Perrysburg Tax Department Find the Business Information

Understanding the Perrysburg Tax Department Business Information

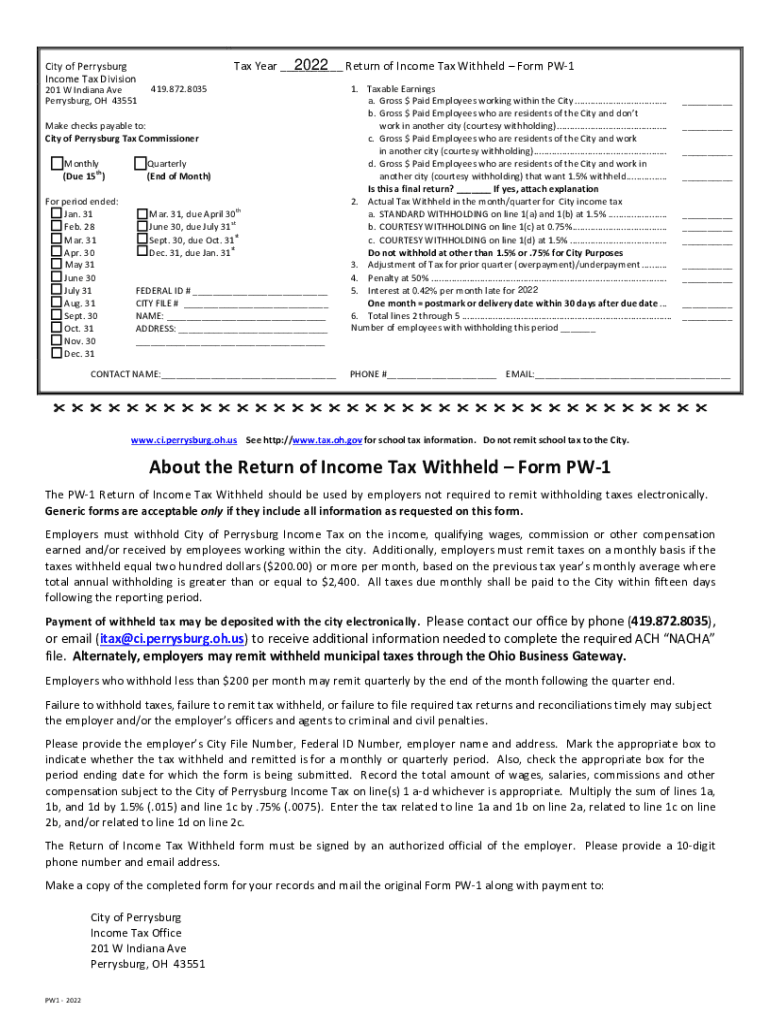

The Perrysburg Tax Department is responsible for managing and overseeing tax-related matters within the city. This includes the collection of local taxes, providing information to businesses about their tax obligations, and ensuring compliance with state and federal regulations. Understanding the role of this department is essential for businesses operating in Perrysburg, as it directly impacts financial planning and compliance strategies.

How to Access the Perrysburg Tax Department Business Information

Accessing business information from the Perrysburg Tax Department can be done through various channels. Businesses can visit the department's official website, where they can find resources and contact information. Additionally, in-person visits to the department's office are available for those who prefer face-to-face interactions. Phone consultations can also provide quick answers to specific inquiries.

Steps to Complete the Perrysburg Tax Department Business Information Form

Completing the Perrysburg Tax Department business information form involves several key steps:

- Gather necessary documentation, such as your business license and identification.

- Visit the Perrysburg Tax Department website or office to obtain the form.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or missing information before submission.

- Submit the form either online or in person, as per the department's guidelines.

Required Documents for the Perrysburg Tax Department Business Information

When submitting the business information form, certain documents are typically required. These may include:

- A valid business license or registration.

- Identification documents for the business owner or authorized representative.

- Financial statements or tax returns, if applicable.

Having these documents ready can streamline the submission process and ensure compliance with local regulations.

Legal Use of the Perrysburg Tax Department Business Information

The information obtained from the Perrysburg Tax Department is intended for legal and compliance purposes. Businesses must use this information to adhere to local tax laws, report income accurately, and ensure that they are fulfilling their tax obligations. Misuse of this information can lead to penalties or legal repercussions.

Eligibility Criteria for Perrysburg Tax Department Business Information

Eligibility to access business information from the Perrysburg Tax Department typically includes being a registered business entity within the city. This can encompass various business types, such as sole proprietorships, partnerships, LLCs, and corporations. It is essential for businesses to ensure they meet these criteria to obtain the necessary information and support.

Quick guide on how to complete perrysburg tax department find the business information

Complete Perrysburg Tax Department Find The Business Information effortlessly on any device

Online document management has become popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Perrysburg Tax Department Find The Business Information on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to alter and electronically sign Perrysburg Tax Department Find The Business Information with ease

- Find Perrysburg Tax Department Find The Business Information and click on Get Form to commence.

- Make use of the tools we offer to complete your form.

- Mark signNow parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your requirements in document management in just a few clicks from any device you choose. Edit and electronically sign Perrysburg Tax Department Find The Business Information to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the perrysburg tax department find the business information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can I access information about the Perrysburg Tax Department?

To find the business information for the Perrysburg Tax Department, you can visit their official website or contact their office directly. They provide various resources and contacts to help you obtain the necessary information. airSlate SignNow can assist you in managing any required documents that may need to be submitted.

-

What documents do I need for the Perrysburg Tax Department?

The required documents can vary depending on the specific services you need from the Perrysburg Tax Department. Common documents include business licenses, tax forms, and identification. If you need to eSign any forms, airSlate SignNow offers a user-friendly solution to streamline the process.

-

Are there any fees associated with services from the Perrysburg Tax Department?

Yes, the Perrysburg Tax Department may charge fees for various services such as business registrations and permits. It’s best to check their website or contact them for a detailed fee schedule. Utilizing airSlate SignNow can help you manage payments and document submissions efficiently.

-

How does airSlate SignNow simplify working with the Perrysburg Tax Department?

airSlate SignNow simplifies your dealings with the Perrysburg Tax Department by allowing you to easily send and eSign required documents online. This streamlines workflows and reduces the time spent on paperwork. With airSlate, you can quickly find and prepare the necessary forms for submission.

-

Can I integrate airSlate SignNow with my existing tax software?

Yes, airSlate SignNow offers integrations with various tax software and applications. This means you can seamlessly manage your documents and submissions related to the Perrysburg Tax Department within your existing systems. Check the integration options available to ensure compatibility.

-

What benefits can I expect from using airSlate SignNow for tax-related documents?

By using airSlate SignNow, you can experience enhanced efficiency and security when dealing with tax-related documents for the Perrysburg Tax Department. The solution provides signed documents quickly, reduces paper usage, and ensures compliance with legal standards. This can greatly simplify your tax preparation process.

-

How secure is the document signing process with airSlate SignNow?

The document signing process with airSlate SignNow is extremely secure, incorporating advanced encryption and authentication measures to protect your sensitive information. This is particularly important when submitting documents to the Perrysburg Tax Department. You can trust that your data is safeguarded throughout the signing and delivery process.

Get more for Perrysburg Tax Department Find The Business Information

- Ncrf 31 certification of higher coverage limits ncrb org form

- Dss sd govmedicaidrecipientsdepartment of social services south dakota form

- Approved by the novant health triad region board of trustees on tuesday october 22 form

- Biopsychosocial history form peace of mind inc

- Medicaid transportation verification form

- Mass clinic form doc

- Fillable online dma 4037 pdf disability determination form

- Consent to adoption by parent who is not the form

Find out other Perrysburg Tax Department Find The Business Information

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later