Form OIC I 2 Individual Offer in Compromise Virginia Tax

Understanding the Form OIC I 2 Individual Offer In Compromise Virginia Tax

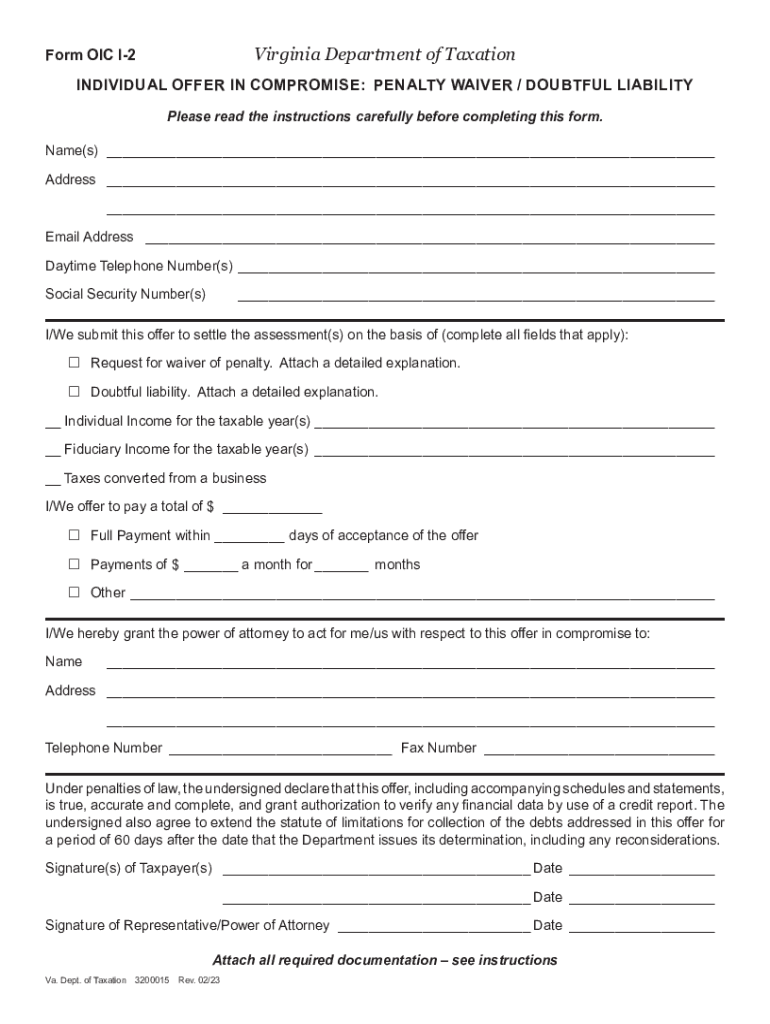

The Form OIC I 2, or Individual Offer In Compromise for Virginia Tax, is a formal request submitted by taxpayers seeking to settle their tax debts for less than the total amount owed. This form is designed for individuals who may be facing financial difficulties and are unable to pay their full tax liabilities. By submitting this form, taxpayers can propose a reduced amount that they can afford to pay, which, if accepted, resolves their tax obligations.

Steps to Complete the Form OIC I 2 Individual Offer In Compromise Virginia Tax

Completing the Form OIC I 2 requires careful attention to detail. Start by gathering all necessary financial documentation, including income statements, expenses, and asset information. Fill out the form accurately, ensuring that all sections are completed. Provide a detailed explanation of your financial situation, including any hardships that may affect your ability to pay. After reviewing the form for accuracy, submit it along with any required attachments to the appropriate Virginia tax authority.

Eligibility Criteria for the Form OIC I 2 Individual Offer In Compromise Virginia Tax

To qualify for the Individual Offer In Compromise, taxpayers must meet specific eligibility criteria. Generally, individuals must demonstrate an inability to pay their tax debts in full due to financial hardship. This may include factors such as unemployment, medical expenses, or other significant financial burdens. Additionally, taxpayers must be compliant with all filing requirements and have filed all necessary tax returns before submitting the form.

Required Documents for the Form OIC I 2 Individual Offer In Compromise Virginia Tax

When submitting the Form OIC I 2, several documents are required to support the application. These typically include proof of income, such as pay stubs or tax returns, documentation of monthly expenses, and information regarding assets and liabilities. It is important to provide comprehensive and accurate documentation to strengthen the case for the proposed compromise amount.

Filing Deadlines for the Form OIC I 2 Individual Offer In Compromise Virginia Tax

Timely submission of the Form OIC I 2 is crucial for taxpayers seeking to resolve their tax liabilities. While specific deadlines may vary, it is generally advisable to submit the form as soon as financial difficulties arise. Taxpayers should be aware of any deadlines set by the Virginia tax authority to ensure their application is considered without delay.

Form Submission Methods for the OIC I 2 Individual Offer In Compromise Virginia Tax

The Form OIC I 2 can be submitted through various methods, including online, by mail, or in person. Taxpayers should choose the method that best suits their circumstances. Online submission may offer quicker processing times, while mailing the form allows for a physical record of the submission. In-person submissions can provide immediate confirmation of receipt.

Quick guide on how to complete form oic i 2 individual offer in compromise virginia tax

Complete Form OIC I 2 Individual Offer In Compromise Virginia Tax seamlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly and without delays. Manage Form OIC I 2 Individual Offer In Compromise Virginia Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to edit and eSign Form OIC I 2 Individual Offer In Compromise Virginia Tax effortlessly

- Obtain Form OIC I 2 Individual Offer In Compromise Virginia Tax and then click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Highlight relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you want to deliver your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Form OIC I 2 Individual Offer In Compromise Virginia Tax and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form oic i 2 individual offer in compromise virginia tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Virginia taxation compromise and how can airSlate SignNow assist with it?

Virginia taxation compromise refers to the process of negotiating with the Virginia Department of Taxation to reduce your tax liabilities. airSlate SignNow provides an easy-to-use platform for eSigning essential documents associated with this negotiation, ensuring that your submissions are timely and secure.

-

How does airSlate SignNow ensure compliance during the Virginia taxation compromise process?

airSlate SignNow is designed to streamline document management and eSignature workflows while ensuring compliance with state regulations. By enabling secure and compliant interactions, users can confidently manage their Virginia taxation compromise submissions without the risk of errors.

-

What are the pricing options for using airSlate SignNow for Virginia taxation compromise?

airSlate SignNow offers several pricing plans tailored for businesses that need to manage Virginia taxation compromise documents. The pricing is transparent and competitive, allowing users to choose a plan that fits their budget while still accessing premium features such as advanced security and integrations.

-

Can I integrate airSlate SignNow with my existing accounting software for Virginia taxation compromise?

Yes, airSlate SignNow offers various integrations with popular accounting software, making it easier to manage your finances alongside your Virginia taxation compromise documents. This allows for seamless data transfer and efficient collaboration within your financial team.

-

What features does airSlate SignNow offer to facilitate Virginia taxation compromise?

airSlate SignNow provides features such as customizable templates, bulk sending options, and real-time tracking of document status. These features simplify the Virginia taxation compromise process, ensuring that your agreements are executed swiftly and efficiently.

-

How secure is my information when using airSlate SignNow for Virginia taxation compromise?

Security is a priority at airSlate SignNow, which utilizes advanced encryption and comprehensive data protection measures. When dealing with Virginia taxation compromise documents, users can rest assured that their sensitive information is safe and secure throughout the eSigning process.

-

Is airSlate SignNow user-friendly for clients unfamiliar with Virginia taxation compromise?

Absolutely, airSlate SignNow is designed with user-friendliness in mind. Clients new to Virginia taxation compromise will find the platform intuitive, with easy navigation and helpful resources that guide them through the document signing and management processes.

Get more for Form OIC I 2 Individual Offer In Compromise Virginia Tax

- Texas childrens doctors excuse 448541680 form

- Equipment performance evaluation texas

- Fort dearborn life insurance company death claim form 50778

- 30th annual pediatric conference brochure form

- Advance care planning baylor scott amp white health form

- Wwwbamymyersmdbbcomb form

- Provider agency model service backup plan form 3628

- Mytexasbenefits con form

Find out other Form OIC I 2 Individual Offer In Compromise Virginia Tax

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document