State of New Jersey APPLICATION for EXTENSION of Form

Understanding the New Jersey Application for Extension

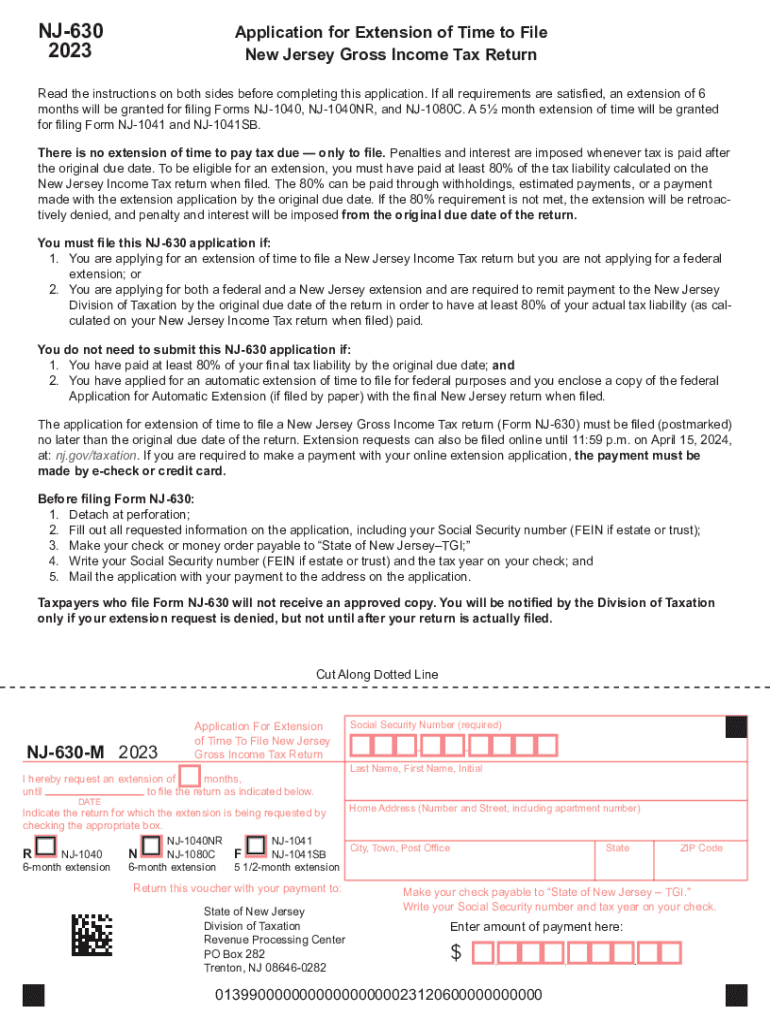

The State of New Jersey Application for Extension allows taxpayers to request additional time to file their state income tax returns. This form is essential for individuals who may need extra time beyond the usual filing deadline to gather necessary documents or complete their returns accurately. Understanding the purpose and requirements of this application can help ensure compliance and avoid penalties.

Steps to Complete the New Jersey Application for Extension

Completing the New Jersey Application for Extension involves several straightforward steps:

- Gather necessary personal information, including your Social Security number and income details.

- Obtain the correct form, typically referred to as the NJ-630 or NJ-630-V for payment vouchers.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the application by the due date, either online or via mail, depending on your preference.

Eligibility Criteria for the New Jersey Application for Extension

To qualify for a tax extension in New Jersey, taxpayers must meet specific criteria. Generally, any individual or business entity that files a New Jersey income tax return can apply for an extension. However, it is crucial to note that an extension to file does not extend the time to pay any taxes owed. Taxpayers should estimate their tax liability and submit any payment due with the application to avoid penalties.

Filing Deadlines for the New Jersey Application for Extension

The deadline for submitting the New Jersey Application for Extension typically aligns with the original filing deadline for state income tax returns. For the 2023 tax year, this means that taxpayers should file their extension requests by April 18, 2023. It is essential to keep track of these dates to ensure timely submission and avoid any late fees.

Form Submission Methods for the New Jersey Application for Extension

Taxpayers have multiple options for submitting the New Jersey Application for Extension. The form can be filed online through the New Jersey Division of Taxation's website, which offers a convenient digital submission process. Alternatively, taxpayers can print the completed form and mail it to the appropriate address provided in the form instructions. In-person submissions may also be accepted at designated tax offices.

Consequences of Non-Compliance with New Jersey Tax Extension Rules

Failing to file the New Jersey Application for Extension or not paying the estimated taxes owed can result in penalties and interest charges. The state imposes a late filing penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of twenty-five percent. Additionally, interest accrues on any unpaid tax from the original due date until payment is made. Understanding these consequences can motivate timely compliance with tax obligations.

Quick guide on how to complete state of new jersey application for extension of

Effortlessly Complete State Of New Jersey APPLICATION FOR EXTENSION OF on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle State Of New Jersey APPLICATION FOR EXTENSION OF on any device with airSlate SignNow's Android or iOS applications and streamline any document-based task today.

The Easiest Way to Edit and Electronically Sign State Of New Jersey APPLICATION FOR EXTENSION OF with Ease

- Obtain State Of New Jersey APPLICATION FOR EXTENSION OF and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just moments and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring reprinting of new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your chosen device. Modify and electronically sign State Of New Jersey APPLICATION FOR EXTENSION OF and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of new jersey application for extension of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 NJ 630 form?

The 2023 NJ 630 form is a tax form used for non-resident and part-year resident individuals in New Jersey. This form allows taxpayers to report their income and calculate their tax liabilities. Utilizing airSlate SignNow can streamline the process of sending and eSigning this document efficiently.

-

How can airSlate SignNow simplify the completion of the 2023 NJ 630?

AirSlate SignNow offers an easy-to-use platform that simplifies the eSigning process for the 2023 NJ 630 form. Users can quickly prepare, send, and sign documents without the need for printing or scanning. This not only saves time but also reduces the likelihood of errors in submission.

-

What are the costs associated with using airSlate SignNow for the 2023 NJ 630?

AirSlate SignNow provides cost-effective solutions, with various pricing plans tailored to different business needs. Depending on your requirements for signing and document management, you can choose the plan that fits best. This makes handling the 2023 NJ 630 more affordable compared to traditional methods.

-

What features does airSlate SignNow offer for managing the 2023 NJ 630?

With airSlate SignNow, you get features such as customized templates, secure cloud storage, and audit trails specifically designed for documents like the 2023 NJ 630. These features enhance organization and ensure that all actions are documented, providing peace of mind during tax season.

-

Can I integrate airSlate SignNow with other tools for the 2023 NJ 630?

Yes, airSlate SignNow supports integrations with various applications, allowing for a seamless workflow when completing the 2023 NJ 630. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to enhance your overall document management process.

-

What are the benefits of using airSlate SignNow for the 2023 NJ 630?

Using airSlate SignNow for the 2023 NJ 630 offers numerous benefits, including increased efficiency, enhanced security, and better collaboration. Users can quickly gather signatures and ensure their forms are submitted on time, reducing stress during tax preparation.

-

Is airSlate SignNow compliant with eSignature laws for the 2023 NJ 630?

Absolutely. AirSlate SignNow complies with all relevant eSignature laws, making it a reliable choice for signing the 2023 NJ 630. This compliance ensures that your eSigned documents are legally binding and enforceable in New Jersey and beyond.

Get more for State Of New Jersey APPLICATION FOR EXTENSION OF

- Protected when completed b page 1 of 2document che form

- How to fill out an imm 5604 separation declaration for minors form

- Pptc190 pdf save reset form protected when completed 659899404

- Ptp banking information change form

- Application for a citizenship certificate adults and minors 659900331 form

- Lic 050 surplus line andor special form

- Report of job injury or illness 801 form x801 form and form 3283

- Minnesota board of law examinersapplication for a form

Find out other State Of New Jersey APPLICATION FOR EXTENSION OF

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter