Form REW 5 Maine Gov

What is the Maine Form REW 5?

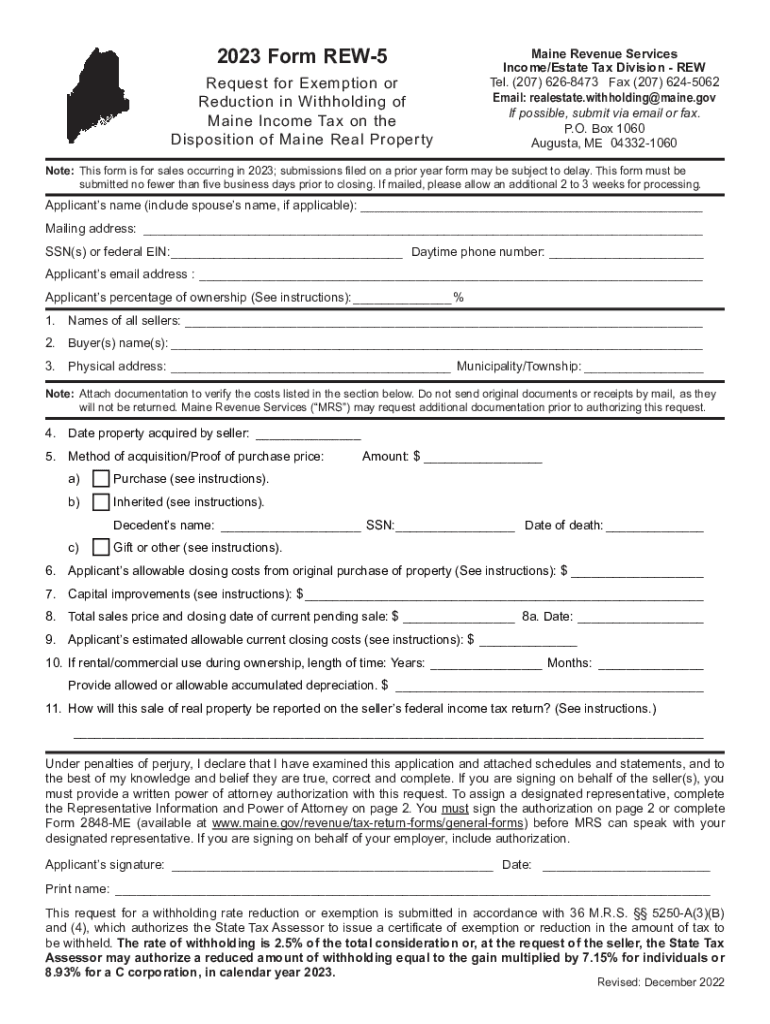

The Maine Form REW 5 is a tax-related document used by individuals and businesses to request an exemption from withholding for Maine income tax purposes. This form is particularly relevant for those who qualify for specific exemptions under Maine tax regulations. The REW 5 form is essential for ensuring that the correct amount of tax is withheld from wages or payments, helping taxpayers avoid over-withholding and ensuring compliance with state tax laws.

How to Use the Maine Form REW 5

To effectively use the Maine Form REW 5, individuals must first determine their eligibility for withholding exemptions. This involves reviewing the criteria set forth by the Maine Revenue Services. Once eligibility is confirmed, taxpayers can complete the form by providing necessary personal information, including name, address, and Social Security number. It is crucial to accurately fill out all sections to ensure proper processing by the state tax authority.

Steps to Complete the Maine Form REW 5

Completing the Maine Form REW 5 involves several key steps:

- Gather your personal information, including your Social Security number and address.

- Review the eligibility criteria for withholding exemptions provided by the Maine Revenue Services.

- Fill out the form, ensuring all required fields are completed accurately.

- Sign and date the form to validate your request.

- Submit the completed form to your employer or the appropriate withholding agent.

Key Elements of the Maine Form REW 5

The Maine Form REW 5 includes several important elements that must be understood for proper completion:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Exemption Claim: Taxpayers must indicate their reason for requesting an exemption from withholding.

- Signature: A signature is required to certify that the information provided is accurate and truthful.

Legal Use of the Maine Form REW 5

The Maine Form REW 5 is legally recognized by the Maine Revenue Services and must be used in accordance with state tax laws. Taxpayers who submit this form are affirming their eligibility for withholding exemptions, which can significantly impact their tax liabilities. It is important to keep a copy of the submitted form for personal records and to ensure compliance with any future inquiries from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Maine Form REW 5 typically align with the start of the tax year or the beginning of employment. Taxpayers should submit the form as soon as they determine their eligibility for withholding exemptions. It is advisable to check with the Maine Revenue Services for any updates or changes to filing deadlines to ensure compliance and avoid penalties.

Quick guide on how to complete form rew 5 maine gov

Complete Form REW 5 Maine gov effortlessly on any device

Online document management has gained signNow popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents rapidly without any delays. Manage Form REW 5 Maine gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

How to edit and eSign Form REW 5 Maine gov with ease

- Obtain Form REW 5 Maine gov and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs within a few clicks from any device you prefer. Edit and eSign Form REW 5 Maine gov and ensure outstanding communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form rew 5 maine gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine Form REW 5 and how can airSlate SignNow help?

The Maine Form REW 5 is a required document for real estate transactions in Maine. airSlate SignNow simplifies the process by providing an easy platform to fill, sign, and send the Maine Form REW 5 securely, ensuring compliance and efficiency.

-

Is airSlate SignNow cost-effective for handling the Maine Form REW 5?

Yes, airSlate SignNow offers a cost-effective solution for handling the Maine Form REW 5, making it ideal for businesses of all sizes. Our pricing plans are designed to fit different budgets while providing robust features tailored for document management.

-

What features does airSlate SignNow offer for the Maine Form REW 5?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure eSignature capabilities specifically for documents like the Maine Form REW 5. These features streamline the signing process to save time and improve accuracy.

-

Can airSlate SignNow integrate with other applications for the Maine Form REW 5?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing the workflow for processes related to the Maine Form REW 5. This allows users to connect with their favorite apps for smoother document management and communication.

-

How does airSlate SignNow ensure security for the Maine Form REW 5?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect the integrity of the Maine Form REW 5 and other sensitive documents, ensuring peace of mind for users.

-

Can I customize the Maine Form REW 5 in airSlate SignNow?

Yes, airSlate SignNow allows users to customize the Maine Form REW 5 to meet specific needs. You can add logos, fields, and instructions, making the form tailored to your business requirements while maintaining compliance.

-

What benefits do I gain by using airSlate SignNow for the Maine Form REW 5?

Using airSlate SignNow for the Maine Form REW 5 brings numerous benefits, including improved efficiency, reduced errors, and faster turnaround times. The platform is designed to simplify the signing experience, empowering your business to focus on growth.

Get more for Form REW 5 Maine gov

Find out other Form REW 5 Maine gov

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document