Partnership Forms SC Department of Revenue

What is the Wisconsin Form 3K-1?

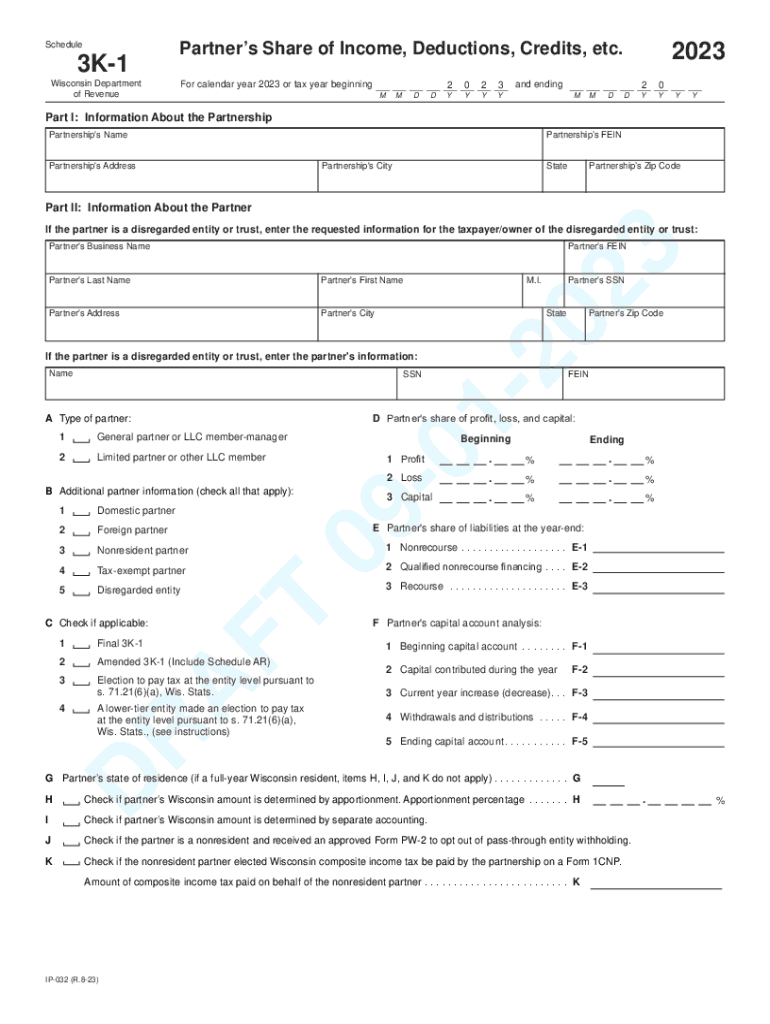

The Wisconsin Form 3K-1 is a tax document used by partnerships to report income, deductions, and credits to the state of Wisconsin. This form is essential for partnerships operating within Wisconsin, as it provides the necessary information for each partner's individual income tax return. The form outlines the partnership's income and the specific amounts allocated to each partner, ensuring compliance with state tax regulations.

Steps to Complete the Wisconsin Form 3K-1

Completing the Wisconsin Form 3K-1 involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the partnership's income and deduction information on the form.

- Allocate the income and deductions to each partner based on their ownership percentage.

- Review the completed form for accuracy and ensure all required fields are filled.

- Distribute copies of the completed Form 3K-1 to each partner for their tax filings.

Filing Deadlines for the Wisconsin Form 3K-1

The filing deadline for the Wisconsin Form 3K-1 typically aligns with the federal tax deadline, which is April 15 for most partnerships. However, if the partnership operates on a fiscal year basis, the deadline will be the fifteenth day of the fourth month following the end of the fiscal year. It is important to be aware of these deadlines to avoid penalties and ensure timely compliance with state tax laws.

Key Elements of the Wisconsin Form 3K-1

The Wisconsin Form 3K-1 includes several important elements:

- Partnership Information: This section requires the partnership's name, address, and federal employer identification number (EIN).

- Partner Information: Details about each partner, including their name, address, and ownership percentage.

- Income and Deductions: A breakdown of the partnership's total income and the deductions that can be claimed by each partner.

- Credits: Information about any tax credits that the partnership qualifies for, which can be passed on to partners.

Legal Use of the Wisconsin Form 3K-1

The Wisconsin Form 3K-1 is legally required for partnerships operating in the state. It ensures that partners report their share of the partnership's income and deductions accurately on their individual tax returns. Failure to file this form can lead to penalties and interest charges, making it crucial for partnerships to comply with state laws regarding tax reporting.

Examples of Using the Wisconsin Form 3K-1

Using the Wisconsin Form 3K-1 can vary based on the partnership's structure. For instance:

- A limited liability company (LLC) treated as a partnership must file this form to report income and deductions to its members.

- A general partnership must also utilize this form to ensure each partner accurately reports their share of partnership income on their tax returns.

These examples illustrate the form's versatility in accommodating different partnership types while maintaining compliance with Wisconsin tax regulations.

Quick guide on how to complete partnership forms sc department of revenue

Prepare Partnership Forms SC Department Of Revenue effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed forms, as you can easily locate the needed document and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Partnership Forms SC Department Of Revenue across any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to modify and eSign Partnership Forms SC Department Of Revenue with ease

- Locate Partnership Forms SC Department Of Revenue and click Obtain Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose offered by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Finish button to save your modifications.

- Choose your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your selected device. Modify and eSign Partnership Forms SC Department Of Revenue to ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the partnership forms sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 3k 1, and how can it benefit my business?

The form 3k 1 is a versatile document template designed for easy completion and electronic signing. By utilizing this form, businesses can streamline their workflow, reduce paper usage, and enhance efficiency in document handling. Implementing the form 3k 1 can help your team focus on critical tasks instead of administrative paperwork.

-

How does airSlate SignNow integrate with the form 3k 1?

airSlate SignNow seamlessly integrates with the form 3k 1, allowing users to prepare, send, and eSign the document within a user-friendly platform. This integration ensures that your team can access and manage the form 3k 1 alongside other valuable documents, improving collaboration and productivity. You can easily customize the form to suit specific needs while keeping everything organized.

-

What is the pricing structure for airSlate SignNow using the form 3k 1?

AirSlate SignNow offers competitive pricing plans tailored to different business needs, including access to the form 3k 1. Whether you're a small business or a large enterprise, there's a plan that fits your budget and requirements. Each plan provides unlimited access to features that enhance the use of the form 3k 1.

-

Can I customize the form 3k 1 for my specific needs?

Yes, airSlate SignNow allows users to customize the form 3k 1 to match their specific requirements. You can add fields, change text, and adjust layouts to ensure the form meets your unique business processes. This customization capability makes the form 3k 1 highly adaptable for various industries.

-

Is the form 3k 1 secure for sensitive information?

Absolutely, the form 3k 1 is designed with security in mind. AirSlate SignNow employs advanced encryption methods to protect all documents, ensuring sensitive information is kept secure during transmission and storage. Compliance with industry standards also safeguards your data when using the form 3k 1.

-

What features does airSlate SignNow offer with the form 3k 1?

AirSlate SignNow provides a robust set of features that enhance the functionality of the form 3k 1, including templates, bulk sending, and real-time status tracking. These features help streamline your document management process, making it easier to send and track forms efficiently. Ultimately, the goal is to simplify your paperwork burden.

-

How can I integrate the form 3k 1 into my existing workflows?

Integrating the form 3k 1 into your existing workflows is straightforward with airSlate SignNow. The platform allows you to connect with other business tools and applications, ensuring that your team can easily incorporate the form into their daily tasks. This integration fosters smoother operations and reduces the chance of errors.

Get more for Partnership Forms SC Department Of Revenue

- Public worksobtaining a development permit dallas county form

- Forms permits and applications tillamook county or

- Ao 85 rev 0217 notice consent and reference form

- Fact witness voucher form

- Official form 23 1213 u s courts uscourts

- Base filing fee 25 form

- Sw colorado federal credit union form

- Grain electronic contract agreement central farm service form

Find out other Partnership Forms SC Department Of Revenue

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile