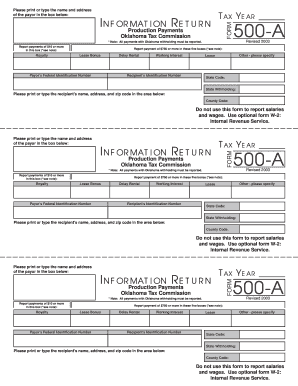

Report Payments of $10 or More in This Box *see Note Tax Ok Form

What is the Report Payments Of $10 Or More In This Box *see Note Tax Ok

The Report Payments Of $10 Or More In This Box *see Note Tax Ok is a specific section on tax forms that requires businesses to report certain payments made to individuals or entities. This section is crucial for ensuring compliance with IRS regulations regarding income reporting. Payments that meet or exceed ten dollars must be documented accurately to maintain transparency and accountability in financial reporting.

Steps to complete the Report Payments Of $10 Or More In This Box *see Note Tax Ok

Completing the Report Payments Of $10 Or More In This Box involves several key steps:

- Gather all relevant payment records to ensure accuracy.

- Identify which payments meet the $10 threshold.

- Enter the total amount of qualifying payments in the designated box.

- Review the information for any errors before submission.

Following these steps will help ensure that the form is filled out correctly, reducing the risk of issues with the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of payments of ten dollars or more. According to these guidelines, businesses must report payments made for services rendered, rents, and other compensatory transactions. The IRS requires that these payments be reported accurately to prevent tax evasion and ensure that all income is accounted for. It's essential to stay updated on any changes to these guidelines to maintain compliance.

Penalties for Non-Compliance

Failure to report payments of ten dollars or more can result in significant penalties. The IRS may impose fines for inaccuracies or omissions in reporting. These penalties can vary based on the severity of the non-compliance, including potential interest on unpaid taxes. Businesses should prioritize accurate reporting to avoid these financial repercussions.

Examples of using the Report Payments Of $10 Or More In This Box *see Note Tax Ok

Common scenarios for using the Report Payments Of $10 Or More In This Box include:

- Payments made to freelancers for services such as graphic design or consulting.

- Rental payments made to property owners for leased spaces.

- Compensatory payments to contractors for work performed.

These examples illustrate the types of transactions that must be reported, helping businesses understand their obligations.

Form Submission Methods

The Report Payments Of $10 Or More In This Box can be submitted through various methods, including:

- Online submission via the IRS e-filing system.

- Mailing a paper form directly to the IRS.

- In-person submission at designated IRS offices.

Choosing the appropriate submission method can affect processing times and ensure timely compliance with reporting requirements.

Quick guide on how to complete report payments of 10 or more in this box see note tax ok

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-based operation today.

The simplest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form: by email, text message (SMS), invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Adjust and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Report Payments Of $10 Or More In This Box *see Note Tax Ok

Create this form in 5 minutes!

How to create an eSignature for the report payments of 10 or more in this box see note tax ok

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to Report Payments Of $10 Or More In This Box *see Note Tax Ok?

Reporting payments of $10 or more helps ensure compliance with tax regulations. It allows businesses to document and declare these transactions properly, minimizing the risk of audits. Make sure to follow all guidelines when reporting.

-

How can airSlate SignNow help with documenting payment reports?

airSlate SignNow provides a seamless platform for creating and managing essential documents. With features that allow you to easily fill out and eSign forms, you can efficiently report payments of $10 or more whenever necessary. This ensures streamlined documentation and compliance.

-

Are there any costs associated with using airSlate SignNow when I need to report payments?

Yes, while airSlate SignNow offers a cost-effective solution, there are different pricing tiers based on your business needs. Regardless, using airSlate SignNow to report payments of $10 or more ensures you save time and resources compared to traditional methods. You can choose a plan that suits your budget.

-

What features does airSlate SignNow offer for reporting payments?

airSlate SignNow includes features such as customizable templates, automatic reminders, and secure storage. These features streamline your workflow and help you effectively report payments of $10 or more in accordance with tax requirements. You'll also have access to real-time tracking of document statuses.

-

Can I integrate airSlate SignNow with other software to handle payment reporting?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, including accounting software. This makes it easier to report payments of $10 or more in this box *see note tax OK directly from your existing systems, enhancing your efficiency.

-

What benefits can I expect from using airSlate SignNow for payment reporting?

Using airSlate SignNow for your payment reporting ensures accuracy and expediency. You'll benefit from enhanced compliance and reduced paperwork, allowing you to confidently report payments of $10 or more. Additionally, its user-friendly interface makes the entire process straightforward.

-

Is airSlate SignNow secure for reporting sensitive payment information?

Yes, security is a top priority for airSlate SignNow. The platform employs advanced encryption and secure cloud storage to protect all your information, including sensitive data when you report payments of $10 or more in this box *see note tax OK. You can trust us with your confidential documents.

Get more for Report Payments Of $10 Or More In This Box *see Note Tax Ok

Find out other Report Payments Of $10 Or More In This Box *see Note Tax Ok

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy