I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Schedule H EZ Wisconsin Homestead Credit

What is the I 015i Schedule H EZ?

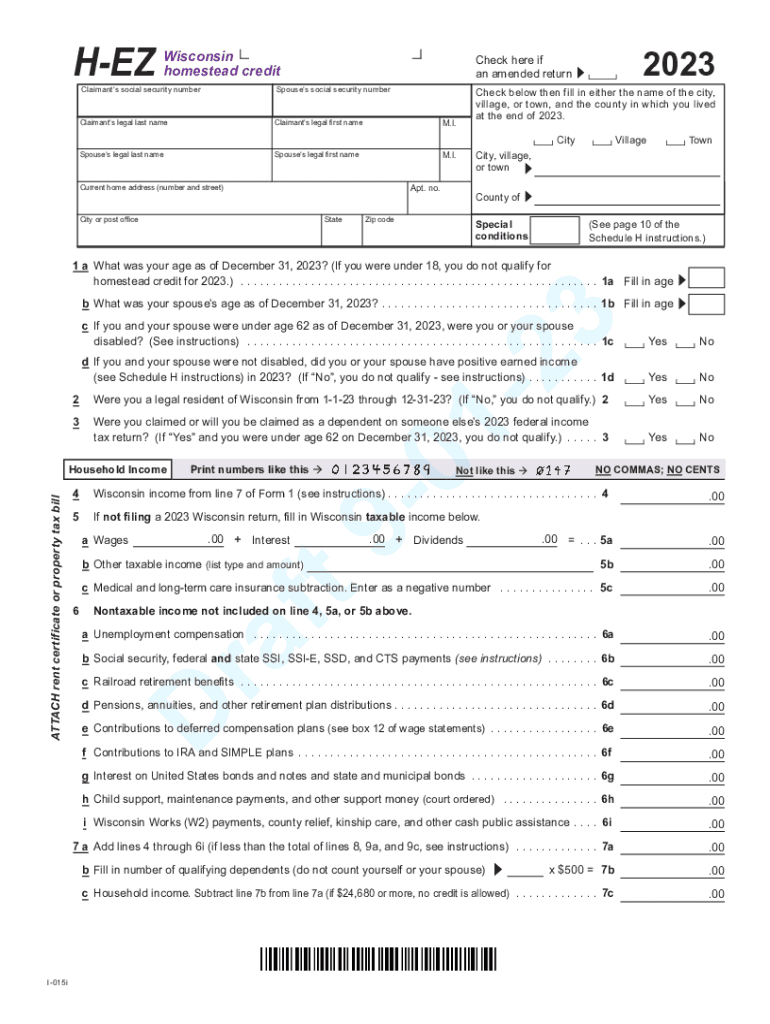

The I 015i Schedule H EZ is a simplified form used in Wisconsin for individuals applying for the Homestead Credit. This short form is designed for eligible homeowners and renters who meet specific criteria, allowing them to receive tax relief based on their property taxes or rent paid. The Wisconsin Homestead Credit aims to support low-income residents by reducing their tax burden, making housing more affordable.

Eligibility Criteria for the Homestead Credit

To qualify for the Wisconsin Homestead Credit, applicants must meet several criteria:

- Be a resident of Wisconsin.

- Be at least eighteen years old or have a spouse who meets this age requirement.

- Have a household income below the specified limit set by the state.

- Own or rent a home in Wisconsin and occupy it as your principal dwelling.

It is essential to review these requirements carefully to ensure eligibility before completing the application process.

Steps to Complete the I 015i Schedule H EZ

Completing the I 015i Schedule H EZ involves several straightforward steps:

- Gather necessary documents, including proof of income, property tax bills, or rent receipts.

- Fill out the form with accurate personal information, including your name, address, and income details.

- Provide information about your property or rental situation, including the amount of property taxes paid or rent incurred.

- Review the completed form for accuracy before submission.

Following these steps ensures a smooth application process for the Wisconsin Homestead Credit.

Required Documents for Application

When applying for the Wisconsin Homestead Credit using the I 015i Schedule H EZ, certain documents are necessary:

- Proof of income, such as W-2 forms or tax returns.

- Property tax bills or rent certificates that detail the amounts paid.

- Identification documents, such as a driver's license or state ID.

Having these documents ready will facilitate a quicker and more efficient application process.

Form Submission Methods

The I 015i Schedule H EZ can be submitted in various ways:

- Online through the Wisconsin Department of Revenue's website, if available.

- By mail, sending the completed form to the appropriate local tax office.

- In-person at designated local government offices.

Choosing the right submission method can help ensure that your application is processed promptly.

Key Elements of the I 015i Schedule H EZ

Understanding the key elements of the I 015i Schedule H EZ is crucial for successful completion:

- Personal identification information.

- Income details, including all sources of income.

- Property or rental information, including tax amounts or rent paid.

- Signature and date to certify the accuracy of the information provided.

Each element plays a vital role in determining eligibility and ensuring that applicants receive the correct credit amount.

Quick guide on how to complete i 015i schedule h ez wisconsin homestead credit short form schedule h ez wisconsin homestead credit

Effortlessly Prepare I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Schedule H EZ Wisconsin Homestead Credit on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Schedule H EZ Wisconsin Homestead Credit on any device using airSlate SignNow's Android or iOS applications and improve any document-centric process today.

Steps to Modify and eSign I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Schedule H EZ Wisconsin Homestead Credit with Ease

- Find I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Schedule H EZ Wisconsin Homestead Credit and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method to share your form, either by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Schedule H EZ Wisconsin Homestead Credit while ensuring excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the i 015i schedule h ez wisconsin homestead credit short form schedule h ez wisconsin homestead credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the WI Homestead Credit and who qualifies for it?

The WI Homestead Credit is a tax credit designed for homeowners and renters who meet certain income requirements. To qualify, you must be a resident of Wisconsin and meet specific age or disability criteria. Understanding how to file WI Homestead Credit is essential to ensure you receive the benefits you deserve.

-

How can I file for the WI Homestead Credit?

You can file for the WI Homestead Credit by completing the necessary forms available on the Wisconsin Department of Revenue's website. It's important to gather any supporting documents that verify your income and property status before starting the process. Learning how to file WI Homestead Credit accurately helps expedite your application.

-

What documents do I need to file for the WI Homestead Credit?

When filing for the WI Homestead Credit, you will need to provide proof of income, property tax bills, and any additional documentation relevant to your property situation. Ensure that you have all your financial records organized for a smooth filing experience. Knowing how to file WI Homestead Credit includes understanding which documents will support your claim.

-

What is the deadline for filing the WI Homestead Credit?

The deadline for filing the WI Homestead Credit typically falls on April 15th each year. However, be sure to check with the Wisconsin Department of Revenue for any changes or updates to this deadline. To avoid missing out, it’s crucial to know how to file WI Homestead Credit on time.

-

Can I file the WI Homestead Credit online?

Yes, you can file the WI Homestead Credit online through the Wisconsin Department of Revenue's eFile system. This digital option makes the filing process more convenient and faster, allowing you to submit your application from the comfort of your home. Familiarizing yourself with how to file WI Homestead Credit online can save time.

-

What happens if I make a mistake on my WI Homestead Credit application?

If you make a mistake on your WI Homestead Credit application, it is important to correct it as soon as possible to avoid delays in processing. You may need to submit an amended application to rectify any errors. Understanding how to file WI Homestead Credit correctly can help reduce the chances of making mistakes.

-

Are there any fees associated with filing for the WI Homestead Credit?

There are generally no fees associated with filing for the WI Homestead Credit itself, as the process is managed by the state. However, if you choose to seek help from a tax professional, there may be fees involved. Knowing how to file WI Homestead Credit independently can save you these potential costs.

Get more for I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Schedule H EZ Wisconsin Homestead Credit

- Building permits ampamp inspections city of pompano beach form

- City of toledobuilding inspection and permitsbuilding permits ampamp inspections city of knoxvillepermitcenter welcome to the form

- City of pompano beachdepartment of development ser form

- Solar and energy loan fund loan application solar and energy loan fund program overview thank you for your interest in the form

- Fence permit application city of lakeland form

- City of pompano beach building department permit search form

- 4670 fax 954 form

- Signature affidavit guide pompano beach form

Find out other I 015i Schedule H EZ, Wisconsin Homestead Credit Short Form Schedule H EZ Wisconsin Homestead Credit

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer