Form 401 ES Estimated Income Tax Estates and Trusts

What is the Form 401 ES Estimated Income Tax Estates And Trusts

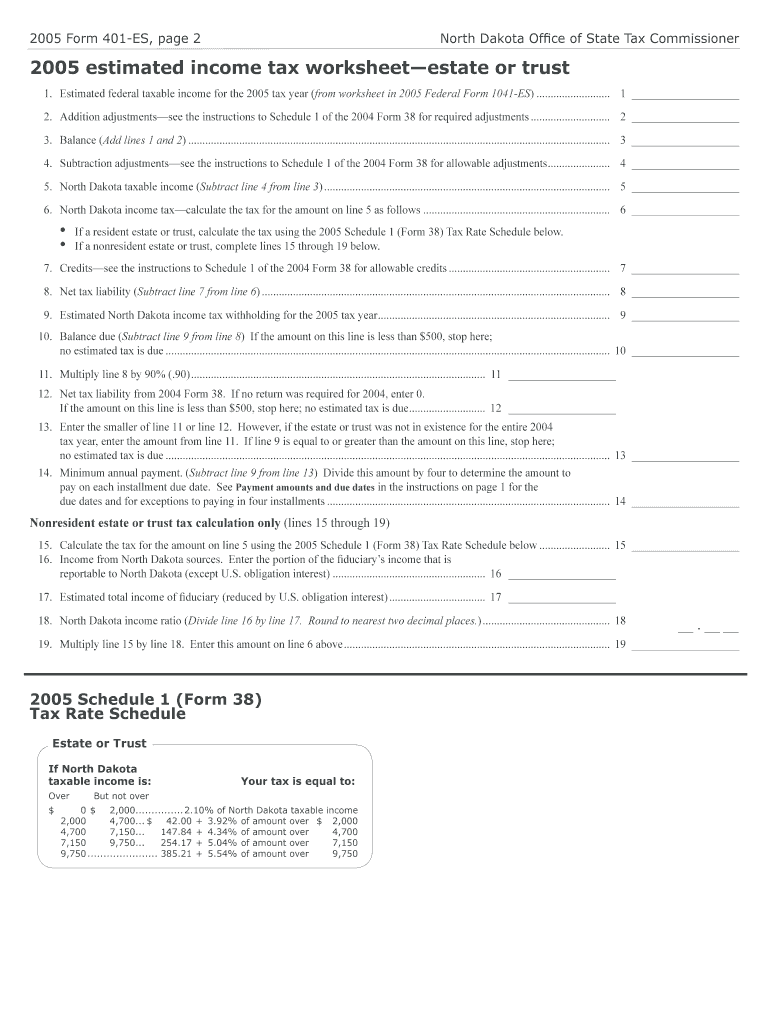

The Form 401 ES Estimated Income Tax Estates And Trusts is a tax form used by estates and trusts in the United States to calculate and pay estimated income taxes. This form is essential for fiduciaries who manage estates or trusts, as it helps ensure compliance with federal tax obligations. By submitting this form, estates and trusts can avoid penalties associated with underpayment of taxes throughout the year.

How to use the Form 401 ES Estimated Income Tax Estates And Trusts

To use the Form 401 ES, fiduciaries must first determine the estimated taxable income for the estate or trust. This involves calculating anticipated income, deductions, and credits for the upcoming tax year. Once the estimated income is determined, the fiduciary can complete the form by providing necessary information, including the name and address of the estate or trust, the tax identification number, and the estimated tax liability. The completed form should then be submitted according to the specified filing methods.

Steps to complete the Form 401 ES Estimated Income Tax Estates And Trusts

Completing the Form 401 ES involves several key steps:

- Gather all relevant financial information for the estate or trust, including income sources and deductible expenses.

- Calculate the estimated taxable income based on the gathered information.

- Determine the estimated tax liability using the appropriate tax rates.

- Fill out the form with accurate details, including the estate or trust's identifying information.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 401 ES are crucial for compliance. Generally, estimated tax payments must be made quarterly, with specific due dates typically falling on the fifteenth day of April, June, September, and January of the following year. Fiduciaries should be aware of these deadlines to avoid penalties for late payments.

Required Documents

To complete the Form 401 ES, fiduciaries need to gather several documents, including:

- Financial statements for the estate or trust.

- Records of income and expenses.

- Previous tax returns, if applicable.

- Any relevant documentation supporting deductions and credits.

Penalties for Non-Compliance

Failure to file the Form 401 ES or to make estimated tax payments on time can result in significant penalties. These may include interest on unpaid taxes and additional fines for late filing. It is essential for fiduciaries to stay informed about their obligations to avoid these financial repercussions.

Who Issues the Form

The Form 401 ES is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax administration in the United States and provides the necessary forms and guidelines for tax compliance, including those specific to estates and trusts.

Quick guide on how to complete form 401 es estimated income tax estates and trusts

Effortlessly Prepare [SKS] on Any Device

Digital document handling has gained traction among companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly with no delays. Manage [SKS] across any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

A Simple Way to Modify and eSign [SKS]

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Select important sections of your documents or hide sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you wish to send your form, whether via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] to ensure outstanding communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 401 ES Estimated Income Tax Estates And Trusts

Create this form in 5 minutes!

How to create an eSignature for the form 401 es estimated income tax estates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 401 ES Estimated Income Tax Estates And Trusts?

Form 401 ES Estimated Income Tax Estates And Trusts is a tax form used by estates and trusts to report their estimated income tax liabilities. This form helps ensure compliance with tax regulations and allows for timely payment of estimated taxes. Utilizing airSlate SignNow can simplify the process of completing and submitting this essential tax documentation.

-

How does airSlate SignNow assist with Form 401 ES Estimated Income Tax Estates And Trusts?

airSlate SignNow offers a convenient platform for filling out, signing, and securely sending Form 401 ES Estimated Income Tax Estates And Trusts. Our service provides templates that streamline the process and minimize errors, ensuring accurate tax filings. This helps users manage their tax obligations efficiently.

-

What are the pricing options for airSlate SignNow when dealing with Form 401 ES Estimated Income Tax Estates And Trusts?

airSlate SignNow offers various pricing plans that cater to different needs, including services for managing Form 401 ES Estimated Income Tax Estates And Trusts. Our competitive pricing ensures that users can find an affordable solution without compromising on features. Interested customers can check our website for specific plans and discounts.

-

Can I integrate airSlate SignNow with other software for handling Form 401 ES Estimated Income Tax Estates And Trusts?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, allowing users to manage Form 401 ES Estimated Income Tax Estates And Trusts within their existing workflows. This integration enhances productivity by eliminating the need for manual data entry and ensuring cohesive operation among different applications.

-

What features does airSlate SignNow provide to simplify the process of submitting Form 401 ES Estimated Income Tax Estates And Trusts?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage to streamline the process of submitting Form 401 ES Estimated Income Tax Estates And Trusts. These tools help reduce turnaround times and improve accuracy, making your tax preparation straightforward and stress-free.

-

Are there any benefits of using airSlate SignNow for Form 401 ES Estimated Income Tax Estates And Trusts?

Using airSlate SignNow for Form 401 ES Estimated Income Tax Estates And Trusts offers several benefits, including enhanced security, easy document management, and the ability to track the signing process in real-time. These features contribute to a more efficient workflow, ensuring that all necessary forms are completed correctly and timely.

-

Is it easy to use airSlate SignNow for preparing Form 401 ES Estimated Income Tax Estates And Trusts?

Absolutely! airSlate SignNow is designed to be user-friendly, making it simple for anyone to prepare Form 401 ES Estimated Income Tax Estates And Trusts without extensive training. Our intuitive interface guides users through the essential steps, ensuring that you can quickly manage your tax forms with confidence.

Get more for Form 401 ES Estimated Income Tax Estates And Trusts

- How to organize a house party for project inform

- Iowa dnr ust section notification of tank closure or change in form

- Notification and authorization form kenyon college documents kenyon

- Vendor direct deposit and advance payment depts ttu form

- Premise alert program notification form rockfordil

- Wedding party contract template form

- Wedding photo contract template form

- Wedding photography cancellation contract template form

Find out other Form 401 ES Estimated Income Tax Estates And Trusts

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement