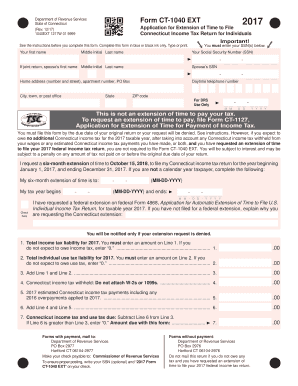

CT 1040 EXT 20170911 Indd Form

Steps to complete the CT 1040 form

Completing the CT 1040 form requires a systematic approach to ensure accuracy and compliance with state tax regulations. Follow these steps to fill out the form effectively:

- Gather your financial documents, including W-2s, 1099s, and any other income statements.

- Review the instructions for the CT 1040 form to understand the specific requirements for your situation.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, dividends, and any other sources of income.

- Calculate your deductions and credits, which may include standard deductions or itemized deductions based on your eligibility.

- Determine your tax liability using the tax tables provided in the CT 1040 instructions.

- Review your calculations for accuracy before signing and dating the form.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial to avoid penalties and interest on unpaid taxes. The following dates are important for the CT 1040 form:

- The standard filing deadline for the CT 1040 form is April 15 each year.

- If you need additional time, you can file for an extension using the CT 1040 EXT form, which typically extends the deadline by six months.

- Be mindful of any changes to deadlines that may occur due to holidays or state-specific regulations.

Required Documents

To complete the CT 1040 form accurately, you will need several documents that provide the necessary information for reporting income and deductions. Essential documents include:

- W-2 forms from employers, detailing your earnings and withheld taxes.

- 1099 forms for any freelance or contract work, which report various types of income.

- Records of any other income sources, such as rental income or dividends.

- Documentation for deductions, including mortgage interest statements, property tax receipts, and medical expenses.

Form Submission Methods

Submitting your CT 1040 form can be done through various methods, depending on your preference for digital or paper submissions. The available options include:

- Online filing through approved tax preparation software, which often includes e-filing options for faster processing.

- Mailing a printed copy of the completed form to the appropriate state tax office address.

- In-person submission at designated tax offices, which may offer assistance in completing the form.

Legal use of the CT 1040 form

The CT 1040 form is legally binding and must be completed in accordance with state tax laws. Understanding its legal implications is vital for compliance. Key points include:

- The form must be signed and dated by the taxpayer to validate the information provided.

- Filing a false return can result in penalties, including fines and interest on unpaid taxes.

- Maintaining accurate records and documentation is essential in case of an audit by the state tax authority.

Eligibility Criteria

Not all taxpayers are required to file a CT 1040 form. Eligibility criteria typically include:

- Residency status in Connecticut for the tax year in question.

- Income thresholds that determine whether you must file, based on your filing status and age.

- Special circumstances, such as self-employment or significant capital gains, which may necessitate filing regardless of income level.

Quick guide on how to complete ct 1040 ext 2018

Complete ct 1040 ext 2018 effortlessly on any device

Web-based document management has become widely embraced by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to obtain the necessary paperwork and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Handle ct form 1040 on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign form ct1040 effortlessly

- Obtain ct 1040 2017 and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important parts of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and electronically sign ct 1040 ext and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs ct 1040 instructions

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

Related searches to ct 1040 instructions 2017

Create this form in 5 minutes!

How to create an eSignature for the 1040ext

How to generate an electronic signature for your Ct 1040 Ext 20170911indd in the online mode

How to create an electronic signature for the Ct 1040 Ext 20170911indd in Chrome

How to make an eSignature for putting it on the Ct 1040 Ext 20170911indd in Gmail

How to generate an electronic signature for the Ct 1040 Ext 20170911indd right from your smart phone

How to create an electronic signature for the Ct 1040 Ext 20170911indd on iOS

How to create an eSignature for the Ct 1040 Ext 20170911indd on Android OS

People also ask ct1040

-

What is the ct form 1040 and why is it important?

The ct form 1040 is a critical document for individuals filing their state income taxes in Connecticut. It allows taxpayers to report their income, deductions, and credits to determine their tax liability. Completing the ct form 1040 accurately is crucial to ensure compliance with state tax laws.

-

How does airSlate SignNow facilitate the signing of the ct form 1040?

airSlate SignNow simplifies the process of signing the ct form 1040 by allowing users to electronically sign documents securely. With its user-friendly interface, users can quickly upload their ct form 1040, add eSignatures, and send it directly to the relevant parties without hassle.

-

What features does airSlate SignNow offer for managing the ct form 1040?

airSlate SignNow offers various features for managing the ct form 1040, including document templates, automated workflows, and real-time tracking. This ensures that users can complete and manage their tax documents efficiently, reducing the chances of errors during submission.

-

Is airSlate SignNow a cost-effective solution for filing the ct form 1040?

Yes, airSlate SignNow provides a cost-effective solution for handling the ct form 1040 and other documents. With competitive pricing plans, businesses and individuals can streamline their document management processes without incurring high costs.

-

Can I integrate airSlate SignNow with other software to manage my ct form 1040?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, making it easy to manage your ct form 1040 alongside other business tools. This allows users to enhance their workflows and streamline document management processes.

-

What are the benefits of using airSlate SignNow for my ct form 1040?

Using airSlate SignNow for your ct form 1040 offers numerous benefits, including increased efficiency, enhanced security, and reduced paper clutter. The electronic signing process also speeds up document turnaround, helping users meet their tax deadlines more effectively.

-

How secure is airSlate SignNow when handling sensitive documents like the ct form 1040?

airSlate SignNow prioritizes security, utilizing encryption and other protective measures to ensure the safety of sensitive documents such as the ct form 1040. This commitment to security provides users with peace of mind when managing their tax-related documents digitally.

Get more for ct1040ext

- F500 094 000 form

- External evaluation of the washington state bilingual sbe wa form

- Form 5208c 1

- Change address with dshs in tacoma wa 2010 form

- Washington department of agriculture pesticide application record version 1 form

- Wsda form record

- Washington rev 84 0001b 2012 form

- Wa dol hearing dui indigent 2012 form

Find out other form ct 1040

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document