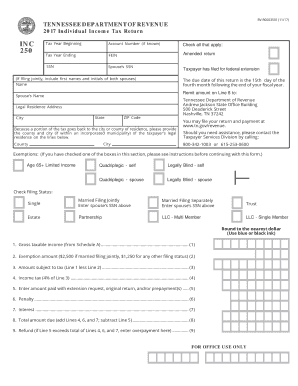

Tennessee Individual Income Tax Return INC250 Individual Income Tax Form

What is the Tennessee Individual Income Tax Return (INC250)?

The Tennessee Individual Income Tax Return, known as INC250, is the official form used by residents to report their income and calculate their state income tax obligations. This form is essential for individuals who earn income in Tennessee, as it helps determine the amount of tax owed or any potential refund. The INC250 is specifically designed for the reporting of income derived from various sources, including wages, salaries, and other forms of compensation. Understanding the purpose of this form is crucial for compliance with Tennessee tax laws.

Steps to Complete the Tennessee Individual Income Tax Return (INC250)

Completing the INC250 involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099 forms, and any other income statements. Next, you will need to fill out the form by entering your personal information, income details, and any applicable deductions or credits. It is essential to follow the specific instructions provided for each section of the form. After completing the form, review it carefully for any errors before submitting it to the appropriate state tax authority.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for avoiding penalties. The deadline for submitting the Tennessee Individual Income Tax Return typically aligns with the federal tax deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to the deadline each tax year to ensure timely filing.

Required Documents for the Tennessee Individual Income Tax Return (INC250)

To complete the INC250 accurately, you will need to gather several key documents. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Previous year’s tax return for reference

Having these documents ready will streamline the process of filling out the form and help ensure that all income is reported accurately.

Legal Use of the Tennessee Individual Income Tax Return (INC250)

The INC250 must be completed and submitted in accordance with Tennessee state tax laws. It serves as a legally binding document that outlines your income and tax liabilities. To ensure that the form is legally valid, it must be signed and dated appropriately. Additionally, using a reliable eSignature solution can enhance the legal standing of your submission, as it provides a digital certificate that verifies the signer's identity and intent.

Form Submission Methods for the Tennessee Individual Income Tax Return (INC250)

The INC250 can be submitted through various methods, providing flexibility for taxpayers. These methods include:

- Online submission through the Tennessee Department of Revenue’s website

- Mailing a printed copy of the completed form to the designated address

- In-person submission at local tax offices, if applicable

Choosing the right submission method can depend on personal preference and the availability of resources. Online submission is often the fastest and most efficient option.

Quick guide on how to complete tennessee individual income tax return inc250 2017 individual income tax

Effortlessly prepare Tennessee Individual Income Tax Return INC250 Individual Income Tax on any device

Managing documents online has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Tennessee Individual Income Tax Return INC250 Individual Income Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Tennessee Individual Income Tax Return INC250 Individual Income Tax seamlessly

- Obtain Tennessee Individual Income Tax Return INC250 Individual Income Tax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specially designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Tennessee Individual Income Tax Return INC250 Individual Income Tax and guarantee efficient communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I file income tax return independently?

Greeting !!!If you are going to file it yourself, then following is the procedure:-Before you start the process, keep your bank statements, Form 16 issued by your employer and a copy of last year's return at hand. Next, log on to www.incometaxindiaefiling.gov.in. Follow these steps:Step 1: Register yourself on the website. Your Permanent Account Number (PAN) will be your user ID.Step 2: View your tax credit statement — Form 26AS — for the financial year 2012-13 . The statement will reflect the taxes deducted by your employer actually deposited with the I-T department. The TDS as per your Form 16 must tally with the figures in Form 26AS. If you file the return despite discrepancies, if any, you could get a notice from the I-T department later.Step 3: Under the 'Download' menu, click on Income Tax Return Forms and choose AY 2013-14 (for financial year 2012-13 ). Download the Income Tax Return (ITR) form applicable to you. If your exempt income exceeds Rs 5,000, the appropriate form will be ITR-2 . If the applicable form is ITR-1 or ITR 4S, you can complete the process on the portal itself, by using the 'Quick e-file ITR' link.Step 4: Open the downloaded Return Preparation Software (excel utility) and complete the form by entering all the details , using your Form 16.Step 5: Ascertain the tax payable by clicking the 'Calculate Tax' tab. Pay tax (if applicable) and enter the challan details in the tax return.Step 6: Confirm all the information in the worksheet by clicking the 'Validate' tab.Step 7: Proceed to generate an XML file and save it on your computer.Step 8: Go to 'Upload Return' on the portal's left panel and upload the saved XML file after selecting 'AY 2013-2014 ' and the relevant form. You will be asked whether you wish to digitally sign the file. If you have obtained a DS (digital signature), select Yes. Or, choose 'No'.Step 9: Once the website flashes the message about successful e-filing on your screen, you can consider the process to be complete. The acknowledgment form — ITR—Verification (ITR-V ) will be generated and you can download it.Step 10: Take a printout of the form ITR-V , sign it preferably in blue ink, and send it only by ordinary or Speed post to the Income-Tax Department-CPC , Post Bag No-1 , Electronic City Post Office, Bangalore - 560 100, Karnataka, within 120 days of filing your return online.Its Advisable to go with CA help for filling Tax return. There are lots of amendment come in every year, to file accurate return and Tax planning benefit etc so Prefer to go with expert like CA, Tax Preparer etc…Be Peaceful

-

Which income earning group in case of individual can fill online income tax return?

The Central Board of Direct Taxes (CBDT) has widened the scope of e-filing of income tax (I-T ) returns. And one of the changes introduced through a recent notification impacts salaried taxpayers. E-filing of I-T returns is now mandatory for individuals, including salaried taxpayers, earning more than Rs 5 lakh taxable income during the financial year ended March 31, 2013.Prior to this notification, e-filing was mandatory for individuals having a taxable income of more than Rs 10 lakh. According to sources in the ministry of finance, nearly 18 lakh individual taxpayers fall in the Rs 5-10 lakh tax slab, all of whom will now have to file their I-T returns online. Salaried employees have to file their I-T returns for the income earned in FY13 by July 31, 2013.Salaried taxpayers, however , do not have to obtain a digital signature for e-filing their I-T returns. After having filed online, for verification of the return, a hard copy has to be sent to the central processing unit in Bangalore.Salaried taxpayers having income from salary, house property and income from other sources such as bank interest can e-file the simple form - Sahaj (ITR1). However, if they report a loss under the head income from house property or winnings from lottery or from betting at a racecourse or even capital gains, then Sahaj form is not applicable and Form ITR2 or another appropriate form needs to be filled in and filed online. A free online filing facility is available at https:// incometaxindiaefiling .gov.in/"Salaried individuals earning less than Rs 5 lakh and whose saving bank interest income is less than Rs 10,000 in a year will continue to be exempt from filing of their tax return, provided they meet the prescribed conditions. These conditions include that the employer has discharged the entire tax liability through deduction of tax at source and deposited it with the government . If an employee has switched jobs during the year, then this leeway of tax filing exemption is not available," explained a tax official."E-filing of I-T returns also helps speed up the process of granting refunds to taxpayers - the processing is carried out at the central processing unit in Bangalore . The process of e-filing is now simple. If one considers only Form 1, as a sample case, as many as 64 lakh I-T returns were filed during FY 2012-13 . We are equipped to handle the additional e-returns ," said a finance ministry official.According to L K Jain, a Mumbai-based chartered accountant , "Small taxpayers who are not computer savvy will now have to seek professional help for filing I-T returns . The plus side is that the tax authorities have assured speedy refunds when e-returns are filed."Many chartered accountants said the official website of the tax department which enables e-filing of returns is difficult to access, especially during the peak return filing season.Through the same notification , the CBDT has also introduced e-filing of tax audit reports, transfer pricing (TP) reports and Minimum Alternate Tax (MAT) certificates . Earlier, while e-filing of I-T returns was mandatory for India Inc, these reports had to be physically filed at the local tax office.Mukesh Butani, chairperson , BMR Advisors, said, "It is important to ensure that the information technology system has stabilized and there are no hiccups as we have seen with digitization efforts in the past."Spreading e-tax netIndividuals, including salaried taxpayers, earning more than 5L now have to mandatorily e-file their I-T returns Salaried taxpayers with income less than 5 lakh and bank interest less than 10,000 continue to be exempt from filing I-T returns India Inc can now e-file tax audit report, transfer pricing (TP) report and Minimum Alternate Tax (MAT) certificate.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

Can you use a ‘white out’ on your signature and redo it in your 1040 individual income tax return form?

Yes. You can also write your return in pencil and then photocopy the final result, after making changes along the way.

-

How do I submit income tax returns online?

Here is a step by step guide to e-file your income tax return using ClearTax. It is simple, easy and quick.From 1st July onwards, it is mandatory to link your PAN with Aadhaar and mention it in your IT returns. If you have applied for Aadhaar, you can mention the enrollment number in your returns.Read our Guide on how to link your PAN with Aadhaar.Step 1.Get startedLogin to your ClearTax account.Click on ‘Upload Form 16 PDF’ if you have your Form 16 in PDF format.If you do not have Form 16 in PDF format click on ‘Continue Here’Get an expert & supportive CA to manage your taxes. Plans start @ Rs.799/-ContinueWhat are you looking for?Account & Book KeepingCompany RegistrationGST RegistrationGST Return FilingIncome Tax FilingTrademark RegistrationOtherStep 2.Enter personal infoEnter your Name, PAN, DOB and Bank account details.Step 3.Enter salary detailsFill in your salary, employee details (Name and TAN) and TDS.Tip: Want to claim HRA? Read the guide.Step 4.Enter deduction detailsEnter investment details under Section 80C(eg. LIC, PPF etc., and claim other tax benefits here.Tip: Do you have kids?Claim benefits on their tuition fees under Section 80CStep 5.Add details of taxes paidIf you have non-salary income,eg. interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26ASStep 6.E-file your returnIf you see “Refund” or “No Tax Due” here, Click on proceed to E-Filing.You will get an acknowledgement number on the next screen.Tip: See a “Tax Due” message? Read this guide to know how to pay your tax dues.Step 7: E-VerifyOnce your return is file E-Verify your income tax return

-

How do I find my and my spouse's individual income on the tax return 1040 form? We filed jointly.

You do that directly from the main forms. Depending on the tax program used and the diligence of the preparer, you may be able to get the information from supporting statements. If both of you had accounts at the same bank and the preparer simply typed “Wells Fargo” and a dollar amount for each of your accounts, the statement may not help.What I describe in the first paragraph can be a lot of work. The easiest thing to do is to request a transcript from the IRS. All income reported to you is under your Social Security Number so you will see only your income. If there are sales of securities (stocks, bond, mutual funds, etc.) then you would need a copy of the 1099 from the broker which should give your cost basis information.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

Create this form in 5 minutes!

How to create an eSignature for the tennessee individual income tax return inc250 2017 individual income tax

How to make an electronic signature for your Tennessee Individual Income Tax Return Inc250 2017 Individual Income Tax online

How to generate an electronic signature for the Tennessee Individual Income Tax Return Inc250 2017 Individual Income Tax in Google Chrome

How to generate an eSignature for signing the Tennessee Individual Income Tax Return Inc250 2017 Individual Income Tax in Gmail

How to generate an eSignature for the Tennessee Individual Income Tax Return Inc250 2017 Individual Income Tax straight from your smartphone

How to make an eSignature for the Tennessee Individual Income Tax Return Inc250 2017 Individual Income Tax on iOS

How to generate an eSignature for the Tennessee Individual Income Tax Return Inc250 2017 Individual Income Tax on Android devices

People also ask

-

What is the Tennessee Individual Income Tax Return INC250 Individual Income Tax?

The Tennessee Individual Income Tax Return INC250 Individual Income Tax is a state-specific form used by residents to report their income and calculate their tax liabilities. This form is essential for ensuring compliance with Tennessee tax laws and can be easily completed using various online tools.

-

How does airSlate SignNow assist with filing the Tennessee Individual Income Tax Return INC250 Individual Income Tax?

airSlate SignNow provides a seamless solution for electronically signing and submitting the Tennessee Individual Income Tax Return INC250 Individual Income Tax. Our platform allows users to securely send documents, collect signatures, and manage the entire filing process efficiently.

-

Is airSlate SignNow cost-effective for filing the Tennessee Individual Income Tax Return INC250 Individual Income Tax?

Yes, airSlate SignNow offers a cost-effective solution for individuals and businesses needing to file the Tennessee Individual Income Tax Return INC250 Individual Income Tax. Our pricing plans are designed to be budget-friendly while providing powerful features that simplify the eSigning process.

-

What features does airSlate SignNow offer for the Tennessee Individual Income Tax Return INC250 Individual Income Tax?

airSlate SignNow includes features like customizable templates, secure storage, and real-time tracking, making it easy to manage the Tennessee Individual Income Tax Return INC250 Individual Income Tax. Additionally, our intuitive interface ensures a smooth user experience.

-

Can I integrate airSlate SignNow with other software to streamline my Tennessee Individual Income Tax Return INC250 Individual Income Tax filing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing you to streamline the process of completing and filing your Tennessee Individual Income Tax Return INC250 Individual Income Tax. This integration helps reduce manual data entry and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for the Tennessee Individual Income Tax Return INC250 Individual Income Tax?

Using airSlate SignNow to file your Tennessee Individual Income Tax Return INC250 Individual Income Tax offers several benefits, including increased accuracy, reduced processing time, and enhanced security. Our platform ensures that your personal information is protected while making the signing and filing process hassle-free.

-

How secure is the airSlate SignNow platform when filing the Tennessee Individual Income Tax Return INC250 Individual Income Tax?

airSlate SignNow prioritizes security with advanced encryption and compliance measures, ensuring that your Tennessee Individual Income Tax Return INC250 Individual Income Tax is protected throughout the eSigning process. Our platform is designed to safeguard your sensitive data from unauthorized access.

Get more for Tennessee Individual Income Tax Return INC250 Individual Income Tax

Find out other Tennessee Individual Income Tax Return INC250 Individual Income Tax

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast