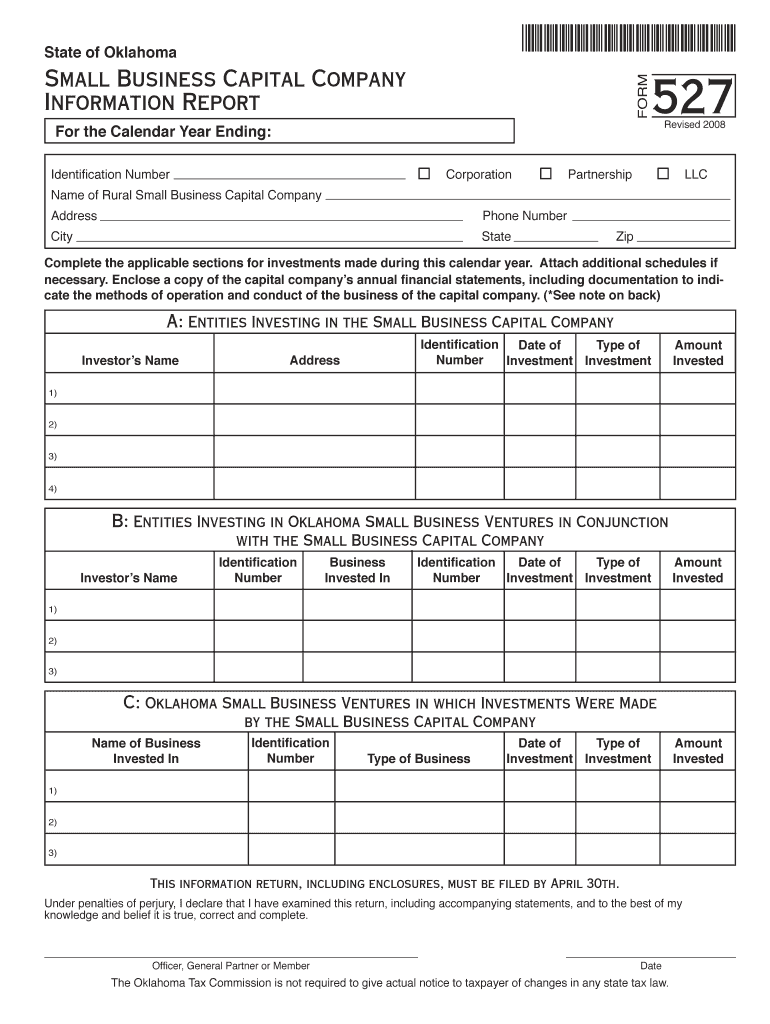

FORM Corporation Phone Number State Zip Partnership Tax Ok

What is the FORM Corporation Phone Number State Zip Partnership Tax Ok

The FORM Corporation Phone Number State Zip Partnership Tax Ok is a specific tax form used by corporations and partnerships in the United States to report essential information to the IRS. This form typically includes details such as the corporation's phone number, state of registration, and zip code, which are crucial for tax identification and compliance. It ensures that the IRS has accurate contact information for any correspondence related to tax obligations.

How to use the FORM Corporation Phone Number State Zip Partnership Tax Ok

To use the FORM Corporation Phone Number State Zip Partnership Tax Ok, businesses must first gather all necessary information, including the corporation's legal name, phone number, state, and zip code. Once the form is completed, it should be reviewed for accuracy before submission. This form is often used in conjunction with other tax documents, so it is essential to ensure that all information is consistent across filings.

Steps to complete the FORM Corporation Phone Number State Zip Partnership Tax Ok

Completing the FORM Corporation Phone Number State Zip Partnership Tax Ok involves several key steps:

- Gather required information: Collect the corporation's name, phone number, state of incorporation, and zip code.

- Fill out the form: Enter the gathered information accurately in the designated fields.

- Review the form: Check for any errors or omissions to ensure all information is correct.

- Submit the form: Follow the appropriate submission method, whether online, by mail, or in person.

Legal use of the FORM Corporation Phone Number State Zip Partnership Tax Ok

The legal use of the FORM Corporation Phone Number State Zip Partnership Tax Ok is essential for compliance with federal tax regulations. This form serves as an official record of the corporation's contact details, which the IRS may use for communication regarding tax matters. Failure to provide accurate information can lead to penalties or delays in processing tax returns.

Filing Deadlines / Important Dates

Filing deadlines for the FORM Corporation Phone Number State Zip Partnership Tax Ok may vary depending on the corporation's tax year and specific requirements set by the IRS. Generally, corporations must submit this form along with their annual tax return. It is important to stay informed about any updates or changes to deadlines to avoid late filing penalties.

Required Documents

To complete the FORM Corporation Phone Number State Zip Partnership Tax Ok, businesses typically need the following documents:

- Previous tax returns to ensure consistency in information.

- Corporate formation documents that include the legal name and registered address.

- Any correspondence from the IRS that may relate to the corporation's tax status.

Who Issues the Form

The FORM Corporation Phone Number State Zip Partnership Tax Ok is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax administration in the United States and provides various forms and guidelines for compliance. Corporations must ensure they are using the most current version of the form as issued by the IRS to meet their tax obligations.

Quick guide on how to complete form corporation phone number state zip partnership tax ok

Effortlessly prepare [SKS] on any device

Managing documents online has gained traction among both enterprises and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to alter and electronically sign [SKS] seamlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] while ensuring effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FORM Corporation Phone Number State Zip Partnership Tax Ok

Create this form in 5 minutes!

How to create an eSignature for the form corporation phone number state zip partnership tax ok

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does airSlate SignNow provide?

airSlate SignNow offers a comprehensive electronic signature solution that allows businesses to send, sign, and eSign documents securely. It is designed to support organizations of all sizes, facilitating efficient document management and enhancing workflow. This is particularly valuable for users seeking to simplify processes related to FORM Corporation Phone Number State Zip Partnership Tax Ok.

-

How does airSlate SignNow ensure document security?

AirSlate SignNow prioritizes document security by implementing advanced encryption and compliance measures, including GDPR and HIPAA adherence. This means that users can trust that their documents, especially those associated with FORM Corporation Phone Number State Zip Partnership Tax Ok, are safe and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow offers seamless integrations with popular software tools such as Google Drive, Salesforce, and more. This connectivity helps streamline processes related to document workflows, making it easier for businesses involved with FORM Corporation Phone Number State Zip Partnership Tax Ok to manage their operations efficiently.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow provides flexible pricing plans to accommodate various business needs. These plans are competitively priced to ensure that organizations can effectively manage their document signing processes, including those related to FORM Corporation Phone Number State Zip Partnership Tax Ok, without breaking the bank.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to users of all business sizes, including small businesses that may require efficient document management solutions. Its affordability and user-friendly interface make it a great choice for small businesses dealing with FORM Corporation Phone Number State Zip Partnership Tax Ok.

-

How can airSlate SignNow enhance my team's productivity?

By streamlining the document signing process, airSlate SignNow signNowly enhances team productivity. It allows users to send and eSign documents in minutes, reducing turnaround time and improving overall efficiency for tasks related to FORM Corporation Phone Number State Zip Partnership Tax Ok.

-

Does airSlate SignNow provide customer support?

Yes, airSlate SignNow offers dedicated customer support to assist users with any inquiries or issues. Their support team is available to help navigate features, troubleshoot problems, and optimize the use of the platform for tasks surrounding FORM Corporation Phone Number State Zip Partnership Tax Ok.

Get more for FORM Corporation Phone Number State Zip Partnership Tax Ok

Find out other FORM Corporation Phone Number State Zip Partnership Tax Ok

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile