financial activities, ensuring that all partners are taxed appropriately. It is advisable for partnerships to consult with a tax professional to ensure compliance with all legal requirements associated with this form.

Key Elements of Form IT 204

Key elements of Form IT 204 include sections for reporting total income, deductions, and credits. The form also requires detailed information about each partner, including their share of income and losses. Additionally, partnerships must provide information regarding any special allocations or adjustments that may apply. Understanding these elements is crucial for completing the form accurately and ensuring compliance with state tax laws.

Filing Deadlines for Form IT 204

Partnerships must file Form IT 204 by the 15th day of the third month following the close of their tax year. For partnerships operating on a calendar year, this typically means the deadline is March 15. It is important for partnerships to be aware of these deadlines to avoid late filing penalties. Extensions may be available under certain circumstances, but it is advisable to file on time whenever possible.

Quick guide on how to complete it 204

Complete it 204 effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily access the necessary form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly and without hold-ups. Manage it 204 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The simplest method to alter and eSign it 204 with ease

- Obtain it 204 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searching, or mistakes requiring new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign it 204 and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to it 204

Create this form in 5 minutes!

How to create an eSignature for the it 204

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask it 204

-

What is Form IT 204 and why is it important for a Partnership Return?

Form IT 204 is a New York State tax form specifically designed for Partnership Returns. It is important because it ensures that partnerships accurately report their income, deductions, and tax liability to the state of New York. Filing this form correctly is crucial to avoid penalties and ensure compliance with New York tax laws.

-

How can airSlate SignNow help me with my IT204 Tax NY filings?

airSlate SignNow streamlines the process of completing and submitting Form IT 204, Partnership Return, IT204 Tax NY. Our platform allows you to easily eSign and send documents digitally, ensuring that your filings are submitted on time and in compliance with New York tax regulations.

-

Is there a cost associated with using airSlate SignNow for Form IT 204 filings?

Yes, airSlate SignNow offers various pricing plans tailored to different needs. Each plan includes features that make it easy to manage Form IT 204, Partnership Return, IT204 Tax NY filings efficiently. You can choose a plan that fits your budget and requirements, ensuring a cost-effective solution.

-

What features does airSlate SignNow offer for managing tax documents like Form IT 204?

airSlate SignNow includes features like customizable templates, automated reminders, and secure eSigning to help manage tax documents like Form IT 204. These features enhance productivity and ensure that your Partnership Return, IT204 Tax NY is handled smoothly and accurately.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software. This means you can seamlessly integrate your workflow for managing Form IT 204, Partnership Return, IT204 Tax NY, enhancing efficiency and accuracy in your tax filings.

-

What are the benefits of using airSlate SignNow for tax filings?

Using airSlate SignNow for your tax filings, including Form IT 204, Partnership Return, IT204 Tax NY, offers several benefits. It simplifies the document management process, saves time with eSigning, and reduces errors by providing clear templates and guidance for accurate submissions.

-

Is airSlate SignNow compliant with New York State tax regulations?

Yes, airSlate SignNow is designed to assist users in complying with New York State tax regulations, including those related to Form IT 204, Partnership Return, IT204 Tax NY. Our platform keeps up-to-date with local laws to ensure your filings meet all necessary requirements.

Get more for it 204

Find out other it 204

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now