Form 38 Nd

What is the Form 38 Nd

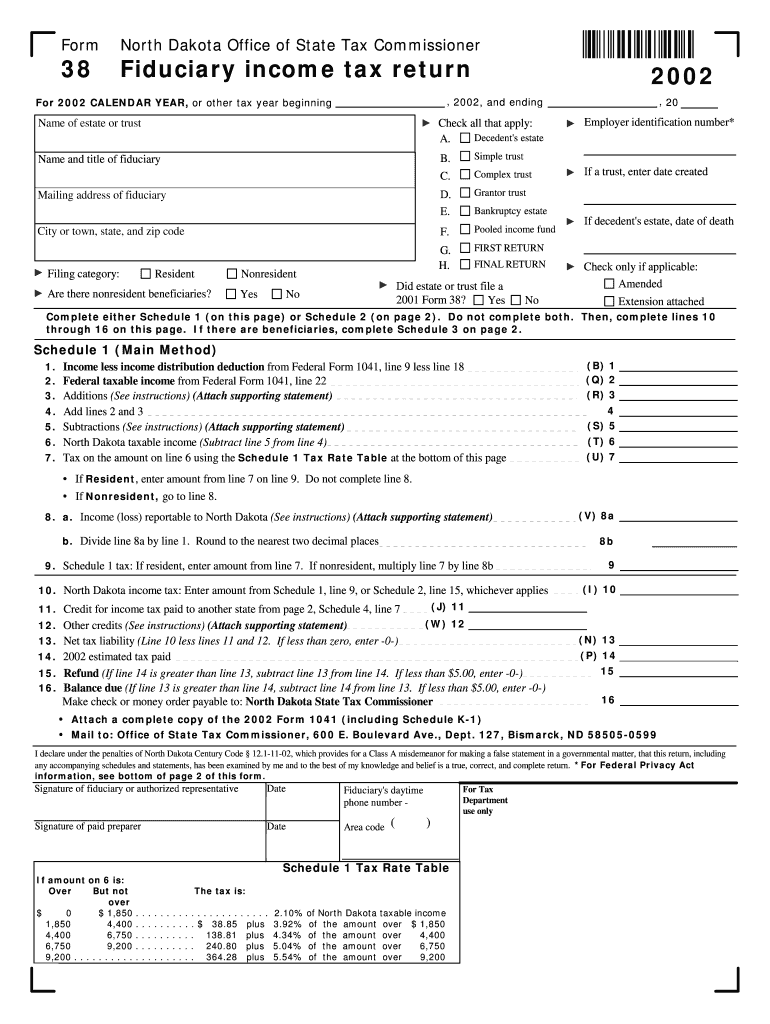

The Form 38 Nd is a specific document used within the United States for various legal and administrative purposes. It is essential for individuals or businesses to understand its function and requirements. This form may be utilized in contexts such as tax reporting, compliance, or other regulatory needs. Knowing the precise purpose of the Form 38 Nd can help ensure that it is filled out correctly and submitted in a timely manner.

How to use the Form 38 Nd

Using the Form 38 Nd involves a series of steps to ensure accuracy and compliance with legal standards. First, gather all necessary information and documents required to complete the form. This may include personal identification, financial records, or other relevant data. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Finally, review the form for any errors before submission, as inaccuracies can lead to delays or penalties.

Steps to complete the Form 38 Nd

Completing the Form 38 Nd requires attention to detail and adherence to specific guidelines. The following steps outline the process:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documentation, such as identification and financial records.

- Fill out the form section by section, ensuring all information is correct.

- Double-check for any errors or missing information.

- Sign and date the form as required.

- Submit the form according to the provided guidelines, whether online, by mail, or in person.

Key elements of the Form 38 Nd

Understanding the key elements of the Form 38 Nd is crucial for successful completion. Important components often include:

- Personal or business identification information.

- Details regarding the purpose of the form.

- Financial data or other relevant information necessary for compliance.

- Signature and date fields to validate the submission.

Legal use of the Form 38 Nd

The legal use of the Form 38 Nd is governed by specific regulations that dictate when and how it should be used. It is important for users to familiarize themselves with the legal implications of submitting this form. Incorrect or incomplete submissions may result in legal consequences, including fines or delays in processing. Therefore, ensuring compliance with all applicable laws is essential when using the Form 38 Nd.

Filing Deadlines / Important Dates

Filing deadlines for the Form 38 Nd can vary depending on the specific context in which it is used. It is important to be aware of any relevant dates to avoid penalties. Users should consult the official guidelines or resources to determine the exact deadlines associated with their particular situation. Keeping track of these dates ensures timely submission and compliance with legal requirements.

Quick guide on how to complete form 38 nd

Complete [SKS] effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to the conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents promptly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to alter and eSign [SKS] without hassle

- Obtain [SKS] and select Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive data using tools specifically designed for such tasks by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all information carefully and click on the Done button to secure your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, frustrating form searches, or mistakes that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 38 Nd

Create this form in 5 minutes!

How to create an eSignature for the form 38 nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 38 Nd and how can airSlate SignNow help me with it?

Form 38 Nd is an essential document utilized for various business transactions. airSlate SignNow provides an intuitive platform to easily fill out, sign, and manage your Form 38 Nd electronically, streamlining your workflow and saving time.

-

What are the pricing options for using airSlate SignNow with Form 38 Nd?

airSlate SignNow offers flexible pricing plans tailored to meet your business needs, whether you're a startup or a large enterprise. You can choose from monthly or annual subscriptions, ensuring you have access to the features necessary for managing Form 38 Nd efficiently without overspending.

-

Can I integrate airSlate SignNow with other applications to manage Form 38 Nd?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM platforms. This ensures you can easily manage your Form 38 Nd and other documents in one place, boosting your productivity and minimizing manual data entry.

-

What features does airSlate SignNow offer for managing Form 38 Nd?

airSlate SignNow offers features like customizable templates, bulk sending, and real-time tracking for your Form 38 Nd. These capabilities enhance your document workflows, allowing you to collect signatures and necessary information quickly and efficiently.

-

How does airSlate SignNow ensure the security of my Form 38 Nd?

airSlate SignNow prioritizes your document security with advanced encryption and compliance with industry standards, such as GDPR and HIPAA. This means your Form 38 Nd and any sensitive information contained within are protected during the signing and storage process.

-

Is it easy to use airSlate SignNow for someone who has never managed Form 38 Nd before?

Absolutely! airSlate SignNow is designed for users of all experience levels. With its user-friendly interface, you can easily navigate through the process of creating, sending, and signing your Form 38 Nd without any extensive training.

-

What are the benefits of using airSlate SignNow for Form 38 Nd compared to traditional methods?

Using airSlate SignNow for your Form 38 Nd signNowly reduces the time and costs associated with printing, mailing, and physically signing documents. This electronic solution enhances efficiency, accelerates turnaround time, and allows for tracking of the document status in real-time.

Get more for Form 38 Nd

- Mad minute multiplication pdf form

- Building dna gizmo assessment answers form

- Dmv practice test in arabic form

- Ndt level 3 study material pdf download form

- Illinois warranty deed form

- Oregon subpoena pdf form

- The cask of amontillado vocabulary worksheet answers form

- Registrar of societies kenya form

Find out other Form 38 Nd

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile