Nebraska Individual Estimated Income Tax Payment Vouchers Form

Understanding the Nebraska Individual Estimated Income Tax Payment Vouchers

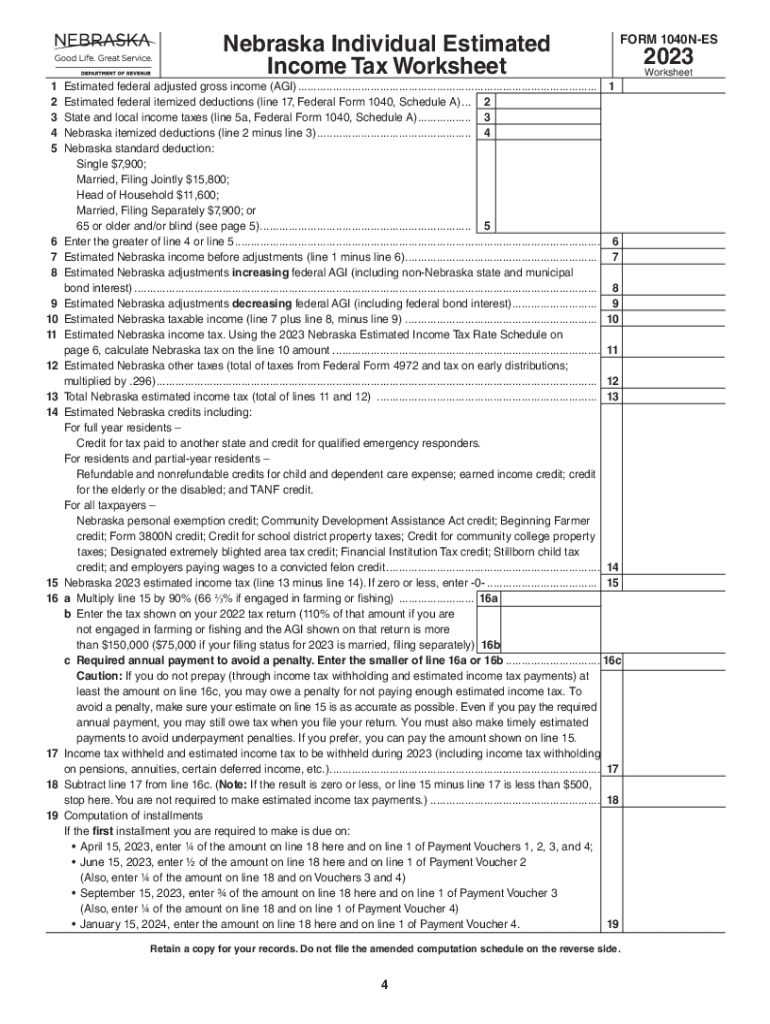

The Nebraska Individual Estimated Income Tax Payment Vouchers are essential tools for taxpayers who expect to owe state income tax. These vouchers allow individuals to make estimated tax payments throughout the year, ensuring they meet their tax obligations. The vouchers are particularly useful for those whose income is not subject to withholding, such as self-employed individuals, freelancers, or those with significant investment income.

Steps to Complete the Nebraska Individual Estimated Income Tax Payment Vouchers

Completing the Nebraska Individual Estimated Income Tax Payment Vouchers involves several straightforward steps:

- Gather your financial information, including your expected income and deductions for the year.

- Determine your estimated tax liability using the Nebraska Department of Revenue guidelines.

- Fill out the voucher form accurately, ensuring all required fields are completed.

- Calculate the payment amount based on your estimated tax liability and any previous payments made.

- Submit the completed voucher along with your payment by the specified due date.

How to Obtain the Nebraska Individual Estimated Income Tax Payment Vouchers

Taxpayers can obtain the Nebraska Individual Estimated Income Tax Payment Vouchers through the Nebraska Department of Revenue website. The forms are available for download in a printable format. Additionally, taxpayers may request physical copies of the vouchers by contacting the Department of Revenue directly. It is advisable to ensure you have the correct version for the current tax year.

Key Elements of the Nebraska Individual Estimated Income Tax Payment Vouchers

The Nebraska Individual Estimated Income Tax Payment Vouchers include several key elements that taxpayers must complete:

- Taxpayer Information: Name, address, and Social Security number.

- Payment Amount: The estimated payment due for the current quarter.

- Tax Year: The year for which the estimated payment is being made.

- Signature: Required to validate the submission.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines for the Nebraska Individual Estimated Income Tax Payment Vouchers. Generally, payments are due quarterly:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Penalties for Non-Compliance

Failure to submit the Nebraska Individual Estimated Income Tax Payment Vouchers on time can result in penalties. Taxpayers may incur interest on unpaid amounts and may face additional fines for late payments. It is crucial to adhere to the deadlines to avoid unnecessary financial burdens.

Quick guide on how to complete nebraska individual estimated income tax payment vouchers

Effortlessly prepare Nebraska Individual Estimated Income Tax Payment Vouchers on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents quickly without delays. Manage Nebraska Individual Estimated Income Tax Payment Vouchers on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Nebraska Individual Estimated Income Tax Payment Vouchers with ease

- Obtain Nebraska Individual Estimated Income Tax Payment Vouchers and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that require printing new document versions. airSlate SignNow caters to your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Nebraska Individual Estimated Income Tax Payment Vouchers and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska individual estimated income tax payment vouchers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska form tax and how can airSlate SignNow help me manage it?

The Nebraska form tax refers to tax documentation required by the state of Nebraska for various tax-related purposes. airSlate SignNow streamlines the process of sending and signing these forms by providing an easy-to-use platform that reduces paperwork and saves time. With features like templates and automatic reminders, you can efficiently manage your Nebraska form tax needs.

-

Is airSlate SignNow affordable for small businesses dealing with Nebraska form tax?

Yes, airSlate SignNow offers cost-effective solutions suitable for small businesses handling Nebraska form tax issues. Our flexible pricing plans cater to various budgets while ensuring powerful functionalities are accessible. This makes it an ideal choice for businesses looking to simplify their tax document management without breaking the bank.

-

What features does airSlate SignNow offer for handling Nebraska form tax?

airSlate SignNow provides a variety of features designed to assist users with their Nebraska form tax. These include customizable templates for tax forms, eSignatures for legally binding agreements, and secure cloud storage for easy access to documents. These features make it easier to stay organized and compliant with Nebraska tax regulations.

-

Can I integrate airSlate SignNow with other software for managing Nebraska form tax?

Absolutely! airSlate SignNow seamlessly integrates with various applications, such as CRM systems and accounting software, allowing you to manage your Nebraska form tax more efficiently. This integration helps streamline workflows and reduces the potential for errors in documentation and filing, enabling easier overall tax management.

-

How does airSlate SignNow ensure the security of Nebraska form tax documents?

Security is a priority at airSlate SignNow when it comes to handling sensitive documents like Nebraska form tax. We use advanced encryption methods to protect your data and ensure that only authorized individuals can access important files. Our secure platform also complies with various regulatory standards, giving you peace of mind when dealing with tax documents.

-

What benefits does using airSlate SignNow provide for Nebraska form tax document signing?

Using airSlate SignNow for Nebraska form tax document signing offers numerous benefits, including time savings, improved accuracy, and enhanced convenience. The ability to sign documents electronically means you can complete tax-related tasks from anywhere without the need for printing or mailing. This efficiency helps you meet deadlines while reducing stress related to paperwork.

-

Is customer support available if I have questions about Nebraska form tax procedures?

Yes, airSlate SignNow provides robust customer support to assist you with any questions about Nebraska form tax procedures. Our knowledgeable team is available through various channels to ensure that you receive timely assistance and guidance. Whether you're facing technical issues or need clarification on forms, we're here to help you navigate your tax responsibilities.

Get more for Nebraska Individual Estimated Income Tax Payment Vouchers

- Foundation course application form foundation college

- Register for organs donor form for maryland

- Us bully registry litter registration form

- Far 43 appendix d form

- Swaziland revenue authority s r a form

- Rbc personal statement of affairs form

- Water cycle gizmo quiz answers form

- Spray tanning release form please read understand

Find out other Nebraska Individual Estimated Income Tax Payment Vouchers

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF