Them to Form ST 100 Tax Ny

Understanding Them To Form ST 100 Tax Ny

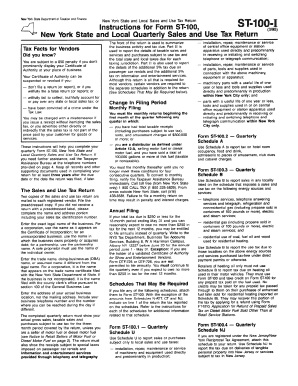

Them To Form ST 100 Tax Ny is a crucial document used for tax purposes in New York State. It serves as a sales tax return form, allowing businesses to report their sales and calculate the amount of sales tax owed to the state. This form is essential for compliance with state tax laws and helps ensure that businesses fulfill their tax obligations accurately.

Steps to Complete Them To Form ST 100 Tax Ny

Completing Them To Form ST 100 Tax Ny involves several key steps:

- Gather necessary financial records, including sales receipts and previous tax returns.

- Fill out the form with accurate sales figures, ensuring all sections are completed.

- Calculate the total sales tax owed based on the sales reported.

- Review the form for accuracy to avoid errors that could lead to penalties.

- Submit the completed form by the designated filing deadline.

How to Obtain Them To Form ST 100 Tax Ny

Businesses can obtain Them To Form ST 100 Tax Ny through various methods:

- Download the form directly from the New York State Department of Taxation and Finance website.

- Request a physical copy by contacting the department or visiting a local office.

- Access the form through tax preparation software that includes state tax forms.

Filing Deadlines for Them To Form ST 100 Tax Ny

It is essential to be aware of the filing deadlines for Them To Form ST 100 Tax Ny to avoid late fees and penalties. Generally, the form must be filed quarterly, with specific due dates depending on the reporting period. Businesses should mark these dates on their calendars to ensure timely submission.

Required Documents for Them To Form ST 100 Tax Ny

When preparing to complete Them To Form ST 100 Tax Ny, businesses should have the following documents ready:

- Sales records, including invoices and receipts.

- Previous tax returns for reference.

- Any relevant documentation that supports sales figures and tax calculations.

Legal Use of Them To Form ST 100 Tax Ny

Them To Form ST 100 Tax Ny is legally required for businesses operating in New York that collect sales tax. Failing to submit this form can result in penalties and interest on unpaid taxes. Proper use of the form ensures compliance with state laws and helps maintain good standing with tax authorities.

Quick guide on how to complete them to form st 100 tax ny

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as a fantastic environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents quickly and without interruptions. Manage [SKS] on any platform using the airSlate SignNow apps for Android or iOS and simplify your document-related processes today.

How to Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign [SKS] while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Them To Form ST 100 Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the them to form st 100 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Them To Form ST 100 Tax Ny and why is it important?

Them To Form ST 100 Tax Ny is a critical document used for sales tax purposes in New York. It allows businesses to report and remit sales taxes collected from customers. Understanding this form is essential for compliance and avoiding penalties.

-

How can airSlate SignNow help with completing Them To Form ST 100 Tax Ny?

airSlate SignNow provides a user-friendly platform to easily create, modify, and eSign Them To Form ST 100 Tax Ny documents. Our solution enhances workflow efficiency, allowing you to complete your tax documentation remotely and securely.

-

What features does airSlate SignNow offer for managing Them To Form ST 100 Tax Ny?

With airSlate SignNow, you can access templates, collaborate with team members, and automate reminders all while working on your Them To Form ST 100 Tax Ny. Our platform ensures that you can manage your documents efficiently to meet tax deadlines.

-

Is there a cost associated with using airSlate SignNow for Them To Form ST 100 Tax Ny?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. By utilizing our service for Them To Form ST 100 Tax Ny, you invest in a cost-effective solution that minimizes paperwork and boosts productivity.

-

Can I integrate airSlate SignNow with other software for processing Them To Form ST 100 Tax Ny?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive and Salesforce. This means you can easily manage documents related to Them To Form ST 100 Tax Ny across different platforms without losing efficiency.

-

What benefits do I get when using airSlate SignNow for Them To Form ST 100 Tax Ny?

Using airSlate SignNow for Them To Form ST 100 Tax Ny streamlines your document management process. It enhances security, facilitates remote signing, and allows for real-time collaboration, resulting in time savings and improved operational efficiency.

-

How secure is airSlate SignNow when handling Them To Form ST 100 Tax Ny?

Security is a top priority at airSlate SignNow. Our platform complies with industry standards to ensure the confidentiality and integrity of your Them To Form ST 100 Tax Ny documents, providing encryption and secure access controls.

Get more for Them To Form ST 100 Tax Ny

Find out other Them To Form ST 100 Tax Ny

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors