North Dakota Schedule CF Composite Filing Method Schedule Attach This Schedule to Form 37 S Attach Copy of Pages 1 and 2 of Form

Understanding the North Dakota Schedule CF Composite Filing Method

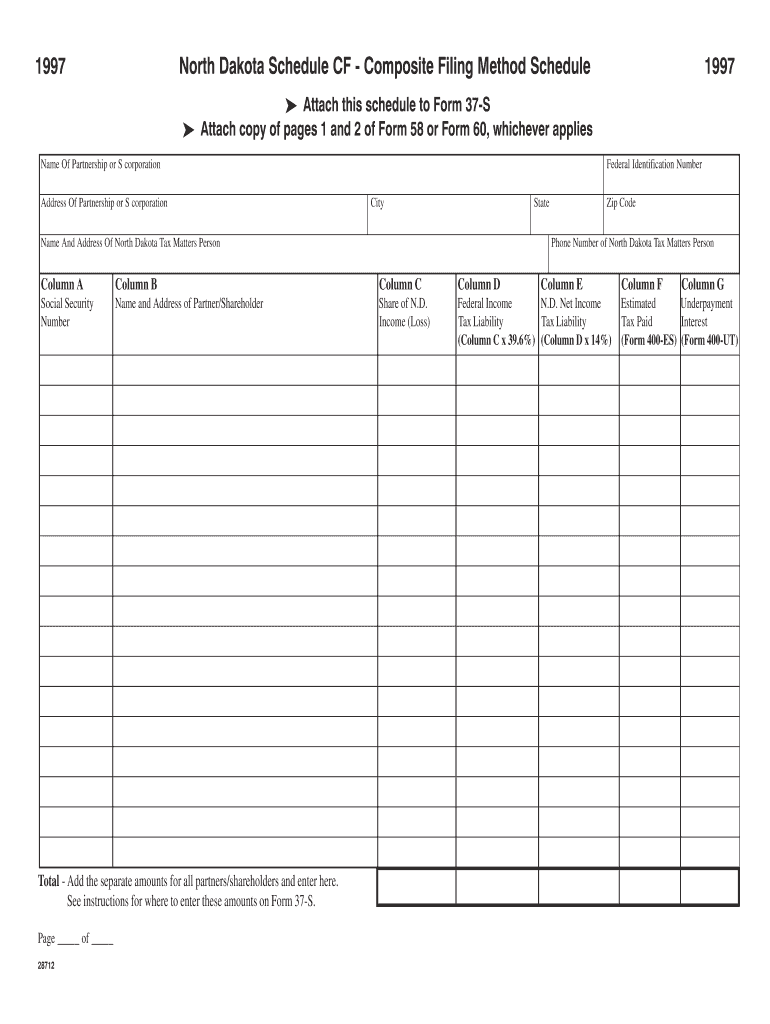

The North Dakota Schedule CF Composite Filing Method is a crucial document for partnerships and S corporations operating in North Dakota. This schedule must be attached to Form 37 S, which is used for reporting income and taxes for these entities. The Schedule CF allows for the composite filing of income tax on behalf of non-resident partners or shareholders, simplifying the tax process for businesses with multiple stakeholders. It is essential to include accurate information, such as the name and address of the partnership or S corporation, to ensure compliance with state tax regulations.

Steps to Complete the North Dakota Schedule CF

Completing the North Dakota Schedule CF involves several key steps:

- Gather necessary documents, including Form 58 or Form 60, depending on which applies to your entity.

- Fill out the Schedule CF with the required information, ensuring accuracy in reporting the names and addresses of all partners or shareholders.

- Attach a copy of pages one and two of the applicable Form 58 or Form 60 to the Schedule CF.

- Review the completed schedule for any errors or omissions before submission.

Required Documents for Submission

When submitting the North Dakota Schedule CF, it is vital to include specific documents to ensure proper processing. The primary documents required are:

- Completed North Dakota Schedule CF.

- Form 37 S, which is the main tax return for partnerships and S corporations.

- Pages one and two of either Form 58 or Form 60, as applicable.

These documents must be submitted together to avoid any delays in processing your tax filings.

Legal Use of the North Dakota Schedule CF

The North Dakota Schedule CF is legally mandated for partnerships and S corporations that have non-resident partners or shareholders. By utilizing this schedule, businesses can fulfill their tax obligations in a streamlined manner, ensuring compliance with state laws. Failure to properly file this schedule may result in penalties or additional tax liabilities, making it essential for entities to adhere to the filing requirements.

Filing Methods for the North Dakota Schedule CF

There are several methods available for submitting the North Dakota Schedule CF:

- Online Submission: Many businesses opt to file electronically through authorized tax software that supports North Dakota tax forms.

- Mail Submission: Completed forms can be mailed to the North Dakota Office of State Tax Commissioner. Ensure to use the correct mailing address to avoid processing delays.

- In-Person Submission: Taxpayers may also choose to deliver their forms in person at designated tax offices within the state.

Choosing the right submission method can enhance efficiency and ensure timely processing of tax filings.

Quick guide on how to complete north dakota schedule cf composite filing method schedule attach this schedule to form 37 s attach copy of pages 1 and 2 of

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to access the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without interruptions. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related workflows today.

How to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to get started.

- Utilize the features we provide to complete your form.

- Emphasize important parts of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for delivering your form: via email, SMS, an invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the north dakota schedule cf composite filing method schedule attach this schedule to form 37 s attach copy of pages 1 and 2 of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the North Dakota Schedule CF Composite Filing Method Schedule?

The North Dakota Schedule CF Composite Filing Method Schedule is a document that must be attached to Form 37 S for partnerships and S corporations. It provides essential information about the entity and allows taxpayers to report their composite income for state tax purposes. To ensure compliance, make sure to also attach copies of pages 1 and 2 of either Form 58 or Form 60, whichever is applicable.

-

How do I properly fill out the Schedule CF for North Dakota?

To fill out the North Dakota Schedule CF Composite Filing Method Schedule, you need to provide details including the name and address of your partnership or S corporation. It's crucial to accurately complete this schedule to avoid penalties and ensure your filing is accepted. Don't forget to attach this schedule to Form 37 S along with the required copies of Form 58 or 60.

-

Are there any fees associated with filing the Schedule CF?

Yes, there may be fees related to filing the North Dakota Schedule CF Composite Filing Method Schedule, typically associated with preparing your tax documents or e-filing services. It's important to review the fees outlined by the North Dakota tax authority or consult with a tax professional for precise guidance. Understand that the cost can vary depending on your filing method and additional services needed.

-

What advantages does airSlate SignNow offer for submitting Schedule CF?

airSlate SignNow offers a streamlined and user-friendly solution for submitting the North Dakota Schedule CF Composite Filing Method Schedule. With our eSigning capabilities, you can easily prepare and send documents without hassle. This not only saves time but also enhances the accuracy of your filings by ensuring proper documentation is attached.

-

Can airSlate SignNow integrate with my accounting software for filing purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software to enhance your workflow when preparing the North Dakota Schedule CF Composite Filing Method Schedule. This integration allows for hassle-free data transfer and ensures that your documents are accurate and up to date, which is essential for compliance with Form 37 S filing requirements.

-

Is it safe to use airSlate SignNow for my Schedule CF filings?

Yes, airSlate SignNow prioritizes the security of your documents when you file the North Dakota Schedule CF Composite Filing Method Schedule. Our platform employs advanced encryption protocols and compliance with industry standards to protect your data. You can trust that your sensitive information related to your partnership or S corporation is secure.

-

How can I get support if I have issues with my Schedule CF filing?

If you encounter any issues while filing the North Dakota Schedule CF Composite Filing Method Schedule using airSlate SignNow, our support team is here to help. You can signNow out through our dedicated support channels, and we offer resources such as tutorials and FAQs to assist you. We're committed to ensuring your eSignature and document submission process is smooth and successful.

Get more for North Dakota Schedule CF Composite Filing Method Schedule Attach This Schedule To Form 37 S Attach Copy Of Pages 1 And 2 Of Form

Find out other North Dakota Schedule CF Composite Filing Method Schedule Attach This Schedule To Form 37 S Attach Copy Of Pages 1 And 2 Of Form

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed