Form North Dakota Office of State Tax Commissioner 400 ES Estimated Income Tax Individuals for the Tax Year, You and Your Spouse

Overview of Form North Dakota Office Of State Tax Commissioner 400 ES

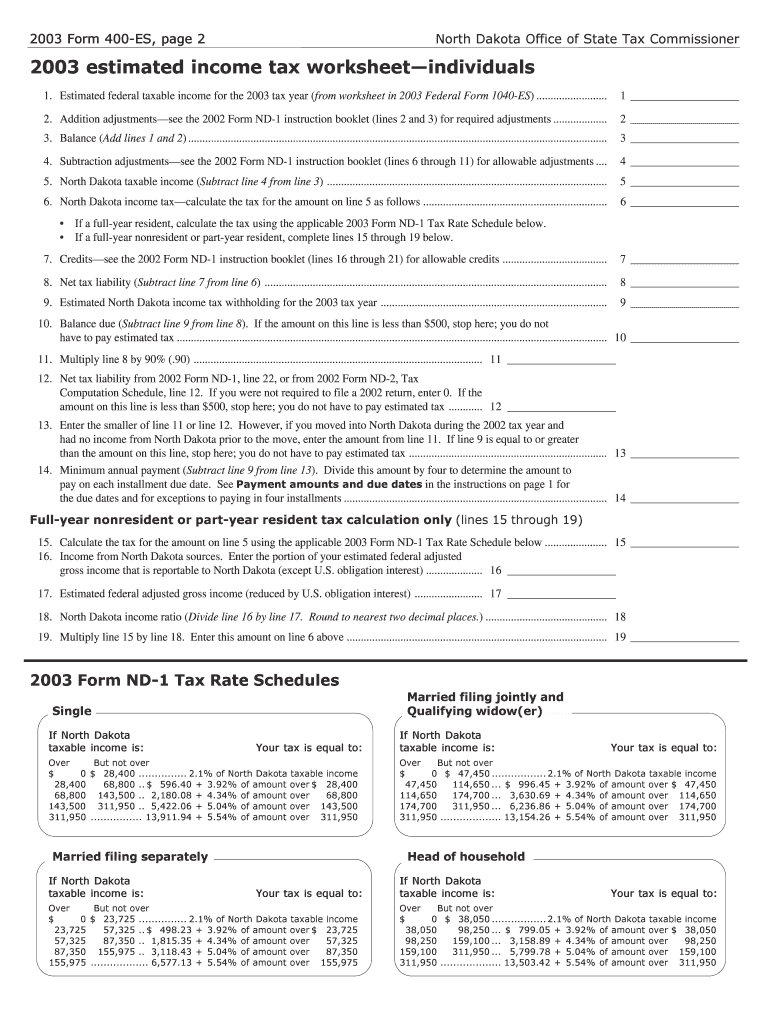

The Form North Dakota Office Of State Tax Commissioner 400 ES is designed for individuals to report and pay estimated income tax for the tax year. This form is essential for taxpayers who expect to owe tax of one thousand dollars or more when filing their annual return. It is important to note that both you and your spouse must make separate estimated tax payments based on your individual incomes, ensuring compliance with state tax regulations.

Steps to Complete the Form North Dakota Office Of State Tax Commissioner 400 ES

Completing the Form 400 ES involves several key steps:

- Gather your financial information, including income sources and deductions.

- Calculate your expected income for the tax year to determine your estimated tax liability.

- Fill out the form by entering your personal information and estimated tax amounts.

- Review the completed form for accuracy before submission.

- Submit the form along with any required payments to the North Dakota Office of State Tax Commissioner.

How to Obtain the Form North Dakota Office Of State Tax Commissioner 400 ES

The Form 400 ES can be obtained directly from the North Dakota Office of State Tax Commissioner’s website. It is also available at local tax offices and can be requested through mail. Ensure you have the most current version of the form to avoid any issues with your tax filing.

Key Elements of the Form North Dakota Office Of State Tax Commissioner 400 ES

Key elements of the Form 400 ES include:

- Your personal identification details, such as name and address.

- Estimated income amounts for the current tax year.

- Calculation of your estimated tax liability based on your income.

- Payment options and instructions for submitting your estimated tax payments.

Filing Deadlines for Form North Dakota Office Of State Tax Commissioner 400 ES

It is crucial to adhere to the filing deadlines for the Form 400 ES. Typically, estimated tax payments are due quarterly, with specific deadlines set by the North Dakota Office of State Tax Commissioner. Missing these deadlines can result in penalties and interest on unpaid taxes, so it is advisable to mark your calendar and plan accordingly.

Legal Use of Form North Dakota Office Of State Tax Commissioner 400 ES

The Form 400 ES is legally required for individuals in North Dakota who expect to owe state income tax. Proper use of this form ensures that you remain compliant with state tax laws and avoid potential legal issues. It is important to keep copies of your submitted forms and any correspondence with the tax office for your records.

Quick guide on how to complete form north dakota office of state tax commissioner 400 es estimated income tax individuals for the tax year you and your spouse

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the correct form and securely store it on the internet. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark essential sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form North Dakota Office Of State Tax Commissioner 400 ES Estimated Income Tax individuals For The Tax Year, You And Your Spouse

Create this form in 5 minutes!

How to create an eSignature for the form north dakota office of state tax commissioner 400 es estimated income tax individuals for the tax year you and your spouse

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form North Dakota Office Of State Tax Commissioner 400 ES Estimated Income Tax individuals For The Tax Year?

The Form North Dakota Office Of State Tax Commissioner 400 ES is required for individuals and couples who are making estimated income tax payments in North Dakota. This form helps taxpayers calculate their estimated tax liability for the year based on their separate incomes, ensuring compliance with state tax regulations.

-

Why do my spouse and I need to make separate estimated tax payments?

You and your spouse must make separate estimated tax payments based on your separate incomes to accurately reflect your individual tax obligations. The Form North Dakota Office Of State Tax Commissioner 400 ES Estimated Income Tax individuals For The Tax Year is specifically designed for this purpose, ensuring that each of you can properly account for your unique financial circumstances.

-

How can I access the Form North Dakota Office Of State Tax Commissioner 400 ES?

You can easily access the Form North Dakota Office Of State Tax Commissioner 400 ES Estimated Income Tax individuals For The Tax Year online through the official North Dakota state tax website. It is also available through various tax preparation software and can be obtained directly from the airSlate SignNow platform for quick eSigning and submission.

-

Are there any fees associated with filing the Form North Dakota Office Of State Tax Commissioner 400 ES?

While there is no direct fee for filing the Form North Dakota Office Of State Tax Commissioner 400 ES, consider potential fees charged by tax preparation services or software. Using airSlate SignNow offers a cost-effective solution for eSigning documents, including this tax form, which can save you time and money.

-

What features does airSlate SignNow offer for handling tax forms like the North Dakota 400 ES?

airSlate SignNow provides a user-friendly platform for eSigning and managing documents, including the Form North Dakota Office Of State Tax Commissioner 400 ES Estimated Income Tax individuals For The Tax Year. Features include secure storage, easy sharing, and integration with various productivity tools, enhancing your overall tax filing experience.

-

Can I track the status of my estimated tax payments using airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your signed documents, including the Form North Dakota Office Of State Tax Commissioner 400 ES Estimated Income Tax individuals For The Tax Year. This feature gives you peace of mind, knowing your tax payments are recorded and acknowledged by the state.

-

What benefits does eSigning the North Dakota 400 ES form provide?

eSigning the Form North Dakota Office Of State Tax Commissioner 400 ES Estimated Income Tax individuals For The Tax Year offers several benefits, including convenience, reduced paperwork, and faster processing times. With airSlate SignNow, you can complete your tax obligations efficiently and securely from anywhere.

Get more for Form North Dakota Office Of State Tax Commissioner 400 ES Estimated Income Tax individuals For The Tax Year, You And Your Spouse

Find out other Form North Dakota Office Of State Tax Commissioner 400 ES Estimated Income Tax individuals For The Tax Year, You And Your Spouse

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free