31, , or Fiscal Year Beginning Name of Trust or Estate it 205 T Page of Tax Ny Form

What is the 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny

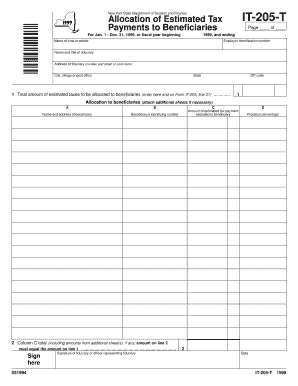

The 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny is a specific form used for reporting income and tax information for trusts and estates in New York. This form is essential for fiduciaries to report the income generated by the trust or estate during a fiscal year. It captures details such as the name of the trust or estate, the fiscal year beginning date, and the total income that must be reported to the state tax authorities. Proper completion of this form ensures compliance with New York tax regulations and accurate reporting of tax liabilities.

Steps to complete the 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny

Completing the 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny involves several key steps:

- Gather all necessary financial documents, including income statements, expense records, and prior tax filings related to the trust or estate.

- Identify the fiscal year beginning date for the trust or estate, as this will be required on the form.

- Fill out the form accurately, ensuring that all required fields are completed, including the name of the trust or estate and the income details.

- Review the completed form for accuracy and completeness, checking for any discrepancies or missing information.

- Submit the form to the appropriate state tax authority by the specified deadline, either electronically or via mail.

Legal use of the 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny

The legal use of the 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny is crucial for ensuring compliance with New York tax laws. This form serves as an official declaration of the income generated by a trust or estate, which is subject to taxation. Failure to file this form or inaccuracies in reporting can lead to penalties, including fines or interest on unpaid taxes. It is important for fiduciaries to understand their responsibilities and the legal implications of the information reported on this form.

Filing Deadlines / Important Dates

Filing deadlines for the 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny are critical for compliance. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the fiscal year. For example, if the fiscal year ends on December 31, the form is due by April 15 of the following year. It is essential to keep track of these dates to avoid late penalties and ensure timely processing of the tax return.

Who Issues the Form

The 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny is issued by the New York State Department of Taxation and Finance. This agency is responsible for the administration of state tax laws and ensures that all tax forms are compliant with current regulations. Fiduciaries and tax professionals should refer to the official guidelines provided by this department for the most accurate and up-to-date information regarding the form and its requirements.

Required Documents

To successfully complete the 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny, certain documents are required:

- Income statements for the trust or estate, detailing all sources of income.

- Expense records related to the administration of the trust or estate.

- Prior year tax returns, if applicable, for reference and consistency.

- Documentation supporting deductions or credits claimed on the form.

Quick guide on how to complete 31 or fiscal year beginning name of trust or estate it 205 t page of tax ny

Complete [SKS] with ease on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric operation today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Adjust and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the 31 or fiscal year beginning name of trust or estate it 205 t page of tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of the 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny?

The 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny is essential for accurately reporting income and managing tax obligations for trusts and estates. Completing this form correctly ensures compliance with New York state tax laws and helps avoid potential penalties.

-

How does airSlate SignNow simplify the process for submitting the IT 205 T?

airSlate SignNow streamlines the submission process for the IT 205 T by allowing users to electronically sign and send documents directly from the platform. This not only saves time but also minimizes errors associated with traditional paper methods.

-

What pricing options does airSlate SignNow offer for its services?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including monthly and annual subscriptions. By choosing a plan that suits your workflow, you can efficiently manage forms like the 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny without overspending.

-

Can airSlate SignNow integrate with other financial software for managing taxes?

Yes, airSlate SignNow integrates seamlessly with various financial software systems. This integration allows users to manage documents related to the 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny more efficiently, ensuring all information is consistent and readily available.

-

What are the benefits of using eSignatures for the IT 205 T form?

Using eSignatures for the IT 205 T form provides a faster and more secure method of signing documents. Additionally, it ensures a clear audit trail and enhances the overall document management experience, making compliance easier.

-

Is it secure to store tax-related documents on airSlate SignNow?

Absolutely! airSlate SignNow employs robust security measures to protect sensitive information, including tax-related documents like the 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny. Data encryption and secure access protocols ensure your documents remain safe and confidential.

-

How can small businesses benefit from using airSlate SignNow for tax forms?

Small businesses can signNowly benefit from using airSlate SignNow by reducing the time spent on paperwork and improving accuracy in submitting forms like the IT 205 T. The platform’s user-friendly interface ensures that even non-technical users can easily navigate the document process.

Get more for 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny

- Manual toyota tercel 94 espaol pdf gratis form

- Ops 420 form

- Cpr in schools certificate wr pdf american heart association form

- Rv f1321701 form

- Place inside of your bbagb glisser dans votre bagage bair canadab form

- Motor vehicle drivers certificate of violations form

- Procura eliberare carte identitate word form

- Ramey warrant form

Find out other 31, , Or Fiscal Year Beginning Name Of Trust Or Estate IT 205 T Page Of Tax Ny

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast