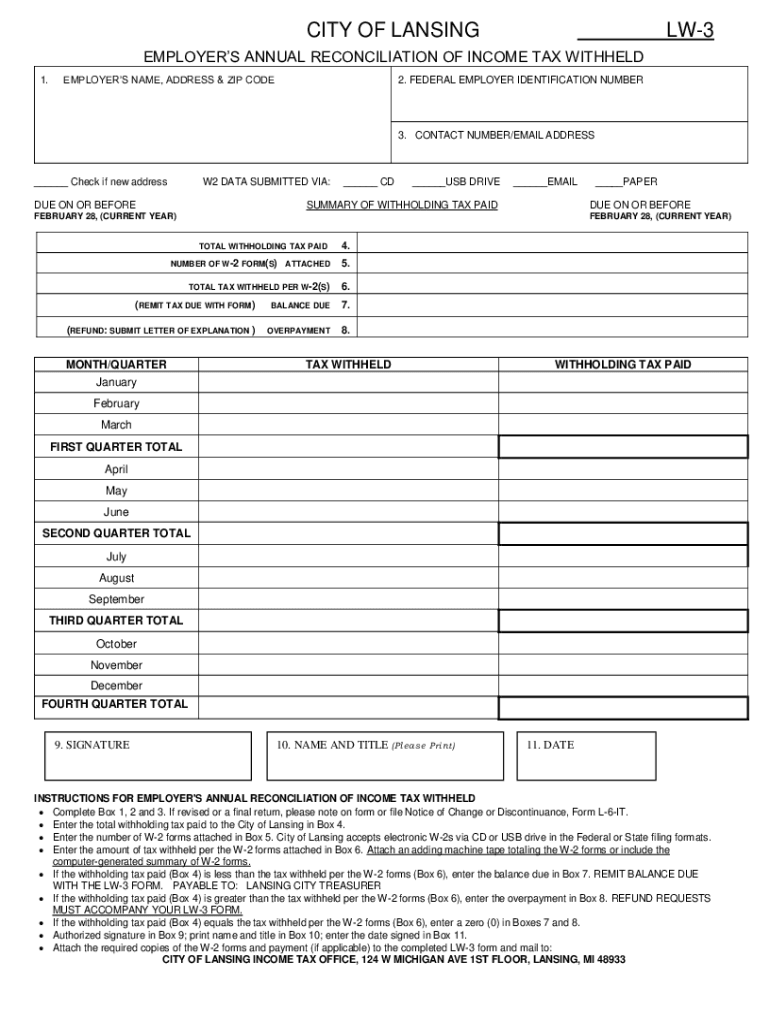

EMPLOYERS ANNUAL RECONCILIATION of INCOME TAX WITHHELD Form

Understanding the employer's annual reconciliation of income tax withheld

The employer's annual reconciliation of income tax withheld is a crucial form for businesses. It summarizes the total amount of federal income tax withheld from employees' wages throughout the year. This form is essential for ensuring compliance with federal tax regulations and for accurately reporting income tax withholdings to the Internal Revenue Service (IRS).

This reconciliation helps employers verify that the correct amount of taxes has been withheld and reported. It also serves as a record for employees, allowing them to confirm their tax withholdings when filing their personal tax returns.

Steps to complete the employer's annual reconciliation of income tax withheld

Completing the employer's annual reconciliation involves several key steps:

- Gather all payroll records for the year, including W-2 forms and any other relevant documentation.

- Calculate the total federal income tax withheld from each employee's wages.

- Fill out the reconciliation form, ensuring all calculations are accurate and reflect the total withholdings.

- Review the completed form for any discrepancies or errors.

- Submit the form to the IRS by the designated deadline, either electronically or via mail.

Key elements of the employer's annual reconciliation of income tax withheld

Several key elements must be included in the employer's annual reconciliation:

- Employer Information: Name, address, and Employer Identification Number (EIN).

- Employee Information: Names, Social Security numbers, and total wages paid for the year.

- Withholding Amounts: Total federal income tax withheld for each employee.

- Signature: The form must be signed by an authorized representative of the business.

Filing deadlines and important dates

It is important to be aware of the filing deadlines for the employer's annual reconciliation. Typically, the form must be submitted to the IRS by January thirty-first of the following year. Employers should also ensure that W-2 forms are distributed to employees by this date to allow them sufficient time for their personal tax filings.

Legal use of the employer's annual reconciliation of income tax withheld

The employer's annual reconciliation is legally required for all businesses that withhold federal income tax from employee wages. Compliance with this requirement helps avoid penalties and ensures that employees receive accurate tax information for their filings. Employers should maintain copies of submitted forms and related documentation for at least four years in case of an audit.

IRS guidelines for the employer's annual reconciliation of income tax withheld

The IRS provides specific guidelines for completing the employer's annual reconciliation. These include instructions on how to calculate withholding amounts, reporting requirements, and submission methods. Employers are encouraged to refer to the IRS website or consult a tax professional to ensure compliance with the latest regulations and guidelines.

Quick guide on how to complete employers annual reconciliation of income tax withheld

Manage EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, enabling users to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD on any device using airSlate SignNow's Android or iOS applications and streamline your document processes today.

How to modify and eSign EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD with ease

- Obtain EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD and select Get Form to initiate the process.

- Use the tools available to finalize your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Alter and eSign EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD and ensure effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employers annual reconciliation of income tax withheld

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD?

The EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD is a document that employers submit to reconcile the total income tax withheld from employees throughout the year. This process ensures compliance with federal and state tax regulations. Properly handling this reconciliation can prevent errors and penalties.

-

How does airSlate SignNow help with the EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD?

airSlate SignNow provides a streamlined solution for managing the EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD. Our platform allows you to create, sign, and send documents electronically, ensuring an efficient process for compiling and submitting necessary tax documents.

-

What features does airSlate SignNow offer for tax reconciliation documents?

Key features of airSlate SignNow include customizable templates, electronic signatures, and secure cloud storage, all of which simplify the EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD process. These tools help reduce errors and improve efficiency, making compliance easier for your business.

-

Is airSlate SignNow cost-effective for handling the EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD?

Yes, airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes. By using our platform, you can save time and reduce costs related to printing, mailing, and storing documents for your EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD.

-

What integrations does airSlate SignNow offer for tax-related processes?

airSlate SignNow integrates seamlessly with various accounting and payroll systems, enhancing your ability to manage the EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD. This connectivity allows for automatic data import, ensuring accurate completion of tax documents without manual entry.

-

Can I track the status of my EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD submissions?

Absolutely! airSlate SignNow allows you to track the status of your submissions in real-time. You'll receive notifications when documents are signed and completed, providing peace of mind throughout the EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD process.

-

How secure is my data when using airSlate SignNow for tax documents?

Security is a top priority at airSlate SignNow. We use advanced encryption and security measures to protect your sensitive information while you handle the EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD, ensuring compliance with industry standards.

Get more for EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD

- Child adolescent diagnostic assessment form 404337411

- Hoover tuscaloosa physician referral form cahaba derm

- Health care practitioner visit form new hampshire department of dhhs nh

- Bnp paribas supplementary ckyc form

- In the tax court form

- Settlers agricultural high school form

- Sasco membership form no download needed

- Mrpg paia manual 072021 v2 final form

Find out other EMPLOYERS ANNUAL RECONCILIATION OF INCOME TAX WITHHELD

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format