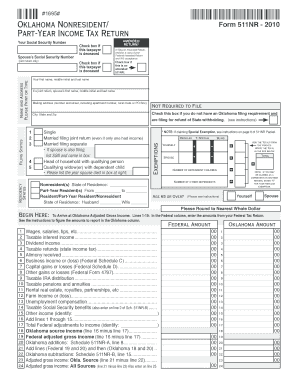

Nonresident and Part Year Resident Return Tax Ok Form

What is the Nonresident And Part Year Resident Return Tax Ok

The Nonresident And Part Year Resident Return Tax Ok is a specific tax form used by individuals who do not reside in a state for the entire year or who are not residents at all. This form allows taxpayers to report income earned within the state while ensuring compliance with state tax laws. Understanding the purpose of this return is crucial for accurate tax reporting and avoiding potential penalties.

Steps to complete the Nonresident And Part Year Resident Return Tax Ok

Completing the Nonresident And Part Year Resident Return Tax Ok involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status and the income earned during your time in the state.

- Fill out the form accurately, ensuring all income is reported correctly.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline, either online or by mail.

Legal use of the Nonresident And Part Year Resident Return Tax Ok

The legal use of the Nonresident And Part Year Resident Return Tax Ok is essential for individuals who earn income in a state where they do not reside. Filing this return ensures compliance with state tax regulations and helps avoid legal issues related to tax evasion. It is important to understand the legal implications of residency status and income reporting to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Nonresident And Part Year Resident Return Tax Ok vary by state, but generally, they align with the federal tax deadline, which is usually April fifteenth. Some states may have different deadlines or extensions available, so it is important to check specific state regulations to ensure timely submission of the form.

Required Documents

To complete the Nonresident And Part Year Resident Return Tax Ok, certain documents are necessary:

- W-2 forms from employers for reported income.

- 1099 forms for freelance or contract work.

- Records of any other income sources, such as rental income or investments.

- Documentation of residency status, if applicable.

Examples of using the Nonresident And Part Year Resident Return Tax Ok

Examples of scenarios where the Nonresident And Part Year Resident Return Tax Ok is applicable include:

- A student who worked in a state during the summer but resides in another state for the school year.

- An individual who moved to a new state mid-year and earned income in both states.

- A remote worker who lives in one state but has clients in another state.

Quick guide on how to complete nonresident and part year resident return tax ok

Complete [SKS] effortlessly on any device

Online document handling has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and electronically sign your documents swiftly without hindrances. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

No more worrying about lost or misplaced documents, cumbersome form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Nonresident And Part Year Resident Return Tax Ok

Create this form in 5 minutes!

How to create an eSignature for the nonresident and part year resident return tax ok

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Nonresident And Part Year Resident Return Tax Ok?

A Nonresident And Part Year Resident Return Tax Ok refers to the specific tax filing used by individuals who have lived in a state for only part of the year or not at all. This form is essential for accurately reporting income earned in different locations while ensuring compliance with state tax laws. Understanding this return can help maximize your tax benefits and minimize liabilities.

-

How can airSlate SignNow assist with Nonresident And Part Year Resident Return Tax Ok?

airSlate SignNow streamlines the process of eSigning and sending tax forms, including the Nonresident And Part Year Resident Return Tax Ok. Our easy-to-use platform allows users to prepare and securely send documents for electronic signature, making tax filing convenient and efficient. This means you can focus on your financial matters instead of paperwork.

-

Is there a fee to use airSlate SignNow for filing Nonresident And Part Year Resident Return Tax Ok?

Yes, airSlate SignNow offers competitive pricing plans that cater to different user needs. You can choose a plan that fits your business size and usage frequency, ensuring a cost-effective solution to manage documents related to Nonresident And Part Year Resident Return Tax Ok. Free trials and flexible payment options are also available.

-

What features make airSlate SignNow suitable for tax-related documents?

airSlate SignNow provides features tailored for tax-related documentation, including templates for Nonresident And Part Year Resident Return Tax Ok, automatic reminders, and secure storage. Additionally, our platform ensures compliance and legal validity of eSignatures, making your tax filing process not only efficient but also legally sound.

-

Can I integrate airSlate SignNow with other software for managing my Nonresident And Part Year Resident Return Tax Ok?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, allowing users to manage their Nonresident And Part Year Resident Return Tax Ok efficiently. This integration helps streamline the workflow, eliminating the need to switch between apps and ensuring that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for Nonresident And Part Year Resident Return Tax Ok?

Using airSlate SignNow for Nonresident And Part Year Resident Return Tax Ok signNowly reduces the time spent on document preparation and ensures accuracy during the filing process. The platform enhances collaboration among team members and provides peace of mind with its secure and reliable eSignature solution. Moreover, it simplifies compliance with state regulations for tax returns.

-

Is it safe to use airSlate SignNow for submitting Nonresident And Part Year Resident Return Tax Ok?

Yes, airSlate SignNow prioritizes the security of your documents, especially those related to the Nonresident And Part Year Resident Return Tax Ok. With advanced encryption protocols and secure storage, you can rest assured that your sensitive information remains protected from unauthorized access. We also comply with all relevant regulations to safeguard your data.

Get more for Nonresident And Part Year Resident Return Tax Ok

Find out other Nonresident And Part Year Resident Return Tax Ok

- Sign Arkansas Banking Lease Agreement Mobile

- How Do I Sign Arkansas Banking Lease Agreement

- Help Me With Sign Arkansas Banking Lease Agreement

- Sign Alabama Banking Emergency Contact Form Online

- Sign Arkansas Banking Lease Agreement Now

- How Can I Sign Arkansas Banking Lease Agreement

- Sign Alabama Banking Emergency Contact Form Computer

- Can I Sign Arkansas Banking Lease Agreement

- Sign Arkansas Banking Lease Agreement Later

- How To Sign Arizona Banking Warranty Deed

- Sign Alabama Banking Emergency Contact Form Mobile

- How Do I Sign Arizona Banking Warranty Deed

- Help Me With Sign Arizona Banking Warranty Deed

- Sign Alabama Banking Emergency Contact Form Now

- Sign Arkansas Banking Lease Agreement Myself

- Can I Sign Arizona Banking Warranty Deed

- How Can I Sign Arizona Banking Warranty Deed

- Sign Alabama Banking Emergency Contact Form Later

- Sign Arkansas Banking Lease Agreement Free

- Sign Alabama Banking Emergency Contact Form Myself