Estate Tax Forms 2022Maine Revenue Services

Understanding the 700 SOV 2023 Form

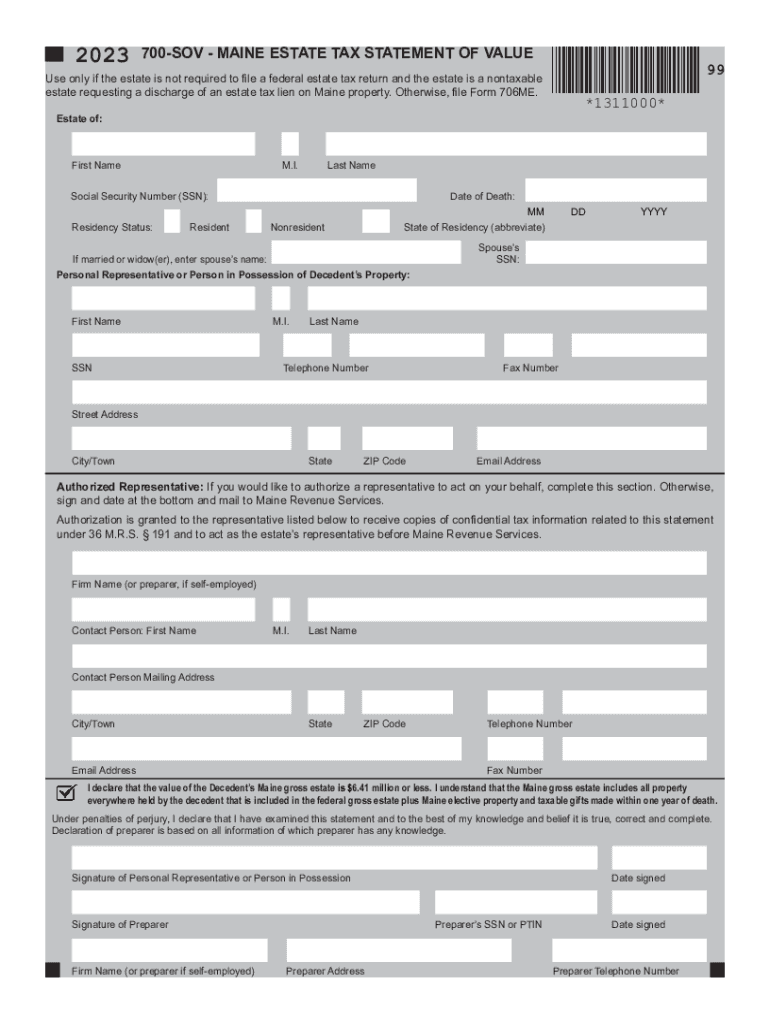

The 700 SOV 2023 form is a crucial document related to estate tax in the United States. It is used to report the value of an estate for tax purposes. Understanding the purpose and requirements of this form is essential for individuals handling estate matters. The form captures detailed information about the deceased's assets, liabilities, and the overall value of the estate. This information is vital for tax assessment and compliance with federal and state regulations.

Steps to Complete the 700 SOV 2023 Form

Completing the 700 SOV 2023 form involves several steps to ensure accuracy and compliance. Begin by gathering all necessary documents related to the estate, including property deeds, bank statements, and investment account information. Next, fill out the form by providing detailed descriptions of all assets and liabilities. Make sure to include the fair market value of each asset as of the date of death. Once completed, review the form for any errors or omissions before submission.

Required Documents for the 700 SOV 2023 Form

To accurately complete the 700 SOV 2023 form, several documents are required. These include:

- Death certificate of the deceased

- Property deeds and titles

- Bank and investment account statements

- Life insurance policies

- Records of any debts or liabilities

Having these documents ready will facilitate the completion of the form and help ensure that all necessary information is included.

Filing Deadlines for the 700 SOV 2023 Form

Timely filing of the 700 SOV 2023 form is essential to avoid penalties. The deadline for submitting this form typically aligns with the federal estate tax return deadlines. It is important to check with the relevant state authorities for specific filing dates, as they may vary. Generally, the form must be filed within nine months of the date of death, but extensions may be available under certain circumstances.

Legal Use of the 700 SOV 2023 Form

The 700 SOV 2023 form serves a legal purpose in the estate settlement process. It is used by the Internal Revenue Service and state tax authorities to assess the estate's tax liability. Proper completion and submission of this form are critical for ensuring compliance with tax laws. Failure to file or inaccuracies in the form can lead to legal repercussions, including fines or audits.

Penalties for Non-Compliance with the 700 SOV 2023 Form

Non-compliance with the filing requirements of the 700 SOV 2023 form can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is essential to adhere to all filing deadlines and ensure that the information provided is accurate to avoid these consequences. Consulting with a tax professional can help mitigate risks associated with non-compliance.

Quick guide on how to complete estate tax forms 2022maine revenue services

Easily Prepare Estate Tax Forms 2022Maine Revenue Services on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the right template and securely store it online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and electronically sign your documents without delays. Manage Estate Tax Forms 2022Maine Revenue Services on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

Editing and eSigning Estate Tax Forms 2022Maine Revenue Services Effortlessly

- Locate Estate Tax Forms 2022Maine Revenue Services and click Get Form to commence.

- Utilize the tools provided to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to secure your modifications.

- Select your preferred method for delivering the form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign Estate Tax Forms 2022Maine Revenue Services and guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the estate tax forms 2022maine revenue services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 700 sov 2023 plan offered by airSlate SignNow?

The 700 sov 2023 plan from airSlate SignNow provides a comprehensive solution for businesses looking to streamline their document signing processes. This plan includes advanced features such as unlimited templates, integrations with popular applications, and enhanced security settings, all designed to empower your business in 2023.

-

How much does the 700 sov 2023 plan cost?

The 700 sov 2023 plan is competitively priced to suit various business needs. Visit the pricing page on the airSlate SignNow website for a detailed breakdown of costs and to see how it compares with other plans, ensuring you find an option that fits your budget.

-

What features are included in the 700 sov 2023 plan?

The 700 sov 2023 plan includes features such as unlimited electronic signatures, customizable workflows, real-time tracking, and mobile access. These features are designed to enhance productivity and ensure your document management process is efficient and secure.

-

How can airSlate SignNow benefit my business in 2023?

By utilizing the 700 sov 2023 plan, businesses can reduce turnaround times, decrease paper usage, and improve overall efficiency. The easy-to-use interface makes it simple for team members to adopt and integrate eSigning into their daily operations.

-

Does airSlate SignNow integrate with other software?

Yes, the 700 sov 2023 plan offers integrations with various popular software solutions, including CRM systems, cloud storage, and productivity tools. This allows for seamless document management and enhances your existing workflows, contributing to a more streamlined business operation.

-

Is airSlate SignNow secure for signing documents?

Absolutely! The 700 sov 2023 plan incorporates robust security measures, including encryption and authentication protocols, to ensure that your documents are safe and compliant with industry standards. You can trust airSlate SignNow to keep your sensitive information secure while you eSign.

-

Can I try the 700 sov 2023 plan before committing?

Yes, airSlate SignNow offers a free trial of the 700 sov 2023 plan, allowing you to explore its features and benefits without any upfront commitment. This trial period is perfect for assessing how well the platform fits your business's eSigning needs in 2023.

Get more for Estate Tax Forms 2022Maine Revenue Services

- English spanish glossaryssa social security administration form

- As printed on pay warrant your full ssn is required by form

- D3n9y02raazwpg cloudfront net americancanyon 699special joint city councilamerican canyon fire protection form

- Encroachment permit city public form

- Instructions for ca fehb sub enrollment change form

- California condominium planning form

- Southridge middle school fontana ca form

- 137 microsoft access databases and templates with examples form

Find out other Estate Tax Forms 2022Maine Revenue Services

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer