Ohio it RE Explanation of Corrections Form

Understanding the Ohio IT RE Explanation of Corrections

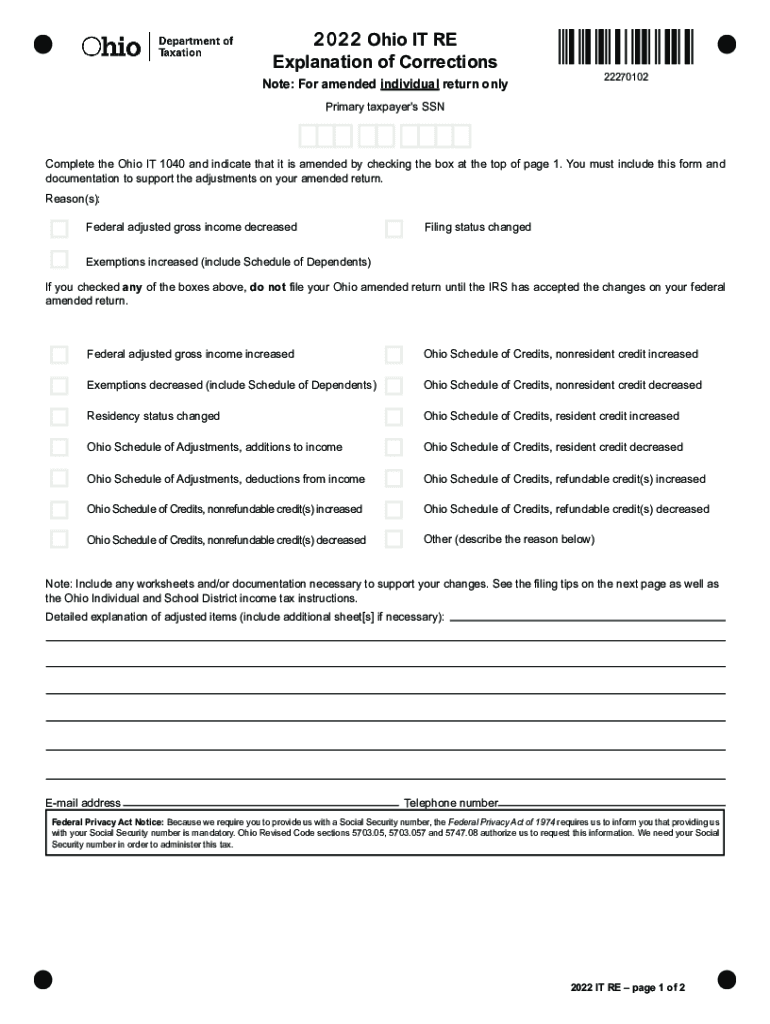

The Ohio IT RE Explanation of Corrections is a critical document used by taxpayers to clarify any discrepancies or errors in their tax filings. This form serves to explain the reasons for adjustments made to a previously filed tax return, ensuring that the Ohio Department of Taxation has a clear understanding of the corrections. Common scenarios requiring this form include changes due to missed deductions, errors in reported income, or adjustments following an audit. By providing a detailed explanation, taxpayers can help facilitate the review process and avoid potential penalties.

Steps to Complete the Ohio IT RE Explanation of Corrections

Completing the Ohio IT RE Explanation of Corrections involves several key steps:

- Gather all relevant documentation related to the original tax return and the corrections being made.

- Clearly outline the specific corrections and provide a rationale for each change. This may include citing specific tax laws or guidelines.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the completed form for accuracy before submission.

Following these steps can help ensure that your explanation is clear and comprehensive, reducing the likelihood of further inquiries from the tax authorities.

Required Documents for the Ohio IT RE Explanation of Corrections

When submitting the Ohio IT RE Explanation of Corrections, it is essential to include supporting documents that validate your claims. Required documents may include:

- A copy of the original tax return that is being amended.

- Any documentation that supports the corrections, such as W-2s, 1099s, or receipts for deductions.

- Correspondence from the Ohio Department of Taxation regarding any previous adjustments or audits.

Including these documents can help expedite the review process and provide clarity to the tax authorities regarding your corrections.

Filing Deadlines for the Ohio IT RE Explanation of Corrections

Timeliness is crucial when submitting the Ohio IT RE Explanation of Corrections. Generally, this form should be filed within three years from the original due date of the tax return or within one year from the date of an audit adjustment. Adhering to these deadlines is important to avoid penalties and ensure that your corrections are processed efficiently. It is advisable to check for any specific updates or changes to deadlines that may occur annually.

Who Issues the Ohio IT RE Explanation of Corrections

The Ohio Department of Taxation is responsible for issuing the Ohio IT RE Explanation of Corrections. This agency oversees the administration of state tax laws and ensures compliance among taxpayers. If you have questions or need assistance regarding the form, the Department of Taxation can provide guidance and clarification on the requirements and processes involved.

Legal Use of the Ohio IT RE Explanation of Corrections

The Ohio IT RE Explanation of Corrections is a legally recognized document that serves to provide transparency and justification for any changes made to a filed tax return. It is essential for taxpayers to understand that submitting this form does not guarantee acceptance of the corrections; however, it does provide a formal avenue to explain discrepancies. Proper use of this form can help mitigate potential legal issues and ensure compliance with state tax regulations.

Quick guide on how to complete ohio it re explanation of corrections

Accomplish Ohio IT RE Explanation Of Corrections effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Ohio IT RE Explanation Of Corrections on any platform with airSlate SignNow Android or iOS applications and simplify any document-centric operation today.

How to modify and eSign Ohio IT RE Explanation Of Corrections with ease

- Locate Ohio IT RE Explanation Of Corrections and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Ohio IT RE Explanation Of Corrections to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio it re explanation of corrections

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of understanding ohio explanation tax?

Understanding the ohio explanation tax is crucial for businesses operating in Ohio, as it helps them comply with state tax regulations. This knowledge can aid in making informed financial decisions and avoiding costly penalties. Proper comprehension ensures that businesses can effectively manage their tax responsibilities.

-

How does airSlate SignNow assist with ohio explanation tax documentation?

airSlate SignNow simplifies the process of creating and signing documents related to the ohio explanation tax by providing a user-friendly platform. Users can easily draft, edit, and electronically sign necessary tax documents, ensuring they are accurately prepared and timely submitted. This streamlines compliance and reduces administrative burdens for businesses.

-

What are the pricing options for airSlate SignNow for businesses concerned with ohio explanation tax?

airSlate SignNow offers various pricing plans tailored to different business needs, making it an economical choice for handling documents related to the ohio explanation tax. From basic plans for small businesses to more advanced options for larger organizations, there is a solution for every budget. The flexible pricing models ensure businesses can find a plan that fits their operational requirements.

-

Can airSlate SignNow integrate with accounting software for ohio explanation tax management?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions to enhance the management of ohio explanation tax-related documents. This integration allows for efficient document sharing and electronic signing, ensuring that all tax documentation is organized and accessible within your preferred financial software. This saves time and promotes accuracy in tax filing.

-

What features does airSlate SignNow offer to simplify ohio explanation tax processes?

airSlate SignNow provides several features designed to simplify ohio explanation tax processes, including template creation, bulk sending, and eSignature capabilities. These features help businesses generate and manage tax-related documents efficiently. Additionally, robust security options ensure that sensitive information is protected throughout the eSigning process.

-

Is airSlate SignNow suitable for both individuals and businesses dealing with ohio explanation tax?

Absolutely! airSlate SignNow caters to both individuals and businesses dealing with ohio explanation tax, offering solutions that fit various needs. Whether you are an individual preparing personal tax documents or a business managing corporate filings, airSlate SignNow's tools are designed to simplify the process. Its versatility makes it a valuable asset across different user demographics.

-

What security measures does airSlate SignNow implement for ohio explanation tax documents?

airSlate SignNow prioritizes the security of its users' documents, especially those related to ohio explanation tax. The platform employs encryption protocols and secure cloud storage to protect sensitive information during transmission and storage. This means that businesses can confidently manage their tax documentation without worrying about unauthorized access.

Get more for Ohio IT RE Explanation Of Corrections

- Dss 8650 form 574418381

- California certified copy record form

- Dmh lacounty gov for providersfor providers department of mental health form

- Family financial statement form

- Covid 19 test requisition formigenex

- Client record form

- Medi cal supplemental cost report schedules department of health dhcs ca form

- Health department los angeles complaint form

Find out other Ohio IT RE Explanation Of Corrections

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter